3Commas Review: Best Crypto Trading Bot to Maximize Profits

3Commas Review: Best Crypto Trading Bot for automating trades using DCA, Grid, and SmartTrade. Explore its features, pricing, usage and safety.

3Commas Review: If you’re looking for the best crypto trading bot to automate your trades and maximize profits, the trading tool might just be the perfect tool for you. Known for its advanced strategies like Dollar-Cost Averaging (DCA), Grid Trading, and the powerful SmartTrade terminal, this software offers a seamless way for both beginners and experienced traders to make informed decisions without constant market monitoring. In this review, we’ll dive into its features, pricing, supported exchanges, safety, and how it compares to other popular trading tools to help you decide if the automated trading system is truly the ultimate solution for optimizing your crypto trading strategy.

What is 3Commas Crypto Trade Bot?

3Commas is an automated trading platform that helps users streamline their crypto trading by utilizing powerful bots and tools. Launched in 2017, the platform offers multiple bot types like Dollar-Cost Averaging (DCA), Grid Bots, and the SmartTrade terminal, making it a popular choice for traders looking to maximize profits while minimizing manual efforts.

With its intuitive interface and support for over 17 major crypto exchanges, including Binance, Coinbase Pro, and Kraken, the trading tool caters to both beginners and experienced traders. By automating trades based on pre-set strategies, it allows users to efficiently manage their portfolios and reduce emotional trading mistakes. For example, a DCA bot can systematically buy assets during market dips, averaging out the entry price, while the Grid Bot captures profits from frequent price fluctuations within a defined range.

In addition to its bots, the SmartTrade terminal provides advanced features like trailing take-profits, stop-loss, and concurrent orders, making it ideal for users who prefer more control. Whether you’re looking for a hands-off trading experience or want to fine-tune your strategies, the trading tool offers a comprehensive solution to enhance trading outcomes.

Key Features of 3Commas

the bot offers a diverse set of features designed to simplify trading and enhance profitability through automation. Below are the key functionalities that make the trading tool stand out:

- Automated Bots

The platform includes several types of bots like Dollar-Cost Averaging (DCA), Grid, and Options Bots, which automate buying and selling based on predefined strategies. For example, the DCA bot is ideal for volatile markets as it averages out entry prices, while the Grid bot captures profits from small price fluctuations within a set range. This versatility allows traders to choose the best bot type for their specific market conditions. - SmartTrade Terminal

SmartTrade is a powerful tool for traders who prefer more control over their strategies. It enables users to set advanced trading conditions, such as trailing stop-loss, take-profit targets, and concurrent orders, all from one interface. This functionality is particularly beneficial for traders looking to manually refine their trading strategies while still benefiting from partial automation. - Portfolio Management and Copy Trading

the trading tool supports comprehensive portfolio management features, allowing users to track, analyze, and rebalance their holdings across multiple exchanges. Moreover, the copy trading option enables beginners to replicate the strategies of successful traders, helping them learn and diversify their investments. - Paper Trading for Risk-Free Testing

One of the standout features is the platform’s paper trading capability, which allows users to test their strategies without risking real funds. This is crucial for both beginners and experienced traders to optimize their setups before going live. - TradingView Integration and Custom Signals

the bot integrates with TradingView, allowing users to create custom signals based on a wide array of technical indicators. This feature is ideal for traders who want to implement highly customized strategies using advanced charting tools. - Supported Exchanges and 24/7 Trading

The platform supports over 17 major crypto exchanges like Binance, Coinbase Pro, and Kraken, enabling seamless trading across multiple markets. Its 24/7 operation means traders can take advantage of profitable opportunities round-the-clock without manually monitoring the market.

| Feature | Description | Benefit | Plan Availability |

|---|---|---|---|

| Automated Bots | Multiple bot types, including DCA, Grid, and Signal bots, to automate trades based on market strategies. | Reduces manual effort and manages trades 24/7. | Pro Plan & Above |

| SmartTrade Terminal | Advanced trade management with features like stop-loss, trailing take-profits, and concurrent orders. | Enables precise control over trades and minimizes risks. | Available in Free & Paid Plans |

| Portfolio Management and Copy Trading | Consolidate portfolio tracking and copy successful traders’ strategies. | Simplifies portfolio management and helps diversify risk. | Pro Plan & Above |

| Paper Trading | Allows testing strategies without risking real funds. | Ideal for learning and optimizing strategies risk-free. | Pro Plan & Above |

| TradingView Integration | Customizable signals and automated trade execution based on advanced charting indicators. | Leverages TradingView analytics for better trading decisions. | Pro Plan & Above |

| Multi-Pair DCA | Run DCA bots on multiple pairs simultaneously to diversify trading strategies. | Enables complex strategies across various trading pairs. | Pro Plan & Above |

| Sub-Account Management | Centralized management of multiple accounts, ideal for users with diversified portfolios. | Allows seamless control over several accounts from a single dashboard. | Expert Plan Only |

| Supported Exchanges | Integration with over 14 major crypto exchanges like Binance, Coinbase, and Kraken. | Ensures flexibility and a broad trading reach. | Available in Free & Paid Plans |

These features, combined with its robust automation options, make the bot a compelling platform for both beginners and seasoned traders looking to optimize their crypto trading.

How Does 3Commas Work?

the automated bot is a cloud-based trading platform that connects to users’ cryptocurrency exchange accounts using API keys. This integration allows traders to manage and automate their trades across multiple exchanges like Binance, Coinbase, and Kraken, all from a single interface. By automating trading strategies and using advanced tools, the trading tool helps traders minimize risks, reduce manual trading effort, and potentially increase profitability.

The platform works by executing trades based on predefined criteria set by the user. Once connected, traders can configure different types of bots, such as the Dollar-Cost Averaging (DCA) and Grid bots, to automatically buy and sell crypto assets according to their market strategies. For example, the DCA bot can buy more assets when prices dip to lower the average entry cost, while the Grid bot operates within a specific price range, ideal for profiting in sideways markets.

the trading tool also includes the SmartTrade terminal, which allows for setting up complex trading conditions, such as stop-loss and take-profit levels, trailing orders, and concurrent trades. This feature enables users to customize and automate trades, even manually, without constantly monitoring the market.

the trading tool simplifies trading by centralizing trade management, automating strategies, and providing real-time analytics, making it a versatile tool for both beginners and experienced traders.

3Commas Free & Paid Plans

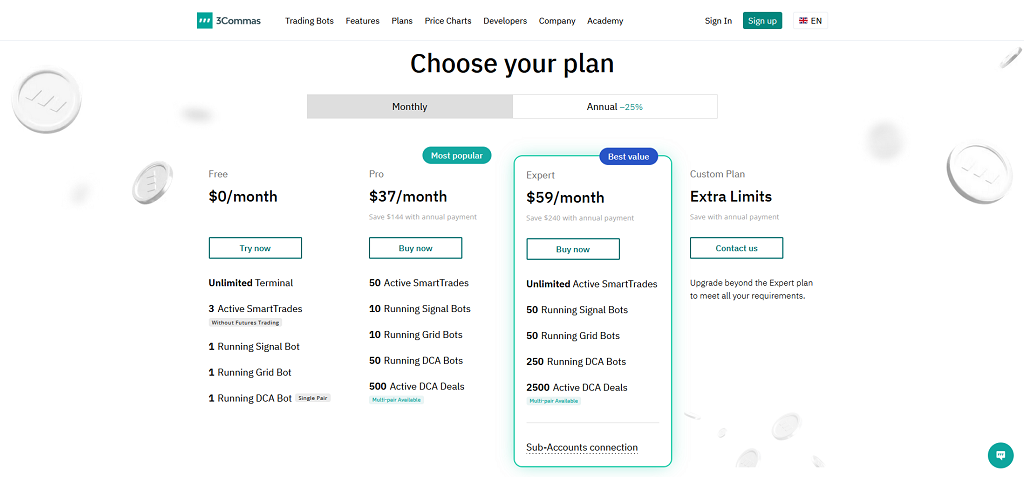

the automated bot offers four primary subscription tiers, tailored to suit varying trading needs and levels of expertise. The plans range from a basic free version to a comprehensive Expert plan, each providing a unique set of features. Here’s a detailed overview to help you pick the best fit for your trading strategy:

1. Free Plan

The Free Plan is ideal for beginners who want to explore the 3Commas platform without financial commitment. It includes basic access to 1 DCA Bot (Single Pair), 1 Grid Bot, and 1 Signal Bot, along with up to 3 Active SmartTrades. However, it lacks Futures Trading and other advanced tools, making it best suited as a trial to familiarize yourself with the interface and core features.

- Best for: New traders testing the platform’s features before considering a paid plan.

2. Pro Plan ($37/month with annual payment, $49/month paid monthly)

The Pro Plan significantly expands capabilities, supporting up to 50 Active SmartTrades, 10 Grid Bots, 10 Signal Bots, and 50 DCA Bots. This plan also introduces Multi-pair DCA trading and up to 500 Active DCA Deals, allowing users to implement more complex strategies. It’s an excellent option for intermediate traders who want more flexibility and higher bot limits.

- Best for: Traders seeking a balance of cost and functionality with Multi-pair DCA capabilities.

3. Expert Plan ($59/month with annual payment, $79/month paid monthly)

The Expert Plan is designed for advanced traders looking for unrestricted access to all bot types and features. It includes unlimited SmartTrades, 50 Signal Bots, 50 Grid Bots, and 250 DCA Bots, alongside 2500 Active DCA Deals. Additional benefits include sub-account connections and centralized management for multiple Binance accounts, making it the most versatile plan for professionals managing multiple portfolios.

- Best for: High-volume traders and professionals managing multiple accounts who require maximum flexibility and advanced configurations.

4. Custom Plan (Contact for Pricing)

If none of the standard plans meet your requirements, the automated bot offers a Custom Plan option. This plan allows you to upgrade beyond the limits of the Expert Plan to match your unique trading needs, providing personalized features and higher limits.

- Best for: Users with specialized requirements looking for tailored features and bot capacities.

| Features | FREE | PRO | EXPERT | CUSTOM |

|---|---|---|---|---|

| Cost | Free | $37/mo (annual) or $49/mo (monthly) | $59/mo (annual) or $79/mo (monthly) | Contact for pricing |

| Grid Bots | 1 | 10 | 50 | Custom Limits |

| Signal Bots | 1 | 10 | 50 | Custom Limits |

| DCA Bots | 1 (Single Pair) | 50 | 250 | Custom Limits |

| Active SmartTrades | 3 | 50 | Unlimited | Unlimited |

| Paper Trading | No | Yes | Yes | Yes |

| Futures Trading | No | Yes | Yes | Yes |

| Multi-Pair DCA | No | Yes | Yes | Yes |

| Sub-Account Connections | No | No | Yes | Yes |

Choosing the Right Plan

For most traders, the Pro Plan provides a solid balance of features and affordability, particularly when opting for the annual payment discount. However, for traders who rely heavily on bot-based strategies and require high flexibility, the Expert Plan is the top choice. Consider your trading strategy, the number of bots needed, and the complexity of your trades when selecting a plan.

Remember, you can start with the Free Plan to get a feel for the platform before committing to a paid subscription. Additionally, all paid plans come with access to Futures Trading, TradingView Integration, Backtesting, and over 14 supported exchanges.

Supported Crypto Exchanges on 3Commas

the bot integrates with a wide range of popular cryptocurrency exchanges, making it a versatile platform for traders seeking to automate their trading strategies across multiple markets. Currently, this bot supports over 17 major exchanges, ensuring that users have access to diverse trading pairs and liquidity options.

Some of the most prominent supported exchanges include:

- Binance

- Coinbase Pro (GDAX)

- Kraken

- Huobi

- KuCoin

- OKX

- Bybit

- BitMEX

- Bittrex

- Poloniex

- Bitstamp

Each of these exchanges can be linked to the bot using API keys, allowing the platform to execute trades based on your predefined criteria. Whether you want to trade on a high-volume exchange like Binance or prefer specialized platforms like Bybit for futures trading, 3Commas offers broad compatibility.

Key Integration Benefits

By connecting multiple exchange accounts through the automated bot, traders can streamline their trading activities from a single interface, making it easier to monitor performance and execute strategies. For instance, a user shared that managing portfolios across different exchanges using this trading tool saved them significant time and improved their efficiency in adjusting strategies without switching between exchange platforms.

Which Exchanges Are Best for Automated Trading?

While this bot supports manual trading on all listed exchanges, only a select few—like Binance, KuCoin, and Coinbase Pro—fully support automated bots such as the DCA, Grid, and SmartTrade functionalities. This distinction is crucial when selecting an exchange to ensure full use of the bot's advanced features.

the automated bot's broad exchange support makes it a robust choice for traders looking to manage and automate strategies across multiple platforms, enhancing flexibility and profitability.

Best Strategies for Using 3Commas Effectively

Using this trading assistant to its full potential requires a clear strategy that matches your trading goals and risk tolerance. Here are some of the best strategies to maximize your results with the trading software:

1. Dollar-Cost Averaging (DCA) for Market Volatility

The DCA strategy is one of the most popular and effective ways to reduce risk in volatile markets. With this approach, you configure the bot to automatically buy more assets when prices drop, lowering the average cost of your holdings over time. This is ideal for markets that have frequent price swings. For example, a user shared that by using the DCA bot during a sudden market dip, they managed to average down their position and turned a potential loss into profit once the market recovered.

Tip: Set multiple safety trades at different price levels to ensure that your DCA bot has room to react to larger price drops.

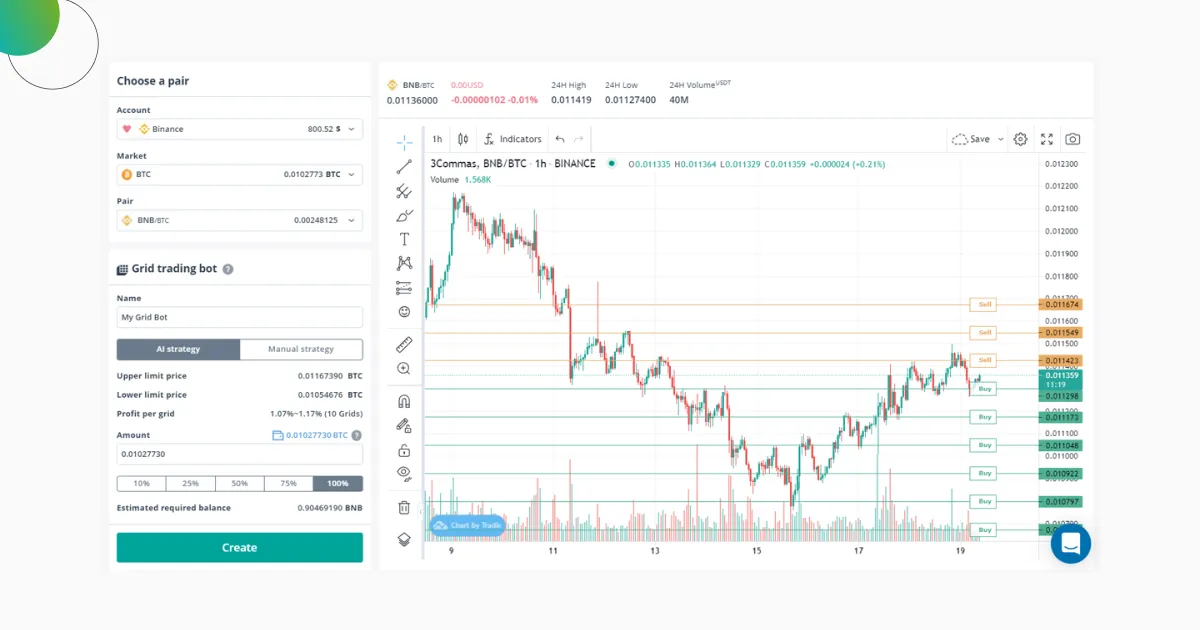

2. Grid Trading for Sideways Markets

The Grid Bot is perfect for trading in a market that moves within a specific range. By setting up buy and sell orders at predefined intervals, you can capture profits from smaller price fluctuations. This strategy is particularly effective in a stable, sideways-moving market where prices bounce between set levels.

Tip: Use a narrower grid spacing for high-volatility pairs and a wider grid for more stable pairs to optimize profitability.

3. Trailing Take Profit for Optimized Gains

One of the standout features in this trading software is the trailing take-profit option, which allows your bot to lock in profits while following price increases. Instead of selling at a fixed target, the bot adjusts the take-profit level as the asset’s price moves up. This strategy can help maximize gains during an uptrend, as it keeps adjusting to new highs.

Tip: Use trailing take-profit combined with a stop-loss to protect your profits in case the market suddenly reverses.

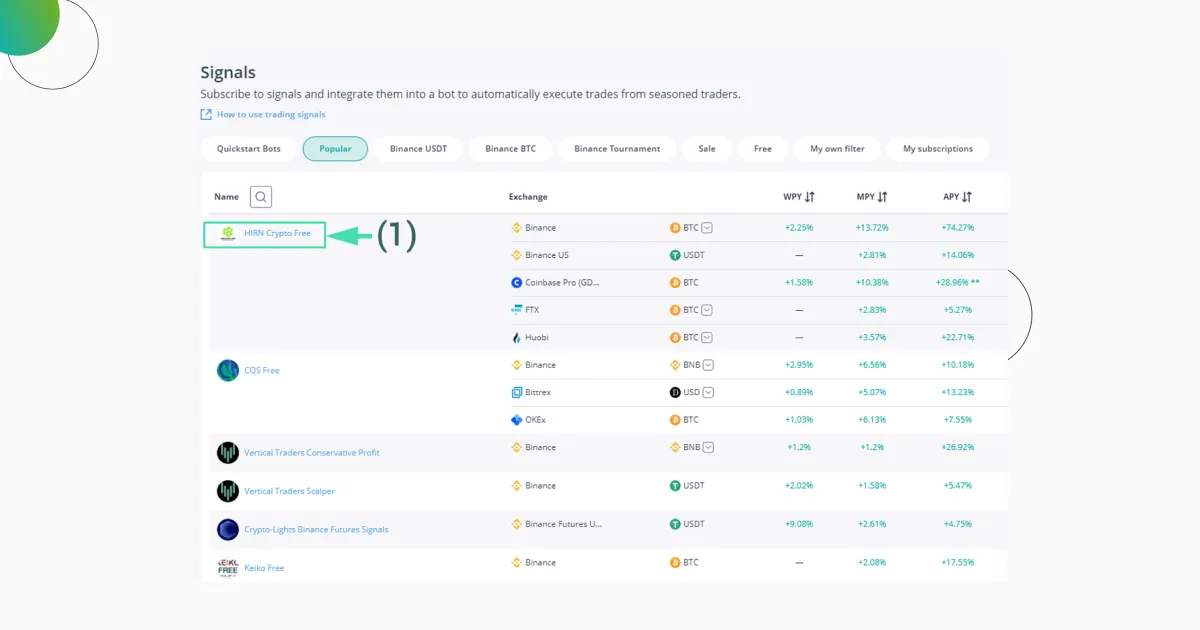

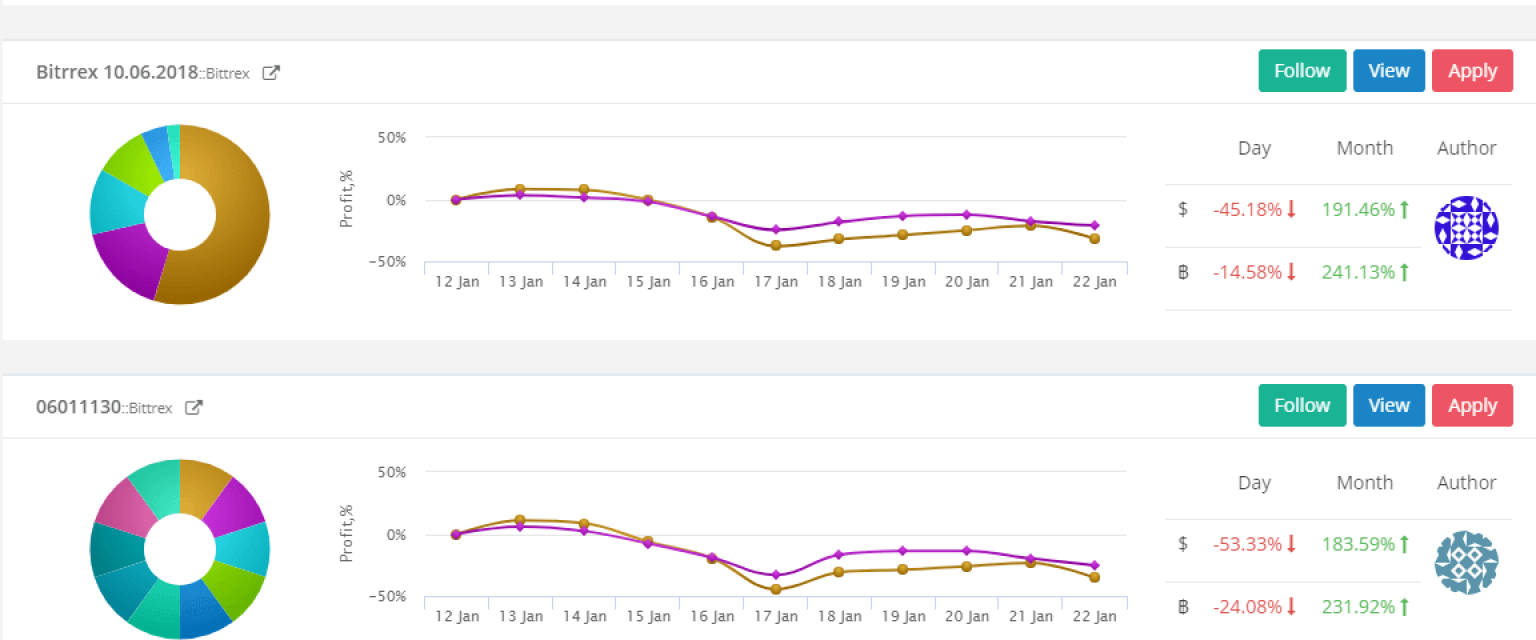

4. Using Copy Trading for Strategy Diversification

If you’re new to trading or want to diversify your strategies, this trading software's copy trading option allows you to replicate the strategies of successful traders. This feature can be particularly useful for beginners who wish to learn from experienced traders or for users who want to spread their risk across multiple strategies.

Tip: Before selecting a trader to copy, review their performance history and ensure their risk tolerance matches your own.

5. Combining Bots for a Multi-Layered Approach

Advanced traders can set up multiple bots simultaneously to execute different strategies based on market conditions. For example, you can run a DCA bot for long-term investment, a Grid bot for capturing short-term price movements, and use the SmartTrade terminal for manual trades. This multi-layered approach helps ensure that you’re covered in various market scenarios.

By employing these strategies and configuring the trading assistant based on market conditions, you can maximize your chances of success and use the platform more effectively to meet your trading goals.

Pros and Cons of Using 3Commas

this the trading tool is widely regarded for its comprehensive automation features and flexibility, but like any platform, it has its strengths and limitations. Below is a balanced look at the main pros and cons based on user experiences and expert reviews.

Pros:

- Comprehensive Automated Trading Tools

the trading software offers a range of bots, including Dollar-Cost Averaging (DCA), Grid, and Options bots, making it adaptable to various trading strategies and market conditions. Users appreciate its versatility, especially when managing multiple strategies simultaneously. - Advanced SmartTrade Features

The SmartTrade terminal provides detailed trading options such as concurrent stop-loss and take-profit, trailing orders, and advanced trading triggers. This level of customization is highly valued by manual traders looking to optimize trade management. - Support for Multiple Exchanges

With integration to over 17 major exchanges like Binance, Coinbase Pro, and Kraken, the trading assistant makes it easy for traders to consolidate their trading activities and access a broad range of trading pairs from a single platform. - Paper Trading for Strategy Testing

The platform’s paper trading feature allows users to test strategies in real-time without risking actual funds. This is particularly beneficial for beginners or those experimenting with new strategies. - User-Friendly Interface

Despite its robust set of features, this trading tool has a clean and intuitive interface, making it accessible to both beginners and advanced traders. Many users report that the learning curve is manageable due to the platform’s well-structured design. - Copy Trading and Marketplace

this trading software enables users to copy successful traders’ strategies through its marketplace, which simplifies the learning process for newcomers and helps diversify risk by following proven strategies.

Cons:

- High Subscription Costs for Full Features

While the automated trading assistant offers a free plan, access to the most powerful features like unlimited bots and advanced options is restricted to higher-tier plans, which can be costly for casual traders. This could deter some users from utilizing the platform’s full potential. - Recent Security Issues

this trading software has faced criticism due to security breaches in the past, which compromised API keys and led to unauthorized trades on user accounts. Although security has been upgraded since, the incidents have impacted user trust. - Steep Learning Curve for New Users

Beginners may find it challenging to configure bots and use advanced features effectively without prior trading knowledge. While the interface is user-friendly, mastering the settings for optimal performance can require a significant amount of time and experience. - Limited Functionality on Some Exchanges

Not all exchanges support the full range of this trading tool's bots and features. For example, automated trading is fully available only on a select few exchanges like Binance and Coinbase Pro, while others may restrict some functionalities. - Reliance on Market Conditions

Like any automated trading solution, the trade bots are not foolproof and can incur losses in rapidly changing markets if not configured properly. Users must constantly monitor and adjust strategies to avoid potential pitfalls.

User Experience Insight:

One trader shared that, while using the DCA bot during a volatile market downturn, they managed to average down their entry price and recover from a significant loss. However, they also noted that improper use of the bot in a strong downward trend without safety trades could lead to heavy losses.

this trading software is a powerful tool for those who can leverage its capabilities correctly, but it requires careful planning and an understanding of market dynamics to be truly effective.

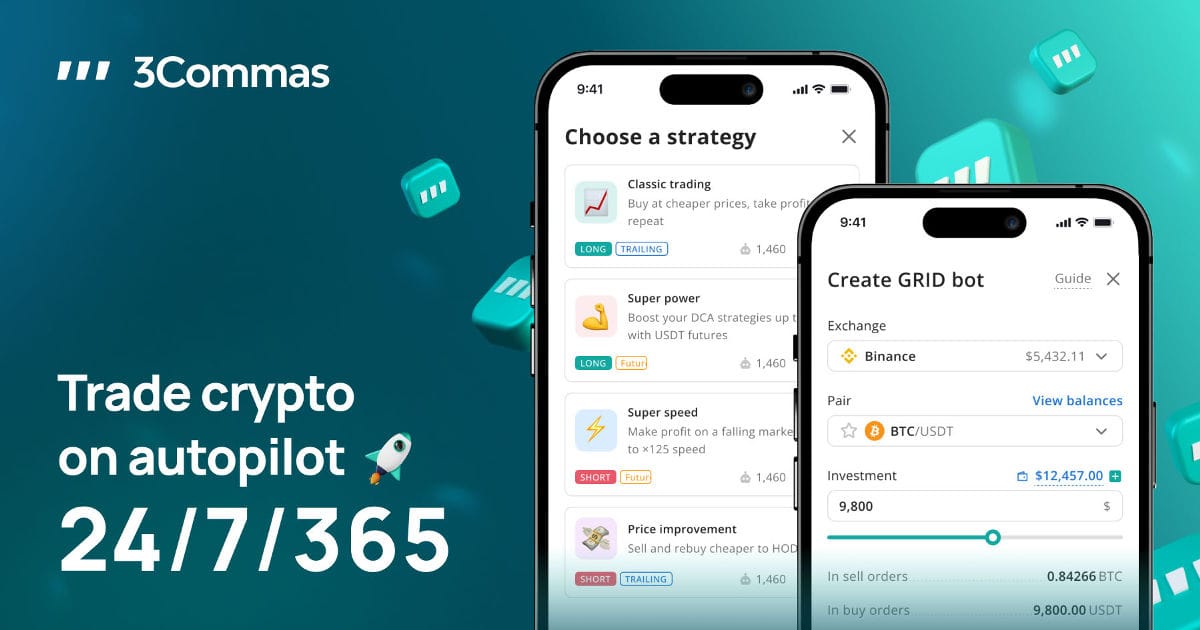

3Commas Mobile App: Manage Trading on the Go

This trading assistant mobile app brings all the powerful features of the desktop platform to your smartphone, enabling traders to manage their strategies, track portfolios, and execute trades from anywhere. Available for both iOS and Android, the app is designed to offer a seamless trading experience for users who need flexibility without sacrificing functionality.

Key Features of the 3Commas Mobile App

- Full Bot Management

The mobile app allows users to create, edit, and monitor their bots on the go. You can configure DCA, Grid, and Options bots directly from your device, making it easy to adapt to changing market conditions even if you’re away from your desktop. - SmartTrade Terminal Access

Just like the desktop version, the app provides access to the SmartTrade terminal. Traders can set complex trading conditions, such as trailing take-profits, concurrent stop-loss, and customized entry/exit points, allowing for comprehensive trade management at any time. - Real-Time Notifications and Alerts

Stay informed with instant alerts for market movements, executed trades, and bot performance. This feature ensures that you never miss a critical opportunity or unexpected market shift, helping you respond faster to market changes. - Portfolio Tracking

View your portfolio across multiple exchanges from a single interface. The mobile app consolidates all your assets and provides a clear view of your overall performance, making it easy to keep track of your investments.

the trading assistant mobile app is a highly efficient tool for traders who need to monitor and manage their trades from anywhere. Its intuitive interface, combined with advanced trading features, makes it a valuable companion for active traders.

3Commas Safety: Is it Safe to Use?

When it comes to trading automation, security is a top priority. the automated bot takes several measures to ensure the safety of its users' funds and accounts. The platform uses API keys to connect to your exchange accounts, which means it does not have access to your funds for withdrawals. This structure significantly reduces the risk of direct financial loss through hacking. However, there have been incidents where unauthorized trades occurred due to compromised API keys linked to third-party tools, highlighting the importance of maintaining secure practices.

Key Security Features:

- API Key Management

- the trading software only requires limited API permissions, such as trading access, but never withdrawal rights. This restriction helps safeguard users’ funds since the platform cannot move assets out of your exchange accounts. For added security, users are encouraged to whitelist IP addresses and use API keys exclusively for this trading software.

- Two-Factor Authentication (2FA)

- Enabling 2FA is strongly recommended for all 3Commas accounts. With 2FA in place, even if someone gains access to your login credentials, they would still need the additional verification code to enter your account.

- IP Whitelisting

- The platform offers IP whitelisting options, allowing you to restrict account access to specific IP addresses. This feature provides an extra layer of protection, especially for users who want to limit account access from unknown sources.

- Instant Alerts and Activity Monitoring

- Users receive real-time notifications via email or the mobile app when any account changes or new logins are detected. This alert system helps identify suspicious activity immediately, giving you the opportunity to respond quickly.

- User Experience Highlight:

A user shared that they experienced suspicious activity when an unfamiliar IP address attempted to access their account. Thanks to instant alerts, they were able to change their API keys and secure their account before any trades were executed.

Potential Security Risks

Despite these measures, the trading assistant has faced a few security incidents in the past, primarily related to API key vulnerabilities. In these cases, bad actors used compromised API keys to conduct unauthorized trades, typically pumping low-liquidity coins to profit from price manipulation. To minimize such risks, it’s crucial to periodically rotate API keys and avoid using the same keys for multiple services.

this trading software is designed to be as secure as possible, but it’s still essential for users to implement best practices like enabling 2FA, setting up IP whitelisting, and keeping their API keys confidential. With these precautions, the trading assistant can be considered a safe and reliable tool for automating crypto trading.

How to Set Up and Start Trading with 3Commas

Setting up and getting started with this trading assistant is straightforward, but it requires some initial configuration to ensure that your trading strategies are executed as planned. Here’s a step-by-step guide to help you connect your exchange, configure your bots, and start automating your trades:

1. Create an Account

- Go to the 3Commas website and sign up for a free trial or select a plan that suits your trading needs.

- Complete the registration process by verifying your email and enabling two-factor authentication (2FA) for added security.

2. Connect Your Exchange

- After logging in, navigate to the “My Exchanges” tab and click “Connect Exchange.”

- Select your preferred exchange (e.g., Binance, Coinbase Pro, or KuCoin) and generate API keys from your exchange account.

- Enter the API keys into the trading software, ensuring that the API permissions are set to “Trade Only” with no withdrawal rights for maximum security.

- Once connected, your account will display the available balance and trading pairs on your chosen exchange.

3. Choose Your Bot Type and Configure It

- this trading software offers several bot types, including DCA Bots, Grid Bots, and Options Bots. Choose the one that fits your strategy.

- For a basic setup, start with a DCA bot, which helps to average down entry prices in volatile markets.

- Go to the “DCA Bots” section, click “Create Bot,” and select a trading pair (e.g., BTC/USDT).

- Set your base trade size, safety trade count, and take-profit targets based on your risk tolerance.

- Configure additional options like trailing take-profit and stop-loss for optimized risk management.

4. Start Paper Trading (Optional)

- If you’re new or want to test your strategy, the trading assistant offers a Paper Trading option. This feature simulates real market conditions, allowing you to see how your bots perform without risking actual funds.

- To enable it, toggle the Paper Trading option in the settings before launching your bot.

5. Launch the Bot and Monitor Performance

- Once you’re satisfied with the configuration, click “Start Bot.” The bot will begin trading according to the parameters you’ve set.

- Use the dashboard to monitor performance, review trade history, and make adjustments as needed. You can also pause or stop the bot at any time.

By following these steps, you’ll be able to configure your trading assistant, automate your trades, and optimize your trading strategy with minimal manual intervention.

3Commas vs. Other Crypto Bots

When choosing a trading assistant platform, understanding the differences between the trading assistant and its competitors is essential for finding the right tool for your needs. this trading software stands out for its comprehensive automation options, ease of use, and strong community support. Here’s a look at how it compares to other popular crypto trading tools:

1. 3Commas vs. Cryptohopper

Cryptohopper is often seen as one of the closest alternatives to 3Commas. Both platforms offer a variety of bot types like DCA and Grid bots, support for multiple exchanges, and advanced strategy customization. However, Cryptohopper leans more towards strategy building through its drag-and-drop interface, making it ideal for users looking to create highly personalized strategies without coding.

- Key Difference: Cryptohopper provides a stronger focus on backtesting and strategy building, while 3Commas excels in its SmartTrade terminal, enabling detailed manual trading options alongside automation.

2. 3Commas vs. Coinrule

Coinrule targets traders who prefer rule-based automation, offering over 100 pre-configured templates that users can implement with just a few clicks. While the original trading tool is ideal for more experienced traders looking to customize bots, Coinrule is more accessible for beginners looking to deploy straightforward strategies.

- Key Difference: Coinrule emphasizes simplicity and ease of use with its templates, whereas the first trading tool offers greater flexibility and advanced features like trailing take-profit and multi-level bot settings.

3. 3Commas vs. Shrimpy

Shrimpy is primarily a portfolio management tool with automated rebalancing features, making it suitable for passive investors. It doesn’t offer the same depth of automated trading strategies as the first automated trading assistant but provides a streamlined solution for those focused on long-term investment and portfolio optimization.

- Key Difference: 3Commas is better for active trading and executing complex strategies, while Shrimpy focuses on automated portfolio management and social trading.

4. User Experience Insight

One user who tried both 3Commas and Cryptohopper noted that while Cryptohopper’s strategy builder was powerful, it took more time to set up. In contrast, the original automated trading assistant's pre-built strategies and intuitive interface allowed them to start trading more quickly, making it a better choice for those looking to get started without extensive configurations.

each platform has its unique strengths, and the choice depends on whether you prioritize ease of use, strategy customization, or a balance of both.

Final Verdict: Is 3Commas the Best Crypto Trading Bot?

this trading tool is undoubtedly a powerful trading platform that offers a diverse set of tools to automate trading and manage strategies with ease. Its combination of multiple bot types, including DCA and Grid bots, the SmartTrade terminal for advanced manual trading, and a well-integrated portfolio management system makes it stand out among its competitors.

The platform caters to both beginners and seasoned traders by providing a mix of simple, user-friendly setups and more advanced configurations for those looking to fine-tune their strategies. Features like trailing take-profit, portfolio rebalancing, and TradingView integration further add to its appeal, making it versatile enough for a range of trading approaches.

However, while this trading tool has many strengths, it does have a few drawbacks. The cost of higher-tier plans can be prohibitive for casual traders, and the platform’s complex bot configurations may overwhelm beginners. Additionally, recent security incidents have raised some concerns, although the trading assistant has since implemented stronger security measures like 2FA and IP whitelisting to address these issues.

User Experience Highlight: Many users have shared positive experiences with the platform’s DCA bot, reporting that it helped them mitigate losses during market downturns and recover positions effectively. This kind of flexibility, paired with real-time monitoring and alerts, makes the trading assistant a favorite among active traders.

Is 3Commas the Best Crypto Bot?

For traders who value automation and need a comprehensive tool that offers both strategy execution and portfolio management, this trading assistant is among the top choices available. While it may not be perfect for everyone, its powerful feature set, extensive exchange support, and community-driven enhancements make it a strong contender in the crypto bot space.

FAQs About 3Commas Crypto Trade Bot

Here are some frequently asked questions to help clarify common concerns and provide insights into using this automated trading software effectively:

How Much Does 3Commas Cost?

3Commas offers four pricing plans: Free, Pro ($37/month with annual payment or $49/month paid monthly), Expert ($59/month with annual payment or $79/month paid monthly), and Custom. The Free plan provides limited access to basic features, while higher-tier plans unlock more advanced tools, such as unlimited bots, multi-pair DCA trading, and sub-account management, catering to traders seeking greater flexibility and control.

Can Beginners Use 3Commas Effectively?

Yes, the automated trading software is designed for both beginners and experienced traders. The platform provides pre-configured bot templates, a simple SmartTrade terminal, and copy trading features that beginners can use to get started without a steep learning curve.

Is 3Commas Safe to Use?

the trading tool is generally safe if you follow best practices. The platform uses API keys with restricted access (no withdrawal rights), supports Two-Factor Authentication (2FA), and offers IP whitelisting for enhanced security. However, users should be vigilant and periodically update their API keys.

Can I Lose Money Using 3Commas Bots?

Yes, bots are not foolproof. Even with the best strategies, market conditions can change rapidly, resulting in potential losses. It’s crucial to configure stop-loss settings and risk management strategies to minimize this risk.

Which Exchanges are Compatible with 3Commas?

the trading tool integrates with over 17 major exchanges, including Binance, Coinbase Pro, Kraken, KuCoin, and Huobi. Each exchange may offer varying levels of bot compatibility, so it’s recommended to check the specific features supported on your preferred exchange.

What is the Best Strategy to Use with 3Commas?

The best strategy depends on your goals and risk tolerance. Dollar-Cost Averaging (DCA) is popular for reducing risk in volatile markets, while Grid Trading is more suitable for capturing small profits in stable markets. You can also explore copy trading to learn from top-performing traders.

Does 3Commas Offer Customer Support?

Yes, this trading tool provides 24/7 customer support via live chat and a comprehensive help center. Users can also access educational resources, video tutorials, and community forums for additional assistance.

Can I Use 3Commas on My Mobile Device?

Yes, the trading assistant has a mobile app available for both iOS and Android. It allows you to manage your bots, access the SmartTrade terminal, and receive real-time notifications, making it easy to trade on the go.

Discussion