Best Altcoins to Buy for the 2025 BullRun: Top 10 Cryptos

Best Altcoins to Buy for the 2025 BullRun: Top 10 crypto coins to invest in now for explosive gains during the next cryptocurrency bull run.

Best altcoins to buy for the 2025 BullRun could deliver explosive gains and significantly outperform other cryptocurrencies if selected carefully. With the next cryptocurrency bullrun expected to kick off in early 2025, savvy investors are keen to identify high-growth crypto coins that can skyrocket in value. Historically, bullruns have been a golden opportunity for altcoins to achieve massive returns, often surpassing Bitcoin’s growth rate. But which top cryptos are primed for this surge?

According to various industry sources like Brave New Coin, TechPoint Africa, CoinMonks, and Crypto News Flash, the key to profiting in the upcoming bullrun lies in picking altcoins with strong fundamentals, innovative technology, and solid community backing. Many analysts highlight that cryptocurrencies like Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) have consistently proven their potential to deliver exceptional returns. These platforms are not just tokens but are leading ecosystems, powering decentralized finance (DeFi) projects, smart contracts, and cross-chain integrations.

Moreover, other altcoins such as Solana (SOL), Avalanche (AVAX), and Polygon (MATIC) have been identified as top altcoins to buy for the 2025 due to their rapid development, scalability, and growing adoption by developers. With the right mix of established and emerging players, investors can position themselves for maximum gains as the next crypto bullrun approaches.

In this article, we’ll delve into the top 10 cryptos to invest in now for the 2025 BullRun, breaking down why each altcoin stands out and how they can potentially deliver 100x or even 1000x returns in the coming years. Whether you’re looking for solid long-term holds or high-risk, high-reward opportunities, these altcoins could be the key to capitalizing on the next big wave in the crypto market.

What Are Altcoins? Understanding Their Role in the Crypto Market

Altcoins, short for “alternative coins,” are any cryptocurrencies other than Bitcoin. While Bitcoin is often referred to as the "king of cryptocurrencies," altcoins emerged to address some of Bitcoin’s limitations, such as transaction speed, scalability, or to introduce entirely new functionalities. They have diversified significantly since their inception, each serving unique purposes and offering distinct use cases, making them a core part of the growing digital economy.

Altcoins typically fall into a few main categories. For example, utility tokens like Ethereum (ETH) and Binance Coin (BNB) provide access to specific platform services, while DeFi coins such as Avalanche (AVAX) enable decentralized financial applications like lending and trading. On the other hand, stablecoins like USDC and USDT are pegged to fiat currencies, offering price stability in the volatile crypto market. There are also governance tokens like Polkadot (DOT), which give holders voting rights on protocol decisions, and meme coins like Dogecoin (DOGE), which have grown in popularity thanks to community support and social media.

The role of altcoins in the crypto market extends beyond just being alternatives to Bitcoin. They drive innovation, foster competition, and push the boundaries of what blockchain technology can achieve. For example, Ethereum introduced smart contracts, which revolutionized the industry by enabling decentralized applications (dApps). Similarly, Solana and Polygon offer high-speed, low-cost blockchain solutions that address Ethereum’s scalability issues, making them attractive options for developers and investors.

Investing in altcoins can be lucrative, especially during a bullrun, as they often experience greater price swings compared to Bitcoin. However, this higher potential comes with increased risk, as the market can be highly volatile. Understanding the technology, the team behind each project, and its real-world applications is essential before adding any altcoin to an investment portfolio.

altcoins are a vital component of the crypto ecosystem, offering unique opportunities for both technological advancements and high returns. As the market matures and new innovations emerge, altcoins will likely continue to play a pivotal role in shaping the future of the digital economy.

Different Types of Altcoins: Which One Should You Invest In?

When navigating the world of altcoins, choosing the right type can significantly impact your returns, especially during a bullrun. Each altcoin category has distinct features, risks, and growth potential, making it essential to understand their differences before deciding which to add to your portfolio. Let’s break down the most popular types of altcoins and explore their roles within the crypto market.

| Type of Altcoin | Purpose | Examples | Investment Potential |

|---|---|---|---|

| Utility Tokens | Power specific blockchain platforms by providing access to services or features. | Ethereum (ETH), Binance Coin (BNB) | Moderate to High - Depends on the adoption of the underlying platform. |

| Payment Tokens | Serve as a medium of exchange for goods and services, similar to traditional currency. | Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH) | Low to Moderate - Primarily used for transactions and value transfer. |

| Stablecoins | Maintain a stable value by being pegged to fiat currencies or commodities. | Tether (USDT), USD Coin (USDC) | Low - Ideal for stability and low-risk holding, not for high returns. |

| Security Tokens | Represent ownership in real-world assets like stocks, real estate, or company shares. | tZero (TZROP), Polymath (POLY) | Moderate to High - Potential for growth if underlying assets perform well. |

| Governance Tokens | Provide holders with voting rights on project decisions and future developments. | Polkadot (DOT), Uniswap (UNI) | Moderate - Depends on the project's success and community involvement. |

| DeFi Tokens | Enable decentralized financial services like lending, borrowing, and trading. | Avalanche (AVAX), Aave (AAVE), Chainlink (LINK) | High - High growth potential but also higher risks due to evolving regulations. |

| Meme Coins | Started as internet jokes or experiments but gained popularity through communities. | Dogecoin (DOGE), Shiba Inu (SHIB) | High - Can experience rapid growth but are extremely volatile. |

| Privacy Coins | Prioritize user privacy and anonymity by hiding transaction details. | Monero (XMR), Zcash (ZEC) | Moderate to High - Potential for growth but may face regulatory challenges. |

| Interoperability Tokens | Facilitate communication and interaction between different blockchain networks. | Polkadot (DOT), Cosmos (ATOM) | High - High demand as more blockchains seek seamless integration. |

| NFTs and Metaverse Tokens | Enable ownership of unique digital assets and participation in virtual worlds. | Decentraland (MANA), Sandbox (SAND) | High - Potential for explosive growth as the metaverse and digital ownership expand. |

Utility Tokens: Powering Blockchain Platforms

Utility tokens are designed to facilitate operations within a specific blockchain network. They provide users with access to particular features, services, or functionalities within that ecosystem. Examples include Ethereum (ETH), which fuels transactions and smart contracts on the Ethereum network, and Binance Coin (BNB), used for reducing trading fees on Binance’s platform. Utility tokens tend to have a more stable value, as their demand is tied to the use of the platform.

Payment Tokens: A Digital Form of Money

Payment tokens are intended to function as a medium of exchange, similar to traditional currencies. Bitcoin (BTC) is the most recognized payment token, but other altcoins like Litecoin (LTC) and Bitcoin Cash (BCH) also fall under this category. These tokens are primarily used for peer-to-peer transactions and purchasing goods and services.

Stablecoins: Reducing Volatility

Stablecoins are pegged to real-world assets like the US Dollar or commodities, providing price stability. Popular stablecoins include Tether (USDT) and USD Coin (USDC). They’re commonly used as a safe store of value during periods of market volatility or for transferring funds between exchanges without exposure to price fluctuations.

Security Tokens: Digital Assets with Real-World Value

Security tokens represent ownership in real-world assets like stocks, real estate, or company shares. They are regulated and must comply with securities laws. For example, security tokens might grant holders a share in a company's profits or voting rights. This category is less popular but is gaining traction as more traditional assets become digitized.

Governance Tokens: Shaping the Future of Projects

Governance tokens give holders the right to vote on project decisions, such as changes to the protocol, new feature implementation, or resource allocation. Examples include Polkadot (DOT) and Uniswap (UNI). Governance tokens allow investors to influence the project’s future, making them appealing for those interested in active participation.

DeFi Tokens: Enabling Decentralized Finance

DeFi (Decentralized Finance) tokens power various financial applications, such as lending, borrowing, and trading, without relying on traditional intermediaries. Avalanche (AVAX) and Aave (AAVE) are well-known DeFi tokens that have seen explosive growth due to the rise of DeFi platforms, which offer innovative financial services on blockchain networks.

Meme Coins: Community-Driven with High Volatility

Meme coins, such as Dogecoin (DOGE) and Shiba Inu (SHIB), began as jokes or social media experiments but have gained serious traction due to strong community support. While they lack the technological innovation seen in other categories, they can experience rapid price surges during hype cycles, making them high-risk, high-reward investments.

Privacy Coins: Focused on Anonymity

Privacy coins, like Monero (XMR) and Zcash (ZEC), prioritize user privacy and anonymity by hiding transaction details. They appeal to users who want to keep their financial activity confidential. However, their focus on privacy has also led to regulatory scrutiny in some regions.

Interoperability Tokens: Connecting Blockchains

Interoperability tokens, like Polkadot (DOT) and Cosmos (ATOM), aim to bridge different blockchain networks, enabling them to communicate and share data seamlessly. These tokens support a connected web of blockchains, facilitating cross-chain transactions and interoperability between diverse ecosystems.

NFTs and Metaverse Tokens: Digital Ownership and Virtual Worlds

NFT (Non-Fungible Token) and Metaverse tokens are used for unique digital assets like art, music, virtual land, and other collectibles. Examples include Decentraland (MANA) and Sandbox (SAND). These tokens are redefining ownership in the digital realm, allowing users to buy, sell, and trade digital properties and items in virtual environments.

Which Type of Altcoins is Right for You?

Selecting the right type of altcoin depends on your investment goals and risk tolerance. Utility and DeFi tokens are ideal for those seeking long-term value, while governance and interoperability tokens appeal to investors interested in influencing project development. For high-risk, high-reward strategies, meme coins or certain privacy coins may be attractive, but they require a strong understanding of market trends and community sentiment. A diversified portfolio that includes a mix of these altcoin categories can help balance potential risks and returns.

Why Invest in Altcoins During a BullRun? Key Benefits and Potential

Investing in altcoins during a BullRun can be highly rewarding, as the value of these cryptocurrencies tends to surge much faster compared to more established coins like Bitcoin. During a BullRun, investor enthusiasm and market optimism create the perfect environment for altcoins to capture attention and deliver significant gains. Understanding why this happens and what the potential benefits are can help investors make more informed decisions.

Higher Growth Potential Compared to Bitcoin

While Bitcoin often leads the charge in a BullRun, altcoins usually experience much larger percentage gains. This is because they generally have smaller market caps and lower liquidity, making them more susceptible to rapid price swings when demand increases. For instance, in past BullRuns, projects like Ethereum (ETH) and Binance Coin (BNB) saw exponential growth, sometimes outpacing Bitcoin’s performance by a considerable margin. Investors looking to maximize returns are drawn to altcoins for this very reason — the potential to 10x or even 100x their investments within a relatively short period.

Innovation and Niche Market Opportunities

Many altcoins are built around solving specific problems or offering unique functionalities that Bitcoin lacks. For example, DeFi tokens like Avalanche (AVAX) and Chainlink (LINK) have carved out a niche by enabling decentralized finance applications, while meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) tap into community-driven momentum. This innovation often translates into high potential for rapid adoption and growth during a BullRun, as investors seek out projects that can bring fresh use cases and disrupt traditional industries.

Diversification and Risk Mitigation

Altcoins offer a way to diversify a crypto portfolio. During a BullRun, Bitcoin’s dominance typically shrinks as capital flows into high-performing altcoins. By diversifying across different categories such as utility tokens, DeFi, and interoperability tokens, investors can reduce risk while still capitalizing on the market’s bullish momentum. For instance, holding both Polkadot (DOT), which focuses on cross-chain communication, and Solana (SOL), known for its high-speed transactions, provides exposure to different growth drivers, mitigating the risk if one segment underperforms.

Case Study: The 2017 BullRun and Ethereum’s Surge

One of the best examples of altcoin potential during a BullRun is Ethereum’s performance in 2017. While Bitcoin’s price increased by about 20x, Ethereum’s value skyrocketed by over 100x in the same period. This happened as Ethereum introduced smart contracts, capturing massive interest and capital from investors looking to support decentralized applications (dApps). This kind of surge illustrates the asymmetric gains altcoins can achieve when a BullRun is in full swing.

Community and Social Media Momentum

Some altcoins thrive during BullRuns due to strong community support and social media hype. Coins like Shiba Inu (SHIB) gained traction primarily through grassroots campaigns and viral marketing, which drove new investors into the ecosystem. When market sentiment is overwhelmingly positive, as it often is in a BullRun, community-driven altcoins can see extraordinary price jumps, making them attractive short-term opportunities.

investing in altcoins during a BullRun can yield significant rewards if approached strategically. The combination of higher growth potential, innovative use cases, and the opportunity to diversify makes them a compelling addition to any crypto portfolio during bullish market conditions. However, it’s important to remain vigilant, as the same factors that drive altcoins’ rapid gains can also lead to swift downturns.

Key Factors and Risks to Consider When Choosing the Best Altcoins to Buy

Choosing the best altcoins for a BullRun involves evaluating multiple factors to ensure you’re selecting projects with solid potential while minimizing risks. With hundreds of altcoins to choose from, it’s easy to be swayed by hype or temporary price pumps, so understanding the key aspects to focus on is essential for making informed decisions.

1. Project Fundamentals and Use Case

A critical factor to consider is the underlying technology and the real-world problem the altcoin aims to solve. Coins like Ethereum (ETH) and Polkadot (DOT) have strong use cases supporting decentralized applications and interoperability, making them foundational projects with long-term value. On the other hand, meme coins like Dogecoin (DOGE) or Shiba Inu (SHIB) rely heavily on community support and social media hype, which can be risky if the novelty fades. Before investing, ask yourself: Does this altcoin provide a unique solution or utility that can drive sustainable demand?

2. Market Position and Competitors

Understanding where an altcoin stands in the market is equally important. Altcoins like Cardano (ADA) and Avalanche (AVAX) are often considered competitors to Ethereum, each trying to improve on scalability and transaction speeds. During a BullRun, investors tend to favor projects with a clear edge over their competitors. Evaluate how the coin differentiates itself and whether it has a significant market share in its niche.

3. Development Team and Community Support

A strong development team and an active community are vital indicators of a project’s potential. Projects backed by reputable teams, such as Chainlink (LINK) and Solana (SOL), have consistently delivered on their roadmaps and gained investor trust. An engaged community can also be a powerful catalyst for growth, as seen with Shiba Inu (SHIB), which leveraged its fan base to build an entire ecosystem. Look for transparency in development updates and active engagement across platforms like GitHub, Reddit, and Twitter.

4. Tokenomics and Supply Distribution

Tokenomics refers to the economic model behind the altcoin. Factors like total supply, inflation rate, and distribution of tokens among investors and team members can impact price stability and future growth. For example, coins with a capped supply like Bitcoin or regular token burns like Binance Coin (BNB) often experience price appreciation as scarcity increases. Conversely, projects with a high initial supply or uneven distribution can suffer from sudden dumps if early investors sell off their holdings.

5. Regulatory Risks and Market Sentiment

Regulation remains a significant risk for altcoins, particularly for privacy-focused coins like Monero (XMR) or security tokens. Governments around the world are tightening their grip on crypto regulations, and altcoins that don’t comply could face delistings or loss of investor confidence. Before investing, keep an eye on the regulatory environment and any potential restrictions that could affect the project’s future.

6. Volatility and Liquidity

Altcoins are typically more volatile than Bitcoin, making them riskier but potentially more rewarding during a BullRun. High volatility can lead to sharp price corrections, especially if the coin lacks liquidity. Check the trading volume and availability across major exchanges to ensure you won’t face issues with entering or exiting your positions.

Which Risks to Prioritize?

Balancing these factors with the potential risks is key. For example, during the 2017 and 2021 BullRuns, many altcoins surged rapidly, only to drop just as quickly when the hype faded or the projects failed to deliver on promises. Prioritizing altcoins with strong fundamentals, a committed team, and a clear use case can help mitigate the downside while positioning your portfolio to capture gains during bullish periods.

Best Altcoins to Buy for the 2025 BullRun: Top 10 Cryptos

As the 2025 approaches, identifying the top-performing altcoins can help maximize returns. Each of these altcoins offers unique features, market positioning, and growth potential, making them prime candidates for the upcoming bull market. Below is a detailed analysis of the top 10 altcoins to buy for the next BullRun.

| Altcoin | Launch Date | Market Cap (as of Oct 2024) | Circulating Supply | All-Time High (ATH) | Current Price | Key Use Case |

|---|---|---|---|---|---|---|

| Ethereum (ETH) | 2015 | $500 billion | 120 million ETH | $4,865 | $3,500 | Powering dApps, DeFi, and smart contracts |

| Binance Coin (BNB) | 2017 | $85 billion | 155 million BNB | $690 | $450 | Trading fee discounts, DeFi, staking |

| Cardano (ADA) | 2017 | $50 billion | 34 billion ADA | $3.09 | $1.50 | Smart contracts, interoperability |

| Solana (SOL) | 2020 | $30 billion | 375 million SOL | $260 | $200 | High-speed, low-cost transactions for dApps |

| Avalanche (AVAX) | 2020 | $15 billion | 315 million AVAX | $146 | $100 | Scalable DeFi and enterprise-grade solutions |

| Polkadot (DOT) | 2020 | $25 billion | 1 billion DOT | $55 | $25 | Interoperability and cross-chain data transfer |

| Chainlink (LINK) | 2017 | $10 billion | 500 million LINK | $52 | $20 | Decentralized oracles for real-world data |

| Stellar (XLM) | 2014 | $12 billion | 25 billion XLM | $0.87 | $0.48 | Low-cost, cross-border payments |

| Kaspa (KAS) | 2022 | $1 billion | 17 billion KAS | $0.08 | $0.05 | High-speed, scalable BlockDAG architecture |

| Polygon (MATIC) | 2017 | $15 billion | 10 billion MATIC | $2.68 | $1.50 | Layer 2 scaling solutions for Ethereum |

Ethereum (ETH): The Backbone of DeFi and Smart Contracts

Overview:

Ethereum is the leading platform for decentralized applications (dApps) and smart contracts. As the pioneer of the smart contract concept, Ethereum has established itself as the go-to network for developers building decentralized finance (DeFi) applications and NFTs.

Key Details:

- Launch Date: 2015

- Market Cap: $500 billion (as of October 2024)

- Circulating Supply: 120 million ETH

- All-Time High (ATH): $4,865

- Current Price: $3,500

Use Case and Unique Features:

Ethereum supports thousands of dApps and serves as the foundation for the entire DeFi ecosystem. Its transition to Ethereum 2.0 will address scalability issues, making it faster and more energy-efficient.

Market Position and Competition:

Ranked #2 by market cap, Ethereum competes with newer platforms like Cardano and Solana. Despite emerging competitors, Ethereum’s extensive ecosystem and early mover advantage keep it in a dominant position.

Recent Developments and Roadmap:

The Ethereum 2.0 upgrade, which includes a shift to Proof-of-Stake (PoS) and the introduction of sharding, is expected to be fully implemented by 2025, significantly boosting the network’s capacity.

Conclusion:

Ethereum’s strong developer community and upcoming upgrades make it a top altcoin for the next BullRun, with a high potential for growth.

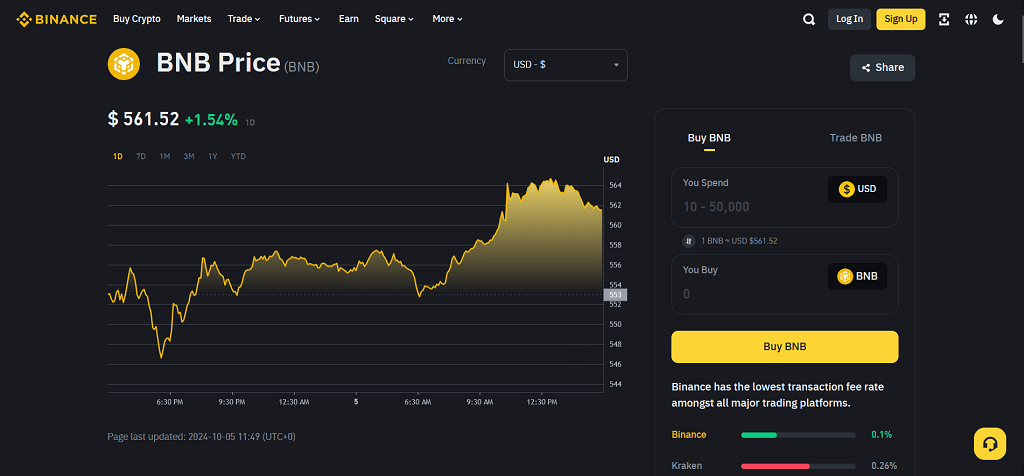

Binance Coin (BNB): Growth and Utility in the Binance Ecosystem

Overview:

Binance Coin (BNB) is the native token of the Binance exchange and the Binance Smart Chain (BSC). Initially created to offer trading fee discounts, BNB has evolved into a multi-purpose asset that powers various DeFi projects, staking, and payment services within the Binance ecosystem.

Key Details:

- Launch Date: 2017

- Market Cap: $85 billion (as of October 2024)

- Circulating Supply: 155 million BNB

- Total Supply: 200 million BNB (with periodic burns)

- All-Time High (ATH): $690

- Current Price: $450

Use Case and Unique Features:

BNB is used for trading fee discounts, participating in token sales, and powering transactions on BSC. Binance’s regular token burns decrease the supply, making BNB a deflationary asset.

Market Position and Competition:

Ranked #4 by market cap, BNB competes with exchange tokens like FTX Token (FTT). Its integration with Binance’s vast ecosystem gives it a significant advantage.

Recent Developments and Roadmap:

Binance is expanding its ecosystem with initiatives like the BNB Greenfield, a decentralized storage system, and ongoing DeFi integrations, which could further drive BNB’s adoption.

Conclusion:

BNB’s utility within the Binance ecosystem and its deflationary tokenomics make it a top pick for 2025.

Cardano (ADA): A Sustainable and Scalable Smart Contract Platform

Overview:

Cardano is a third-generation blockchain platform built on a peer-reviewed, scientific approach to development. It aims to solve the issues of scalability, security, and interoperability that earlier blockchains face.

Key Details:

- Launch Date: 2017

- Market Cap: $50 billion (as of October 2024)

- Circulating Supply: 34 billion ADA

- Total Supply: 45 billion ADA

- All-Time High (ATH): $3.09

- Current Price: $1.50

Use Case and Unique Features:

Cardano’s Proof-of-Stake (PoS) consensus mechanism, Ouroboros, is highly energy-efficient. The platform supports smart contracts, NFTs, and decentralized applications, making it a versatile ecosystem for developers.

Market Position and Competition:

Ranked #6 by market cap, Cardano’s emphasis on research and formal verification sets it apart from competitors like Ethereum and Solana.

Recent Developments and Roadmap:

Recent upgrades introduced smart contracts to the platform, and future plans include Hydra, a Layer 2 solution for scalability.

Conclusion:

Cardano’s strong focus on sustainability and innovation makes it a solid long-term investment for the next BullRun.

Solana (SOL): High-Speed and Low-Cost Transactions for dApps

Overview:

Solana is a high-performance blockchain designed for speed and cost efficiency. Its unique Proof-of-History (PoH) consensus, combined with Proof-of-Stake (PoS), enables it to achieve industry-leading transaction speeds.

Key Details:

- Launch Date: 2020

- Market Cap: $30 billion (as of October 2024)

- Circulating Supply: 375 million SOL

- All-Time High (ATH): $260

- Current Price: $200

Use Case and Unique Features:

Solana’s main advantage is its ability to process over 50,000 transactions per second (TPS) with low fees, making it ideal for DeFi and NFT platforms.

Market Position and Competition:

Ranked #8 by market cap, Solana competes directly with Ethereum, Avalanche, and Cardano. Its high throughput and low costs give it a unique position in the market.

Recent Developments and Roadmap:

Solana is rapidly expanding its ecosystem with partnerships and dApp launches. It aims to improve network stability and scale its infrastructure further.

Conclusion:

Solana’s speed and low transaction costs make it a top choice for high-growth opportunities in the 2025 run.

Avalanche (AVAX): Innovative Consensus and High Scalability

Overview:

Avalanche is a high-performance blockchain platform known for its innovative consensus mechanism and high scalability. Its three-chain architecture allows for custom blockchain creation and decentralized application development.

Key Details:

- Launch Date: 2020

- Market Cap: $15 billion (as of October 2024)

- Circulating Supply: 315 million AVAX

- All-Time High (ATH): $146

- Current Price: $100

Use Case and Unique Features:

Avalanche’s ability to process thousands of transactions per second and near-instant finality makes it ideal for enterprise-level solutions and DeFi applications.

Market Position and Competition:

Ranked #11 by market cap, Avalanche competes with Ethereum and Polkadot. Its Ethereum compatibility enhances its appeal for developers.

Recent Developments and Roadmap:

Avalanche is focusing on enhancing interoperability and expanding its DeFi ecosystem with new partnerships.

Conclusion:

Avalanche’s high throughput and scalability make it a strong contender for high returns in 2025.

Polkadot (DOT): The Multi-Chain Protocol for Web 3.0

Overview:

Polkadot is a multi-chain platform that enables different blockchains to transfer messages and data in a trustless way. It’s designed to create a web of interconnected blockchains, known as parachains, to facilitate cross-chain transfers and interoperability between various blockchain networks, positioning itself as a key player in the development of Web 3.0.

Key Details:

- Launch Date: 2020

- Market Cap: $25 billion (as of October 2024)

- Circulating Supply: 1 billion DOT

- Total Supply: 1.2 billion DOT

- All-Time High (ATH): $55

- Current Price: $25

Use Case and Unique Features:

Polkadot’s parachain architecture allows for the seamless transfer of assets and data between different blockchains, making it a highly scalable and flexible platform. It is often seen as a solution for blockchain interoperability, enabling a connected network of blockchains that can share information and security.

Market Position and Competition:

Ranked #10 by market cap, Polkadot competes with platforms like Cosmos and Avalanche in the interoperability space. Its robust ecosystem and clear use case give it a strong competitive edge.

Recent Developments and Roadmap:

Polkadot’s focus has been on expanding its parachain ecosystem through auctions and onboarding new projects. Upcoming developments include enhancements to its governance model and further improvements to its interoperability capabilities.

Conclusion:

Polkadot’s strong focus on interoperability and Web 3.0 development makes it a top pick for the next BullRun, especially for those seeking exposure to cross-chain technology.

Chainlink (LINK): Secure Oracle Solutions for Real-World Data

Overview:

Chainlink is the leading decentralized oracle network that connects smart contracts with real-world data, enabling external data sources to interact securely with on-chain systems. It plays a vital role in the DeFi ecosystem by providing reliable data feeds for applications like lending protocols, derivatives, and decentralized exchanges.

Key Details:

- Launch Date: 2017

- Market Cap: $10 billion (as of October 2024)

- Circulating Supply: 500 million LINK

- Total Supply: 1 billion LINK

- All-Time High (ATH): $52

- Current Price: $20

Use Case and Unique Features:

Chainlink provides secure, tamper-proof inputs and outputs for smart contracts. Its decentralized oracle network ensures that external data, such as price feeds and weather data, can be trusted by blockchain applications. This has made it the go-to solution for developers needing reliable data.

Market Position and Competition:

Ranked #13 by market cap, Chainlink dominates the decentralized oracle market. Its main competitors include Band Protocol, but Chainlink’s extensive partnerships and integrations have solidified its position as the top oracle provider.

Recent Developments and Roadmap:

Chainlink is expanding its offerings with features like Chainlink Staking and the Cross-Chain Interoperability Protocol (CCIP), which will enable secure messaging and token transfers between different blockchains.

Conclusion:

Chainlink’s role as the primary oracle provider for DeFi makes it a critical infrastructure piece for the blockchain ecosystem. Its strong utility and continuous innovation position it well for significant growth in the 2025 BullRun.

Stellar (XLM): Transforming Global Cross-Border Payments

Overview:

Stellar is a decentralized protocol designed to facilitate low-cost cross-border payments and asset transfers. It aims to bridge the gap between traditional financial systems and cryptocurrencies, enabling quick and affordable international transfers for both individuals and institutions.

Key Details:

- Launch Date: 2014

- Market Cap: $12 billion (as of October 2024)

- Circulating Supply: 25 billion XLM

- Total Supply: 50 billion XLM

- All-Time High (ATH): $0.87

- Current Price: $0.48

Use Case and Unique Features:

Stellar focuses on enabling seamless and low-cost cross-border transactions. It is particularly strong in areas like remittances and micropayments. Its consensus algorithm allows for fast, low-cost transactions, making it ideal for connecting payment systems and financial institutions.

Market Position and Competition:

Ranked #14 by market cap, Stellar competes with Ripple (XRP) in the cross-border payments space. Its partnerships with major financial institutions, such as IBM, give it a strong foothold in the sector.

Recent Developments and Roadmap:

Stellar has been working on enhancing its ecosystem by forming strategic partnerships and expanding its use cases. Upcoming upgrades include protocol improvements for greater efficiency and network scalability.

Conclusion:

Stellar’s focus on real-world financial applications makes it an appealing choice for the 2025 BullRun, especially for investors seeking exposure to the global payments sector.

Kaspa (KAS): High-Speed and Scalable BlockDAG Blockchain

Overview:

Kaspa is a next-generation blockchain protocol that utilizes a BlockDAG (Directed Acyclic Graph) structure to achieve high transaction throughput and fast confirmations. It’s designed to solve the scalability issues of traditional blockchains while maintaining security and decentralization.

Key Details:

- Launch Date: 2022

- Market Cap: $1 billion (as of October 2024)

- Circulating Supply: 17 billion KAS

- Total Supply: 28 billion KAS

- All-Time High (ATH): $0.08

- Current Price: $0.05

Use Case and Unique Features:

Kaspa’s BlockDAG architecture allows for near-instant transaction confirmations and high scalability. It is designed to handle large transaction volumes without sacrificing security, making it suitable for a wide range of applications.

Market Position and Competition:

Kaspa is a relatively new entrant but has quickly gained attention for its innovative approach. Its main competitors include traditional high-speed blockchains like Solana, but Kaspa’s unique structure gives it a strong competitive edge.

Recent Developments and Roadmap:

Kaspa’s focus has been on optimizing its consensus algorithm and expanding its developer community. Future plans include integration with DeFi applications and cross-chain functionality.

Conclusion:

With its innovative technology and strong focus on scalability, Kaspa is a promising contender for explosive growth in the 2025 BullRun.

Polygon (MATIC - Pol): Scaling Ethereum with Layer 2 Solutions

Overview:

Polygon is a Layer 2 scaling solution for Ethereum that aims to provide faster and cheaper transactions. Its sidechain architecture enhances Ethereum’s scalability, making it ideal for developers looking to build decentralized applications without high gas fees.

Key Details:

- Launch Date: 2017

- Market Cap: $15 billion (as of October 2024)

- Circulating Supply: 10 billion MATIC

- Total Supply: 10 billion MATIC

- All-Time High (ATH): $2.68

- Current Price: $1.50

Use Case and Unique Features:

Polygon’s sidechains and Layer 2 solutions enable developers to build scalable dApps with Ethereum compatibility. It supports a wide range of DeFi projects and gaming applications, making it a versatile platform.

Market Position and Competition:

Ranked #9 by market cap, Polygon competes with other Layer 2 solutions like Optimism and Arbitrum. Its strong developer support and extensive ecosystem give it a distinct advantage.

Recent Developments and Roadmap:

Polygon has undergone a significant transformation with the introduction of its new token, POL, as part of the Polygon 2.0 upgrade. POL is set to replace MATIC as the main utility and governance token for the ecosystem. Existing MATIC holders can swap their tokens 1:1 for POL, which is designed to support Polygon’s expanded multi-chain network. This upgrade aims to enhance scalability and security, making Polygon a leading choice for developers building on Ethereum.

Conclusion:

Polygon’s focus on scaling Ethereum and its strong developer support make it one of the top altcoins for the 2025 BullRun.

Which Altcoin is the Best for the 2025 BullRun? Final Thoughts

Choosing the best altcoins to buy for the 2025 ultimately depends on your investment goals and risk tolerance. Each altcoin in the top 10 list has its own strengths and potential growth drivers. Ethereum (ETH) remains a solid choice due to its established ecosystem and upcoming scalability upgrades. If you’re looking for a safer yet rewarding investment, Ethereum’s strong track record and pivotal role in DeFi and NFTs make it an ideal candidate.

For those seeking a high-growth, high-risk option, Solana (SOL) and Avalanche (AVAX) stand out due to their rapid development and strong focus on scalability. These platforms have already shown their ability to attract both developers and users, setting them up for significant gains as the BullRun progresses.

Meanwhile, Binance Coin (BNB) offers the best of both worlds, combining strong utility within the Binance ecosystem and a deflationary tokenomics model. Its growth is closely tied to the continued success of the Binance exchange and Binance Smart Chain (BSC).

However, Polkadot (DOT) is the standout for those interested in cross-chain technology and the future of Web 3.0. Its parachain architecture positions it as a leader in blockchain interoperability, making it a unique pick for investors looking at long-term growth.

Ultimately, a diversified portfolio that includes a mix of these high-potential altcoins — such as Ethereum, Solana, Polkadot, and Chainlink — could be the best approach for maximizing returns during the upcoming BullRun. Remember to consider your risk appetite, conduct thorough research, and stay updated on each project’s developments to make informed investment decisions.

FAQs About the Best Altcoins to Buy for the 2025 BullRun

Navigating the altcoin market during a BullRun can be both exciting and overwhelming. Below are some frequently asked questions that address common concerns and considerations when selecting the best altcoins to invest in for the 2025 BullRun.

What Makes an Altcoin a Good Investment for the Next BullRun?

A good altcoin for 2025 typically has strong fundamentals, innovative technology, and high community support. Key factors to consider include the project’s use case, development team, market position, and recent developments. Cryptocurrencies like Ethereum (ETH) and Binance Coin (BNB) are strong contenders due to their established ecosystems, while emerging altcoins like Avalanche (AVAX) and Kaspa (KAS) offer potential for high growth due to their scalability and technological advancements.

Is It Better to Invest in Established Altcoins or Newer Projects?

Both established and newer altcoins can deliver significant returns during a BullRun, but they come with different risk profiles. Established coins like Ethereum, Cardano (ADA), and Solana (SOL) offer more stability and have a proven track record. Newer projects like Kaspa (KAS) and Polygon (MATIC), however, may provide higher returns but also come with increased volatility and risk. A balanced portfolio with both types can help optimize risk and reward.

Which Altcoin Has the Most Potential to 10x or 100x During the 2025?

Altcoins with smaller market caps and strong growth potential, such as Kaspa or Stellar (XLM), could experience exponential gains. During previous BullRuns, low-cap coins have seen 100x or even 1000x returns. However, these opportunities come with high risk, so thorough research and timing are crucial for capturing such gains.

How Important is Community Support for Altcoins?

Community support plays a vital role in an altcoin’s success, especially during BullRuns. Coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have shown that strong communities can drive price surges, even without significant technological backing. Investing in altcoins with active and supportive communities can provide an additional edge, as these groups often contribute to growth through organic marketing and development.

Should I Diversify My Altcoin Portfolio?

Yes, diversification is recommended to manage risk and capitalize on different growth areas. Including a mix of utility tokens (e.g., Ethereum, Binance Coin), DeFi tokens (e.g., Chainlink), and high-risk, high-reward projects (e.g., Kaspa) can help balance potential gains and losses. This approach allows investors to benefit from various sectors, such as DeFi, interoperability, and scalability, during the BullRun.

What Risks Should I Be Aware of When Investing in Altcoins?

Investing in altcoins comes with risks such as high volatility, regulatory uncertainty, and project failure. During BullRuns, altcoins can experience rapid price spikes followed by sharp corrections. To mitigate these risks, focus on projects with strong use cases, active development teams, and a clear path to long-term success. Additionally, always use proper risk management strategies like setting stop-loss orders.

When is the Best Time to Buy Altcoins During a BullRun?

Timing the market during a BullRun can be challenging. Generally, it’s best to enter when the market shows early signs of bullish momentum but before the peak euphoria phase. Identifying support levels and keeping an eye on Bitcoin’s dominance can also help pinpoint favorable entry points.

How Do I Know If an Altcoin is Overvalued?

To determine if an altcoin is overvalued, consider its price relative to key metrics such as market cap, circulating supply, and total value locked (TVL) in the case of DeFi projects. If the price has surged significantly without corresponding developments or real-world adoption, it could indicate an overvaluation. Technical indicators like RSI (Relative Strength Index) can also help identify overbought conditions.

Can Altcoins Outperform Bitcoin in the next BullRun?

Yes, altcoins often outperform Bitcoin during BullRuns due to their smaller market caps and higher growth potential. In previous cycles, many altcoins saw returns far exceeding those of Bitcoin. For instance, Ethereum’s growth during the 2017 BullRun significantly outpaced Bitcoin’s performance. However, the higher potential comes with increased risk and volatility.

Which Sectors Within the Altcoin Market Show the Most Promise for the 2025 BullRun?

Sectors like DeFi, interoperability, and the metaverse are expected to lead the next BullRun. Coins like Chainlink (LINK) for DeFi, Polkadot (DOT) for interoperability, and Sandbox (SAND) for the metaverse are poised for strong growth. Additionally, Layer 2 scaling solutions such as Polygon (MATIC) are gaining traction as Ethereum’s scalability issues continue.

Discussion