10 Best Crypto Lending Platforms with Best Interest Rates

Find 10 best crypto lending platforms with best interest rates for crypto loans. Compare features, rates & rewards to maximize crypto earnings.

Finding the best crypto lending platforms with the best interest rates is crucial for anyone looking to maximize returns through cryptocurrency lending or secure favorable crypto loans. As cryptocurrency continues to grow in popularity, platforms offering these services provide a unique opportunity for users to either earn interest on their digital assets or borrow against them without traditional banks.

In this article, we’ll explore the top crypto loan platforms and their features, sourced from trusted sites like Techopedia, CoinLedger, SoluLab, and CoinRabbit. Our goal is to help you make informed decisions on the best platforms to earn high interest or take out crypto loans, ensuring your assets work efficiently for you.

By the end, you'll understand how these platforms function, their benefits, and how to choose the best one for your financial needs.

What is Crypto Lending and a Crypto Loan?

Crypto lending is a rapidly growing financial service that allows cryptocurrency holders to lend their digital assets to borrowers in exchange for interest. In simple terms, it's a way to make your crypto work for you, providing a return on holdings that would otherwise sit idle. This concept is particularly appealing in the world of digital finance, where traditional banking options for earning interest are often limited.

On the other hand, a crypto loan allows individuals to borrow funds by using their crypto as collateral. Rather than selling their cryptocurrency—potentially missing out on future price increases—borrowers can lock up their assets in a digital asset lending platform to secure a loan, typically in stablecoins or fiat currency. Once the loan is repaid, they regain access to their collateral.

For example, platforms like Nexo and BlockFi have become popular for offering competitive interest rates to both lenders and borrowers. Nexo, for instance, provides flexibility with daily interest payouts and rates up to 12% for stablecoins like USDC and Tether. Similarly, Aave is renowned for its decentralized approach, allowing users to borrow and lend without intermediaries, offering unique features like flash loans for advanced users.

One real-world example of digital asset lending can be seen in a case where a long-term Bitcoin holder wanted to avoid selling their BTC during a market dip. By taking out a crypto loan on BlockFi, they were able to access immediate cash for a business opportunity while keeping their Bitcoin in place. After the loan was repaid, they still held the same amount of BTC, benefiting from its subsequent price increase.

Both digital asset lending and loans offer significant advantages over traditional finance, such as higher potential returns for lenders and easier access to loans for borrowers without credit checks. However, it’s essential to carefully evaluate loan-to-value ratios (LTV), platform security, and market volatility before engaging with any lending service.

How Crypto Lending Platforms Work

At the heart of blockchain lending is a simple concept: lenders provide their digital assets, such as Bitcoin or Ethereum, to digital asset lending websites, where they earn interest. On the other side, borrowers take out loans using their cryptocurrency as collateral. This process mirrors traditional lending, but without the need for banks or credit checks.

When a user deposits their cryptocurrency into a lending platform, they earn a percentage of interest, often higher than traditional savings accounts. These platforms, like Nexo or BlockFi, take the deposited crypto and lend it to borrowers who pay back the loan with interest. This interest is then passed on to the lender as a reward.

Borrowers, meanwhile, can access quick liquidity without selling their crypto assets. Instead, they put up their digital assets as collateral—the value of which determines how much they can borrow, typically calculated by a Loan-to-Value (LTV) ratio. For example, BlockFi offers loans with an LTV of 50%, meaning a user can borrow half the value of their crypto. As long as the loan is repaid, the borrower regains full control of their collateral.

A key feature of these platforms is flexibility. Platforms like Aave, a decentralized finance (DeFi) platform, even offer unique services like flash loans, which allow users to borrow without collateral, provided the loan is repaid within the same transaction. This option is popular among more experienced traders looking for short-term gains or arbitrage opportunities.

One user example comes from CoinRabbit, a platform known for its simplicity. A user looking to avoid a complicated loan application process was able to secure a loan with just their phone number. With an easy-to-understand interface and no complex sign-up procedures, they received their funds in minutes, using only their crypto holdings as collateral.

These platforms work by connecting borrowers and lenders in a way that benefits both parties. Lenders earn passive income, while borrowers access funds without selling off their crypto. However, it’s crucial for users to be mindful of risks like market volatility, which can lead to collateral liquidation if the value of the asset falls below a certain threshold.

Key Factors to Consider When Choosing the Best Crypto Lending Platforms

Selecting the right cryptocurrency lending platform is essential for maximizing returns and ensuring the security of your assets. With so many options available, it's crucial to weigh a few key factors before making your choice.

1. Interest Rates and Returns

One of the primary considerations is the earnings rate offered by the platform. Platforms like Nexo and BlockFi provide competitive interest returns, with Nexo offering up to 12% on stablecoins such as USDC and Tether. Higher rates mean better returns on your deposited assets, but it's important to balance those rates with other factors, such as loan terms and platform reliability.

2. Loan-to-Value Ratio (LTV)

The loan-to-value (LTV) ratio determines how much you can borrow against your crypto holdings. For instance, BlockFi offers a 50% LTV, meaning you can borrow up to half the value of your deposited cryptocurrency. Choosing a platform with a favorable LTV ratio is crucial for borrowers, as it impacts how much liquidity you can access.

3. Platform Security and Regulation

Security is a top priority when dealing with crypto assets. Look for platforms that prioritize safety features, such as cold storage, insurance policies, and regulatory compliance. Crypto.com, for example, boasts robust security measures, offering insurance on user deposits and operating under strict regulations, making it a trusted choice for many users.

4. CeFi vs. DeFi Platforms

Understanding the difference between centralized (CeFi) and decentralized (DeFi) lending services is essential. Platforms like Aave operate on the DeFi model, allowing users to lend and borrow without intermediaries, offering more control but with higher risk. On the other hand, Nexo and CoinRabbit are centralized, providing a simpler, more user-friendly experience but requiring more trust in the platform itself.

5. Supported Cryptocurrencies

Not all platforms support every cryptocurrency. For example, CoinRabbit focuses heavily on stablecoins, making it ideal for users looking to lend or borrow popular assets like USDT and USDC. Meanwhile, platforms like Aave and Binance offer a broader range of assets, including Ethereum, Bitcoin, and various DeFi tokens, allowing for more flexibility in managing your portfolio.

6. User Experience

A smooth and intuitive user experience can make all the difference. Platforms like CoinRabbit are known for their simplicity, allowing users to get started with just a phone number. This makes the platform accessible to beginners who may find more complex DeFi platforms overwhelming. Conversely, platforms like Aave cater more to advanced users, with additional features like flash loans and yield farming opportunities.

7. Fees and Hidden Costs

Lastly, always examine the fees associated with each platform. Some may charge withdrawal fees, deposit fees, or even penalties for early repayment of loans. Nexo and Crypto.com are known for having no hidden fees on deposits and withdrawals, which can be an attractive feature for long-term lenders and borrowers.

When selecting a crypto loan platform, it's essential to weigh these factors based on your financial goals, risk tolerance, and preferred assets. Whether you're a lender looking for high returns or a borrower in need of quick liquidity, choosing the right platform can make a significant difference in your crypto experience.

Best Crypto Lending Platforms with the Best Interest Rates

Finding the ideal crypto lending platform is essential for anyone looking to make their cryptocurrency work for them, whether through earning interest or taking out a loan. Below, we review the top platforms that offer the best interest rates and services, helping you decide which suits your needs best.

| Platform | Interest Rates (APY) | Loan-to-Value (LTV) | Supported Cryptocurrencies | Key Features |

|---|---|---|---|---|

| Nexo | Up to 12% on stablecoins | 50% | 30+ (BTC, ETH, stablecoins) | Instant loans, insurance-backed, flexible terms |

| Nebeus | Up to 12.85% on stablecoins | Up to 80% | BTC, ETH, USDC, USDT | High LTV, insurance-backed, flexible terms |

| Aave | Up to 12% (variable) | 50-75% | ETH, DAI, USDC, more | Decentralized, flash loans, flexible LTV |

| Compound | Up to 8% (variable) | 50-75% | ETH, DAI, USDC, more | DeFi, no minimum loan, algorithmic rates |

| Crypto.com | Up to 12.5% for CRO stakers | 50% | BTC, ETH, CRO, stablecoins | High interest for CRO stakers, wide asset support |

| Binance | Up to 10% on stablecoins | 65% | 180+ (BTC, ETH, more) | High liquidity, flexible loan terms |

| YouHodler | Up to 12% on stablecoins | Up to 90% | BTC, ETH, stablecoins | High LTV, fast loan processing |

| CoinRabbit | Up to 10% on stablecoins | 50% | USDT, USDC, BTC, more | Simple setup, no credit checks |

| MakerDAO | Up to 8% on stablecoins | 50-75% | ETH, DAI | Decentralized, generates DAI stablecoin |

| AQRU | Up to 10% on stablecoins | 50% | USDC, stablecoins | Easy-to-use, stable returns |

Nexo

Overview: Nexo is a popular platform offering crypto loans and interest-earning accounts. With over 5 million users worldwide, it is known for its flexible terms and instant loan payouts.

Interest Returns: Nexo provides up to 12% interest on stablecoins like USDC and Tether, with Bitcoin and Ethereum rates ranging from 4-8%, depending on loyalty tier.

Loan Terms and LTV Ratio: Nexo offers loans with a 50% loan-to-value (LTV) ratio. Borrowers can receive funds instantly without undergoing credit checks, and repayments are flexible.

Supported Cryptocurrencies: Nexo supports more than 30 cryptocurrencies, including BTC, ETH, USDC, USDT, and many others, making it versatile for both lenders and borrowers.

Security and Regulation: Nexo uses cold storage provided by BitGo and has $375 million in insurance for user assets. The platform is regulated, ensuring compliance and trust.

Pros:

- High interest on stablecoins

- Instant loan payouts

- Flexible repayment options

Cons:

- Loyalty tiers may complicate the process for new users

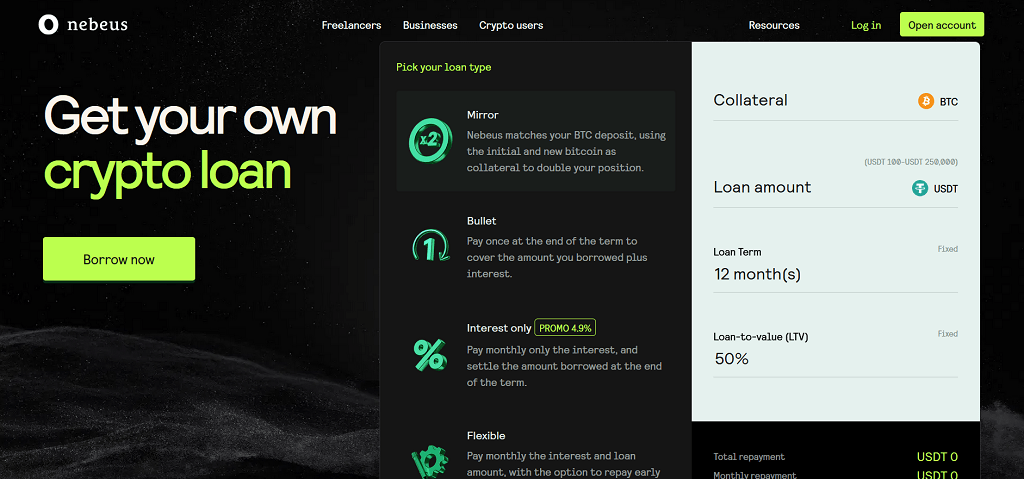

Nebeus

Overview: Nebeus is a versatile digital asset lending website that allows users to earn interest on their digital assets and take out crypto-backed loans. With a focus on flexibility, Nebeus offers a variety of options for both lenders and borrowers, making it a strong alternative for users seeking to earn passive income or access quick liquidity.

Interest Returns: Nebeus offers up to 12.85% interest on stablecoins like USDC and USDT, making it competitive with other top platforms. Interest on Bitcoin deposits ranges between 4-8%, depending on the plan chosen.

Loan Terms and LTV Ratio: Nebeus allows users to borrow with LTV ratios of up to 80%, which is one of the highest in the industry. The platform offers flexible loan repayment terms, making it suitable for both short-term and long-term borrowing needs.

Supported Cryptocurrencies: Nebeus supports a range of cryptocurrencies for both lending and borrowing, including Bitcoin (BTC), Ethereum (ETH), and popular stablecoins like USDT and USDC.

Security and Regulation: Nebeus is a regulated platform operating under EU law, providing users with a secure environment. Assets are stored in cold storage with insurance coverage, ensuring that user funds are well-protected.

Pros:

- High return rates on stablecoins

- Flexible LTV ratios up to 80%

- Regulated under EU law with insurance-backed security

Cons:

- Fewer supported cryptocurrencies compared to larger platforms

Aave

Overview: Aave is a leading decentralized finance (DeFi) platform that allows users to lend and borrow without intermediaries. It’s widely known for its innovative flash loans feature, which requires no collateral if repaid within a single transaction.

Interest Returns: Aave offers variable interest returns depending on the market’s supply and demand. For stablecoins, rates can reach up to 12%, providing competitive returns for lenders.

Loan Terms and LTV Ratio: Aave allows an adjustable LTV ratio, typically ranging from 50-75%, depending on the asset. Borrowers have full control over their loans, with flexible repayment options.

Supported Cryptocurrencies: Aave supports a wide range of cryptocurrencies, including ETH, DAI, USDC, and others, making it highly versatile for both lenders and borrowers.

Security and Regulation: As a fully decentralized platform, Aave uses smart contracts to handle transactions, ensuring transparency and security. The platform undergoes regular audits to maintain security.

Pros:

- Fully decentralized

- Flash loans for advanced users

- High flexibility with assets and loan terms

Cons:

- May be difficult to use for beginners due to its DeFi nature

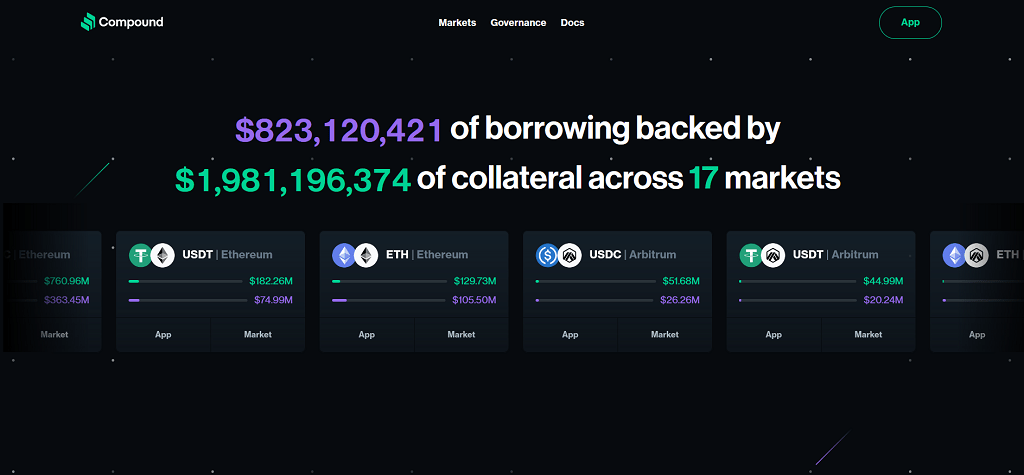

Compound

Overview: Compound is another popular DeFi platform that allows users to lend and borrow cryptocurrencies in a fully decentralized environment. Its return rates are determined by an algorithm that adjusts based on the supply and demand of assets.

Interest Returns: Compound offers return rates up to 8% on stablecoins like DAI and USDC. Rates are algorithmically adjusted in real-time.

Loan Terms and LTV Ratio: Compound offers flexible loan terms with an LTV ratio between 50-75%, depending on the asset. Loans are trustless and handled by smart contracts.

Supported Cryptocurrencies: Compound supports a range of assets, including ETH, DAI, USDC, and other ERC-20 tokens, making it suitable for decentralized lending and borrowing.

Security and Regulation: Compound relies on smart contracts for trustless transactions. The platform is fully decentralized and audited for security vulnerabilities.

Pros:

- No minimum loan requirements

- Flexible, algorithm-driven rates

- Decentralized and transparent

Cons:

- Rates can fluctuate more than on centralized platforms

Crypto.com

Overview: Crypto.com is a full-service platform offering both an exchange and digital currency lending services. It is particularly popular among users staking CRO, the platform’s native token, for additional rewards.

Interest Returns: Crypto.com offers up to 12.5% APY for users staking CRO. Non-stakers can still earn 6-8% on stablecoins like USDC and USDT.

Loan Terms and LTV Ratio: The platform offers loans with an LTV ratio of 50%, and the loan terms are flexible, allowing for customizable repayment plans.

Supported Cryptocurrencies: Crypto.com supports a wide range of cryptocurrencies, including BTC, ETH, CRO, and various stablecoins, making it highly versatile.

Security and Regulation: Crypto.com uses industry-leading security features, including cold storage, insurance coverage, and strict compliance with financial regulations, ensuring a secure experience for users.

Pros:

- High return rates for CRO stakers

- Regulated and secure

- Wide range of supported cryptocurrencies

Cons:

- Lower return rates for non-stakers

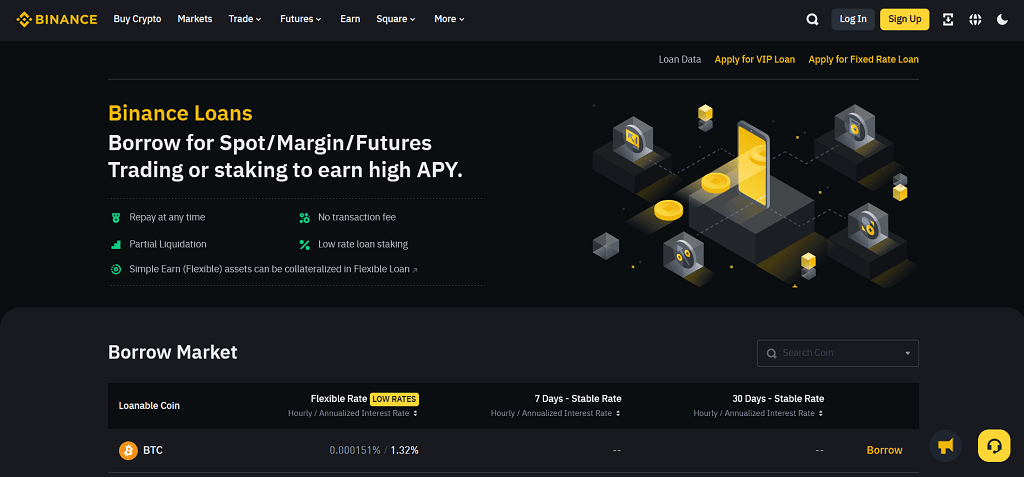

Binance

Overview: Binance, primarily known as a cryptocurrency exchange, offers lending services for its vast global user base. Its lending service is highly flexible and integrates seamlessly with Binance’s trading platform.

Interest Returns: Binance offers earnings rates of up to 10% APY on stablecoins and allows users to earn additional rewards by staking collateral.

Loan Terms and LTV Ratio: Binance offers a 65% LTV ratio, allowing borrowers to access more liquidity. Loan terms are flexible, and users can easily convert their borrowed assets for other purposes on the platform.

Supported Cryptocurrencies: Binance supports over 180 cryptocurrencies, including BTC, ETH, and various stablecoins, making it one of the most versatile platforms for lending and borrowing.

Security and Regulation: Binance is well-known for its high liquidity and advanced security features, such as cold storage and multi-factor authentication.

Pros:

- High liquidity

- Wide selection of assets

- Flexible loan options

Cons:

- Not available to U.S. users

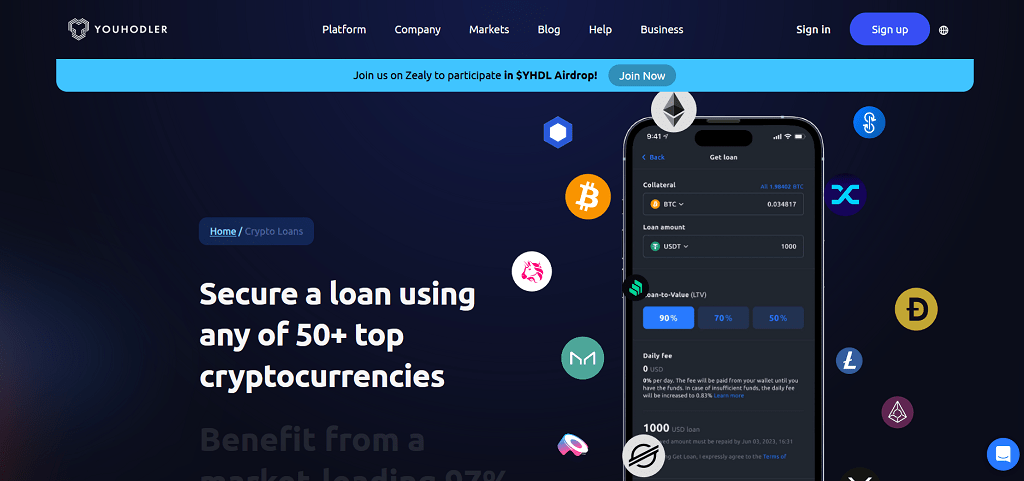

YouHodler

Overview: YouHodler is an easy-to-use lending platform that offers some of the highest loan-to-value (LTV) ratios in the industry, making it ideal for users looking to leverage their crypto assets.

Interest Returns: YouHodler provides up to 12% interest on stablecoins like USDC and USDT, making it a solid choice for lenders seeking high returns.

Loan Terms and LTV Ratio: YouHodler offers loans with an LTV ratio of up to 90%, giving borrowers significant access to liquidity compared to other platforms.

Supported Cryptocurrencies: The platform supports a variety of cryptocurrencies, including BTC, ETH, and major stablecoins, providing flexibility for users.

Security and Regulation: YouHodler employs industry-standard security measures, such as cold storage, to protect user assets. It is not available to U.S. users.

Pros:

- High LTV ratios

- Quick loan processing

- Competitive earnings rates

Cons:

- Limited availability in the U.S.

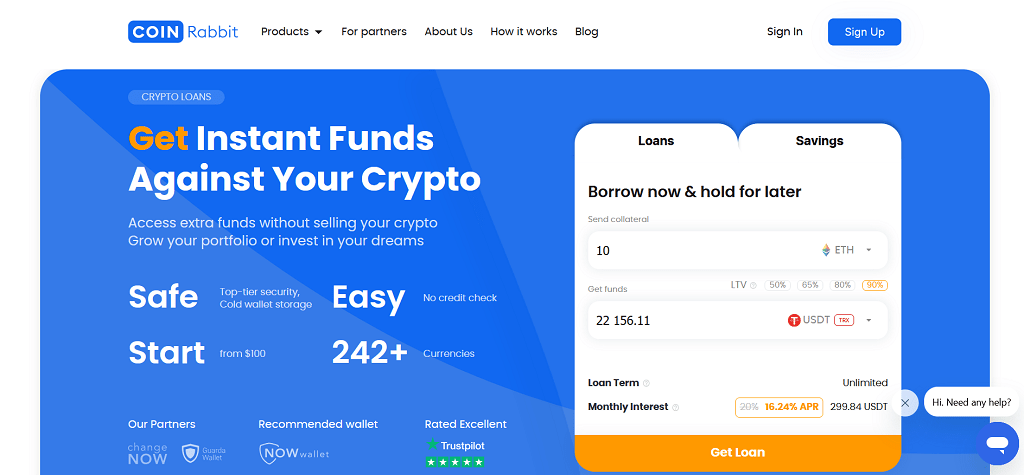

CoinRabbit

Overview: CoinRabbit is a beginner-friendly platform that offers simple and fast digital asset lending services, making it accessible to users new to the space.

Interest Returns: CoinRabbit offers up to 10% interest on stablecoins like USDT and USDC, providing a straightforward way to earn passive income.

Loan Terms and LTV Ratio: The platform allows a 50% LTV ratio, providing quick access to liquidity for borrowers without complex terms or requirements.

Supported Cryptocurrencies: CoinRabbit supports a variety of major cryptocurrencies, including BTC, ETH, and stablecoins like USDT and USDC.

Security and Regulation: CoinRabbit keeps user information minimal, requiring only a phone number to get started. It uses strong security measures but is not as heavily regulated as larger platforms.

Pros:

- Simple sign-up process

- High interest on stablecoins

- No credit checks

Cons:

- Fewer supported cryptocurrencies compared to competitors

MakerDAO

Overview: MakerDAO is one of the pioneers in the decentralized finance space, known for its DAI stablecoin, which is generated through over-collateralized loans.

Interest Returns: MakerDAO offers dynamic earnings rates that can go up to 8% on stablecoins. The decentralized nature of the platform ensures transparency in rate adjustments.

Loan Terms and LTV Ratio: MakerDAO typically offers an LTV ratio of 50-75%, depending on the asset used. Borrowers can create DAI by locking up ETH or other assets as collateral.

Supported Cryptocurrencies: MakerDAO supports major assets like ETH and DAI, making it an excellent choice for users looking to participate in the decentralized stablecoin economy.

Security and Regulation: MakerDAO operates as a decentralized platform, with no intermediaries, and its code is publicly audited to ensure transparency and security.

Pros:

- Fully decentralized

- Generates DAI stablecoin

- Transparent rates and governance

Cons:

- Limited asset support

AQRU

Overview: AQRU is known for its simple user interface and high-interest accounts, primarily focused on stablecoins. It is ideal for users seeking stable, predictable returns on their crypto holdings.

Interest Returns: AQRU offers up to 10% interest on stablecoins like USDC, making it a reliable platform for those looking for passive income with lower risk.

Loan Terms and LTV Ratio: While AQRU primarily focuses on interest-earning accounts, it also offers crypto-backed loans with a 50% LTV ratio, providing moderate access to liquidity.

Supported Cryptocurrencies: AQRU primarily supports stablecoins like USDC, making it a more niche platform for those seeking stable returns.

Security and Regulation: AQRU provides insurance for user assets and complies with regulatory standards, ensuring a secure and trustworthy environment for lenders.

Pros:

- Stable returns on stablecoins

- Simple user interface

- Insurance-backed security

Cons:

- Limited asset support outside of stablecoins

Key Benefits of Using Crypto Loan Platforms

Cryptocurrency lending services have opened up new opportunities for both individual investors and businesses, offering financial flexibility that goes beyond traditional banking. Here are some of the key benefits of using these platforms:

1. Earning Passive Income

One of the primary reasons users turn to cryptocurrency lending services is to earn passive income. By depositing their digital assets, such as stablecoins or cryptocurrencies like Bitcoin and Ethereum, users can earn attractive earnings rates, often far higher than what traditional savings accounts offer. For instance, platforms like Nexo and Aave provide competitive earnings rates of up to 12% on stablecoins. This allows crypto holders to grow their portfolio without needing to actively trade or sell their assets.

Case Study: A user on BlockFi deposited $10,000 worth of USDC and earned 7.5% APY over the year, significantly outperforming a traditional savings account. This passive income helped them cover personal expenses while still retaining full ownership of their crypto holdings.

2. Access to Instant Loans Without Selling Assets

Another significant benefit is the ability to access crypto loans without having to sell your digital assets. Instead of liquidating Bitcoin or Ethereum to meet short-term financial needs, users can use their assets as collateral and borrow stablecoins or fiat currency. This allows borrowers to keep their crypto and benefit from potential future price increases.

Platforms like YouHodler and BlockFi offer loans with flexible loan-to-value (LTV) ratios, often between 50-90%, depending on the platform and the asset. This flexibility makes it easier to access liquidity without giving up ownership of valuable digital assets.

3. Higher Yield Rates than Traditional Banks

One of the standout advantages of blockchain lending solutions is the significantly higher yield rates they offer compared to traditional banks. While the average savings account interest return is typically below 1%, platforms like Crypto.com offer up to 12.5% for CRO stakers, and other platforms like AQRU provide up to 10% on stablecoins. This makes crypto loan providers a more lucrative option for those seeking to maximize returns on their savings.

4. No Credit Checks or Lengthy Approval Processes

Unlike traditional loans, which often require extensive credit checks and lengthy approval processes, crypto loans are much simpler and faster. Platforms like CoinRabbit allow users to secure loans with minimal documentation, often just requiring a phone number, and funds are released within minutes. This convenience makes digital currency loan platforms an attractive option for borrowers who may not have access to traditional credit systems or who need quick liquidity.

5. Flexibility for Both Short-Term and Long-Term Investors

Digital asset lending services cater to both short-term and long-term financial goals. Borrowers can access quick liquidity for immediate needs, while lenders can lock their assets into interest-earning accounts for consistent returns. Platforms like Aave and Compound even allow users to earn interest while keeping their assets available for withdrawal at any time, offering unparalleled flexibility.

6. Decentralized and Transparent Operations

For users who prefer greater control and transparency, decentralized finance (DeFi) platforms like Aave and MakerDAO offer the advantage of operating without intermediaries. Users can lend and borrow directly through smart contracts, which are secure and self-executing. This decentralized nature ensures greater transparency in how funds are managed, and users have full control over their assets at all times.

Blockchain lending solutions offer a wide range of benefits, from earning passive income to accessing fast, hassle-free loans. Whether you're a long-term crypto holder looking to grow your portfolio or a borrower in need of liquidity, these platforms provide an innovative way to meet your financial needs without the restrictions of traditional banking.

Risks of Crypto Lending

While cryptocurrency lending services offer attractive benefits like earning interest and accessing liquidity, it’s important to recognize the potential risks involved. Like any financial venture, there are risks that users should consider before participating in digital currency lending.

1. Market Volatility

One of the biggest risks in digital currency lending is the inherent volatility of cryptocurrencies. Prices can fluctuate dramatically within a short time, which can affect both lenders and borrowers. For borrowers, if the value of the collateral drops significantly, platforms may issue a margin call, requiring the borrower to add more collateral to avoid liquidation. This is especially common during market downturns, where borrowers may lose their collateral if they fail to meet the margin requirements.

Case Study: During the 2021 crypto market crash, some borrowers on platforms like Nexo and Aave faced liquidations when the value of their crypto collateral dropped below the required threshold. Borrowers who couldn’t add more collateral in time lost their assets, showcasing the volatility risk.

2. Platform Risk and Security Concerns

Another key risk to consider is platform security. Not all platforms are created equal, and there have been cases of hacks, security breaches, or internal failures that have led to users losing their funds. For example, platforms like CoinRabbit and Crypto.com offer insurance on deposits, but users should always investigate a platform’s security protocols, such as the use of cold storage, multi-factor authentication, and insurance coverage.

Moreover, some platforms operate under varying levels of regulation. Platforms like Nexo and Crypto.com are regulated and insured, which provides an extra layer of safety, but decentralized platforms like Aave and Compound are trustless, meaning they rely on smart contracts. While these contracts are audited, they are still vulnerable to bugs or potential exploits.

3. Counterparty Risk

For centralized lending solutions, users are exposed to counterparty risk. This occurs when the platform itself might not be able to fulfill its obligations. In other words, if a platform becomes insolvent or fails to manage its assets properly, lenders may lose access to their funds. The collapse of platforms like BlockFi has highlighted this risk, where users were left without access to their assets due to poor internal management or financial instability.

4. Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrency lending is still evolving. Some jurisdictions have begun implementing tighter regulations on crypto loan providers, which could affect the terms of loans, yield rates, or even the legality of certain services. This uncertainty can introduce risk, especially for users in countries where cryptocurrency regulations are unclear or still developing. For example, Nexo and Crypto.com are regulated entities, which helps mitigate this risk, but decentralized platforms may be less protected under current legal frameworks.

5. Liquidation Risk

If the value of a borrower's collateral falls below a certain threshold, liquidation can occur, meaning the collateral is sold to repay the loan. This can happen quickly in a volatile market, leaving borrowers with less control over their assets. To mitigate this risk, platforms like YouHodler and Nebeus offer higher loan-to-value (LTV) ratios, allowing borrowers more flexibility, but this also increases the risk of liquidation.

While digital asset lending solutions offer significant opportunities for both lenders and borrowers, they also come with inherent risks. Market volatility, platform security, counterparty risks, and regulatory uncertainty are all factors that users must consider. By choosing secure, regulated platforms and understanding how collateralization works, users can better protect themselves from these risks and make informed decisions about their crypto assets.

Choosing the Best Crypto Lending Platforms for the Best Interest Rates and Crypto Loans (Conclusion)

As we’ve explored throughout this article, the world of digital currency loan platforms offers exciting opportunities for both lenders and borrowers. Whether you’re looking to earn interest on your digital assets or access crypto loans without the hassle of traditional banks, selecting the right platform is essential for maximizing your returns and minimizing risks.

Yield rates vary significantly across platforms, with providers like Nexo and Nebeus offering up to 12% or more on stablecoins, making them appealing choices for passive income seekers. At the same time, decentralized platforms like Aave and Compound give users more control over their funds while offering competitive, market-driven rates.

For borrowers, platforms like YouHodler and Crypto.com stand out by offering high loan-to-value (LTV) ratios, providing quick liquidity without needing to sell your assets. However, it’s important to consider the risks, such as market volatility and potential liquidation during price drops. The flexibility of cryptocurrency lending, combined with innovative features like flash loans on platforms like Aave, opens up diverse financial possibilities, but it requires careful planning.

Throughout this journey, we’ve also discussed critical factors to consider—such as platform security, regulatory compliance, and supported cryptocurrencies. Choosing a platform that aligns with your financial goals, risk tolerance, and user experience preferences is key. CeFi platforms like Nexo and Nebeus offer regulated environments with insurance-backed security, while DeFi platforms like MakerDAO emphasize transparency and decentralization.

Ultimately, there is no single “best” platform—only the one that best fits your individual needs. Whether you’re a lender looking to grow your assets or a borrower seeking flexible loan terms, it’s crucial to weigh the yield rates, security features, and overall platform reliability before making a decision.

As the digital asset lending space continues to evolve, new platforms and features will emerge, offering even more ways to leverage your crypto holdings. By staying informed and choosing wisely, you can unlock the full potential of your digital assets, whether for earning interest or securing loans.

FAQs about Crypto Lending Platforms

What is crypto loan, and how does it work?

Cryptocurrency lending allows users to lend their cryptocurrency to a platform or other users in exchange for interest. Borrowers, on the other hand, can use their crypto assets as collateral to take out a loan. The process is similar to traditional lending, but instead of using fiat currency, users work with digital assets like Bitcoin, Ethereum, or stablecoins. For example, platforms like Nexo and Aave facilitate this by connecting lenders and borrowers, allowing both parties to benefit—lenders earn passive income, while borrowers gain liquidity without selling their assets.

Are crypto loan platforms safe to use?

Safety varies across platforms, so it’s important to choose a platform that prioritizes security. Centralized platforms like Nexo and Crypto.com are regulated and offer insurance on user deposits, providing a more secure environment. Decentralized platforms, like Aave and Compound, operate on smart contracts, which are transparent and secure but not insured. Always ensure that a platform uses cold storage and multi-factor authentication (MFA) to protect your assets.

What are the risks of cryptocurrency lending?

The primary risks of digital asset lending include market volatility and liquidation risk. If the value of a borrower's collateral drops below a certain threshold, the platform may liquidate the collateral to repay the loan. Additionally, users should be aware of platform security risks, especially on less-regulated platforms. Always assess whether a platform offers insurance, and consider the loan-to-value (LTV) ratio to avoid liquidation during market downturns.

Can I earn interest on my crypto through lending websites?

Yes, cryptocurrency lending services allow users to earn interest on their deposited digital assets. For example, platforms like Nexo offer up to 12% interest on stablecoins, while others like AQRU provide up to 10%. The interest return you earn depends on the platform, the asset, and whether you participate in special programs like staking.

What happens if the value of my collateral falls?

If the value of your collateral falls below the required level, the platform may issue a margin call or liquidate your assets to cover the loan. To avoid liquidation, some platforms like YouHodler allow users to add more collateral to maintain their loan position. It’s crucial to monitor the value of your collateral, especially during market volatility, to avoid liquidation.

How is the loan-to-value (LTV) ratio calculated?

The loan-to-value (LTV) ratio determines how much you can borrow based on the value of your crypto collateral. For example, if a platform offers a 50% LTV ratio, you can borrow half the value of your deposited crypto. Platforms like Nexo and Crypto.com offer a standard 50% LTV, while others like YouHodler provide higher ratios of up to 90%. A higher LTV ratio means you can borrow more, but it also increases the risk of liquidation.

What’s the difference between CeFi and DeFi platforms?

CeFi (Centralized Finance) platforms, like Nexo and Crypto.com, are managed by a central entity and often follow regulatory guidelines. These platforms offer customer support, insurance, and security, but users need to trust the platform with their assets.

DeFi (Decentralized Finance) platforms, such as Aave and Compound, are governed by smart contracts with no central authority. DeFi offers greater control over your assets and more transparency, but there is no insurance, and users must be comfortable managing their funds on-chain.

Can I borrow without a credit check on crypto loan platforms?

Yes, one of the biggest advantages of cryptocurrency lending services is that they generally do not require credit checks. Borrowers use their crypto as collateral, and the amount they can borrow depends on the value of their assets, not their credit score. Platforms like CoinRabbit allow users to take out loans with just a phone number, providing fast and easy access to liquidity without the need for traditional credit checks.

Can I repay my loan early on crypto loan platforms?

Most crypto loan providers allow for early repayment without penalties. Platforms like Nexo and YouHodler provide flexible repayment options, allowing borrowers to pay back their loans at any time. This flexibility helps users manage their debt more effectively, particularly if they experience a sudden increase in the value of their collateral.

Which cryptocurrencies can I lend or borrow?

The range of supported cryptocurrencies varies across platforms. Commonly supported assets include Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDC or USDT. For example, Crypto.com supports a wide range of assets, including its native CRO token, while CoinRabbit focuses more on stablecoins like USDT and USDC. It’s important to check the specific assets supported by the platform you choose, as this may impact your lending and borrowing options.

How are interest rates determined on blockchain lending solutions?

Interest rates on digital asset lending websites are typically influenced by supply and demand. On DeFi platforms like Aave, rates are dynamic and change in real-time based on market conditions. CeFi platforms like Nexo or Crypto.com offer fixed rates for specific assets. It’s important to compare rates across platforms and decide whether you prefer fixed or variable interest.

What happens if the platform I’m using becomes insolvent?

If a centralized platform like Nexo or Crypto.com were to become insolvent, your assets could be at risk. However, platforms with insurance-backed security (like Nexo, which has $375 million in insurance) offer some protection. On the other hand, DeFi platforms rely on smart contracts and don’t offer insurance, meaning users should exercise caution when using them.

Can I use digital currency loan platforms for tax purposes?

Yes, in some cases, blockchain lending can have tax implications, especially if you are earning interest on your crypto or taking out loans. Platforms like CoinLedger offer tools to help track crypto loans, interest earnings, and overall activity for tax reporting purposes. It’s always advisable to consult with a tax professional to understand the specific tax implications of lending or borrowing crypto in your jurisdiction.

Discussion