Best Crypto Staking Platforms for High Staking Rewards

Best Crypto Staking Platforms for top staking coins & high staking rewards. Find top 10 crypto staking platforms with the best staking returns.

Best Crypto Staking Platforms have become crucial for crypto enthusiasts looking to earn passive income by staking their assets. With the growing popularity of staking, choosing the right platform is essential to securing high staking rewards and maximizing your earnings. Whether you’re a beginner or an experienced investor, finding the top staking platforms with the best returns can make all the difference.

In this article, we’ll explore the best platforms for staking crypto that offer the most competitive rewards, strong security, and a user-friendly experience. Drawing from trusted sources like NFTevening, Forbes, Bankrate, and AIBC, we’ll highlight platforms that deliver the best staking returns. By the end, you’ll have a clear understanding of which platforms to use and how to maximize your staking earnings.

What Is Crypto Staking and How Does It Work?

Digital asset staking allows cryptocurrency holders to earn rewards by locking up their digital assets in a proof-of-stake (PoS) network. This process plays a crucial role in helping maintain the network’s operations by validating transactions and securing the blockchain. Unlike mining, which requires heavy computational resources, staking is an eco-friendly alternative that lets users participate in network validation just by holding and committing their crypto assets.

In a PoS system, the more tokens you stake, the higher your chance of being selected to validate transactions and earn rewards. Essentially, staking earnings users with more cryptocurrency, making it an attractive option for those looking to generate passive income while holding onto their assets.

Staking typically involves using a crypto staking provider, where users can select from various staking options. Some platforms offer flexible staking, allowing users to withdraw their staked assets anytime, while others provide locked staking for higher returns. Depending on the platform and the cryptocurrency, staking can yield anywhere from 2% to 20% annual percentage yield (APY), with some promotional periods offering even higher rates.

One notable advantage of staking is that it doesn’t require any technical expertise. Most platforms simplify the process by offering a straightforward interface where users can select their preferred cryptocurrency and start staking with just a few clicks. This makes staking accessible to both new and experienced investors.

Digital asset staking is a method of growing your cryptocurrency holdings by committing them to support a blockchain network. It’s a way to earn high staking rewards without selling your assets, providing a balance between securing the network and generating passive income.

Which Crypto Coins Can I Stake?

Staking is one of the most popular ways for crypto holders to earn passive income, but not all cryptocurrencies can be staked. Only those built on proof-of-stake (PoS) or similar consensus mechanisms are eligible for staking. These networks rely on stakers to validate transactions and secure the blockchain, in contrast to proof-of-work (PoW) systems like Bitcoin, which require miners. Here’s a look at some of the most popular coins you can stake and what makes them appealing to investors.

1. Ethereum (ETH)

Ethereum is one of the largest and most prominent cryptocurrencies available for staking, especially after its transition to Ethereum 2.0, which introduced a PoS model. Ethereum staking is a great option for long-term holders because it allows them to contribute to the security of the network while earning rewards.

Ethereum staking typically requires a lock-up period, but platforms like Lido offer liquid staking, which allows users to stake ETH and still access liquidity via stETH tokens. This means you can earn staking profits and use stETH across decentralized finance (DeFi) applications at the same time.

User Experience:

A staker using Lido reported enjoying the flexibility of liquid staking, as they could stake ETH and use stETH to earn additional rewards in DeFi, offering both income and liquidity.

2. Cardano (ADA)

Cardano is another major player in the staking world, known for its strong focus on sustainability and security. As a PoS-based blockchain, Cardano staking has no lock-up period, which makes it more flexible for users who want to withdraw their funds at any time.

Binance and Kraken are popular platforms for staking Cardano, offering APYs between 4% and 6%. The simplicity of staking ADA, combined with its environmental focus, makes it an attractive option for eco-conscious investors.

3. Polkadot (DOT)

Polkadot is well-known for its innovative multi-chain architecture, allowing different blockchains to interoperate. Staking DOT tokens helps secure the network and provides staking profits that are often higher than average, ranging from 10% to 12% on platforms like Crypto.com and Binance.

Polkadot’s staking model generally requires a 28-day unbonding period, meaning users need to wait before withdrawing their assets. However, the higher returns often make this lock-up period worthwhile for investors seeking long-term rewards.

4. Solana (SOL)

Solana is a high-performance blockchain known for its speed and low transaction costs, making it a favorite for both developers and investors. Staking SOL helps secure this fast-growing network, and platforms like Coinbase and Crypto.com offer staking services with rewards ranging from 5% to 7%.

Solana’s staking process is straightforward, but it usually involves a short lock-up period of a few days. For users who prioritize fast networks with strong growth potential, staking SOL offers competitive rewards.

5. Tezos (XTZ)

Tezos is another popular PoS blockchain that emphasizes governance and the ability to self-amend. Staking Tezos—also known as “baking”—is user-friendly and typically offers returns of around 5% to 6%. One of the main benefits of staking Tezos is that users can stake with as little as one token, making it accessible to even small investors.

Platforms like Kraken and Binance allow for seamless Tezos staking, and many users appreciate the flexibility since there’s no minimum lock-up period required for unstaking.

6. Avalanche (AVAX)

Avalanche has gained popularity for its ability to handle thousands of transactions per second, and staking AVAX tokens supports the network’s consensus mechanism. Staking AVAX on platforms like Crypto.com or Binance typically yields rewards between 8% and 12%. The lock-up period for Avalanche staking ranges from 2 weeks to 1 year, with the potential for higher rewards with longer commitments.

7. Polygon (MATIC)

Polygon is a layer-2 scaling solution for Ethereum, designed to enhance transaction speeds and reduce fees on the Ethereum network. Staking MATIC tokens contributes to securing Polygon’s PoS network and offers staking returns between 5% and 7%, depending on the platform.

Coinbase and Gemini offer easy-to-use staking options for MATIC, making it accessible for investors who want exposure to Ethereum’s ecosystem while benefiting from lower transaction costs.

8. Algorand (ALGO)

Algorand offers a unique approach to PoS, using a system called pure proof-of-stake (PPoS), which allows for low-cost transactions while maintaining security. Staking ALGO offers lower APYs compared to other coins, generally between 2% and 6%, but the rewards are highly consistent.

Platforms like Coinbase and Binance support Algorand staking, and users can stake with as little as one ALGO, making it an appealing option for those who want steady, predictable rewards.

9. Cosmos (ATOM)

Cosmos is often referred to as the “internet of blockchains,” focusing on creating an ecosystem where different blockchains can communicate. Staking ATOM tokens helps secure the Cosmos Hub and typically offers rewards in the range of 7% to 10%, making it one of the more attractive staking options for high yields.

The staking process on Cosmos requires a 21-day unbonding period, so investors should consider this lock-up before staking.

How to Choose the Best Crypto Staking Platforms?

Choosing the right coin staking provider is key to maximizing your earnings while ensuring the security of your assets. With so many options available, it’s important to evaluate platforms based on several critical factors to find one that fits your needs and investment goals. Here’s a guide on what to look for when selecting the best cryptocurrency staking services.

1. Security and Trustworthiness

The safety of your assets should be a top priority when choosing a staking service. Look for platforms with a strong track record in security, such as multi-signature wallets, cold storage, and robust encryption protocols. It’s also a good idea to check for any past security breaches or regulatory issues. Platforms like Binance and Coinbase, for instance, are known for their strict security standards and compliance with regulations, making them reliable choices.

2. Supported Cryptocurrencies

Not all platforms support the same cryptocurrencies for staking. Before selecting a platform, check whether it supports the coins you want to stake. Some platforms offer a wide variety of staking options, including popular assets like Ethereum, Solana, and Cardano, while others may focus on a more limited range of tokens. Platforms like KuCoin and Crypto.com, for example, are popular for offering a broad selection of staking coins, including both major and altcoins.

3. Staking Profits and APY

One of the key reasons people stake is to earn rewards. Different platforms offer different annual percentage yields (APYs), so it’s worth comparing the rates across multiple platforms. However, higher APYs don’t always mean better returns, as platforms with higher rewards may come with added risks or restrictions. Some platforms also adjust their APYs based on market conditions, so keeping an eye on these changes can help you optimize your earnings over time.

4. User Experience and Accessibility

A smooth, user-friendly interface can make staking much more enjoyable, especially if you’re new to the process. Look for platforms that simplify the staking process with clear instructions, easy-to-navigate dashboards, and helpful customer support. Many platforms, like Kraken and Coinbase, focus on making staking as accessible as possible for beginners, allowing users to stake with just a few clicks.

5. Staking Flexibility

Consider whether the platform offers flexible or locked staking options. Flexible staking allows you to withdraw your staked assets anytime, which can be useful if you need liquidity or want to react to market conditions. Locked staking, on the other hand, usually offers higher rewards but requires you to commit your assets for a set period. It’s important to evaluate which option suits your investment style better.

6. Fees and Costs

Many staking sites charge fees, either for staking your assets or when withdrawing your rewards. While fees might seem small, they can add up over time and reduce your overall returns. Platforms like ByBit and Crypto.com are known for offering competitive rates, but it’s always a good idea to check each platform’s fee structure carefully before committing.

Best Crypto Staking Platforms: Our Top Picks for 2024

As blockchain staking becomes a more popular way to earn passive income, selecting the right platform is crucial for maximizing returns and ensuring the safety of your assets. Here are the top cryptocurrency staking platforms for 2024, offering competitive rewards, security, and ease of use.

| Platform | Supported Cryptocurrencies | Staking Options | APY (Approx.) | Security Features | Pros | Cons |

|---|---|---|---|---|---|---|

| Binance | 60+ (ETH, ADA, DOT, etc.) | Locked, Flexible, DeFi | 1% - 100%+ | Multi-signature wallets, cold storage | Wide coin selection, high APYs, multiple staking options | Locked staking limits liquidity, regulatory challenges |

| Coinbase | 9 (ETH, SOL, ADA, etc.) | Flexible | 2% - 5% | Insurance, cold storage, regulatory compliance | User-friendly, no lock-up periods, secure | Limited staking coins, lower APYs |

| Crypto.com | 37+ (BTC, ETH, ADA, etc.) | Locked, Flexible | Up to 5.5% | 2FA, cold storage, regulatory compliance | Wide selection, strong security, competitive rewards | Higher rewards need CRO tokens, not available in some regions |

| KuCoin | 40+ (ETH, ADA, altcoins) | Locked, Flexible, Soft Staking | 5% - 20%+ | Multi-factor authentication, cold storage | Wide altcoin support, high APYs | Not available in the U.S., past security breaches |

| Kraken | 24+ (ETH, SOL, XTZ, etc.) | Flexible | Up to 21% | Cold storage, regular audits, regulatory compliance | Strong security, flexible staking, high rewards | Limited availability in some regions, lower APYs for some coins |

| ByBit | 160+ (ETH, BTC, altcoins) | Flexible | Up to 50% | 2FA, cold storage, proof-of-reserves | High APYs, wide coin selection, flexible staking | Not available in the U.S., promotional APYs are temporary |

| Lido | ETH, SOL, DOT | Liquid Staking | 3% - 5% | Smart contract audits, decentralized | Liquid staking, DeFi integration, flexible | Limited coins, lower APYs than centralized platforms |

| Nexo | 38+ (BTC, ETH, stablecoins) | Locked, Flexible | Up to 16% | Insurance, regular security audits | High APYs, wide support, flexible | Higher rewards depend on holding NEXO tokens |

| Rocket Pool | ETH | Liquid Staking | 3% - 4% | Smart contract audits, decentralized | Low minimum staking, liquid staking with rETH | ETH only, lower APYs than some competitors |

| Gemini | 3 (ETH, SOL, MATIC) | Flexible | 2% - 5% | Insurance, cold storage, regulatory compliance | Regulated, secure, no lock-up periods | Limited staking options, lower APYs |

Binance

Platform Overview

Binance is one of the most widely recognized crypto platforms, offering a broad range of staking options. Known for its flexibility, Binance provides users with both locked and flexible staking, making it a go-to platform for those seeking high staking earnings.

Supported Cryptocurrencies

Binance supports over 60 staking options, including popular coins like Ethereum (ETH), Cardano (ADA), and Polkadot (DOT), giving users a wide variety to choose from.

Staking Options and Flexibility

With Binance, users can opt for locked staking, which generally offers higher returns, or flexible staking, which allows withdrawals at any time. Additionally, Binance offers DeFi staking, allowing users to engage with decentralized finance through their accounts.

Staking Returns (APY)

The platform offers competitive APYs that range from 1% to over 100%, depending on the cryptocurrency and the staking duration. For example, staking Binance Coin (BNB) can yield up to 14% APY.

Security and Trustworthiness

Binance implements top-tier security measures, including multi-signature wallets and cold storage. Despite facing regulatory challenges in some regions, it remains a trusted name globally.

Pros:

- Extensive selection of staking coins

- Competitive APYs, especially for locked staking

- Multiple staking options (locked, flexible, and DeFi)

Cons:

- Locked staking reduces liquidity

- Regulatory issues in some countries

Coinbase

Platform Overview

Coinbase is a user-friendly platform ideal for beginners, especially those based in the U.S. Known for its strong regulatory compliance, Coinbase makes staking accessible to those just starting in the crypto space.

Supported Cryptocurrencies

The platform supports staking for nine major coins, including Ethereum (ETH), Solana (SOL), and Cardano (ADA). While it has fewer staking options compared to competitors, it focuses on high-demand cryptocurrencies.

Staking Options and Flexibility

Coinbase offers flexible staking without lock-up periods, making it easier for users to withdraw funds when needed. This flexibility is ideal for users who want liquidity while earning staking returns.

Staking Profits (APY)

APYs on Coinbase range from 2% to 5%, depending on the cryptocurrency. While not the highest in the market, its ease of use and strong security make up for the lower rewards.

Security and Trustworthiness

Coinbase is highly regarded for its regulatory compliance and security, providing features like insurance coverage and cold storage. This makes it a secure choice, especially for U.S. users.

Pros:

- Beginner-friendly interface

- No lock-up periods

- Strong regulatory compliance and security

Cons:

- Fewer supported coins for staking

- Lower APYs compared to other platforms

Crypto.com

Platform Overview

Crypto.com is known for its security and its wide array of crypto services, including staking through its Crypto Earn program. The platform allows users to stake a wide variety of coins, including major assets like Bitcoin (BTC) and Ethereum (ETH).

Supported Cryptocurrencies

With over 37 cryptocurrencies available for staking, including BTC, ETH, ADA, and AVAX, Crypto.com provides plenty of choices for users looking to diversify their staking portfolios.

Staking Options and Flexibility

Crypto.com offers both flexible and locked staking options. Locked staking provides higher returns, while flexible staking allows users to withdraw their assets whenever they choose.

Staking Profits (APY)

The APY for staking on Crypto.com is competitive, with returns up to 5.5% for Bitcoin and Ethereum. Users can also boost their rewards by holding CRO tokens, Crypto.com’s native currency.

Security and Trustworthiness

Crypto.com is well-regarded for its robust security, employing industry-standard practices such as two-factor authentication and cold storage. Its regulatory compliance adds an extra layer of trust for users.

Pros:

- Wide selection of staking coins

- Competitive rewards, especially for locked staking

- Strong security features

Cons:

- Higher rewards require holding CRO tokens

- Some features not available in all regions

KuCoin

Platform Overview

KuCoin is a popular platform among seasoned investors due to its extensive selection of altcoins and advanced features. It offers a variety of staking options, making it attractive for users looking to stake lesser-known assets.

Supported Cryptocurrencies

KuCoin supports over 40 staking options, including Ethereum (ETH), Cardano (ADA), and several altcoins like Persistence One and Conflux. This variety allows users to explore different staking opportunities.

Staking Options and Flexibility

The platform offers both locked and flexible staking, providing users with the choice to either maximize their rewards or maintain access to their funds. KuCoin’s unique staking options, like soft staking, offer additional flexibility.

Staking Profits (APY)

KuCoin offers APYs ranging from 5% to over 20%, depending on the staking product and cryptocurrency. This makes it one of the more competitive platforms for staking returns.

Security and Trustworthiness

KuCoin is generally trusted in the crypto community, though it has faced security challenges in the past. The platform has since enhanced its security protocols, offering features like multi-factor authentication and cold storage.

Pros:

- Wide selection of staking coins, including altcoins

- High APYs on some staking products

- Flexible staking options

Cons:

- Not available to U.S. users

- Previous security breaches

Kraken

Platform Overview

Kraken is known for its robust security and regulatory compliance. The platform offers a solid staking program, supporting a variety of coins while maintaining high security standards.

Supported Cryptocurrencies

Kraken supports staking for over 24 coins, including Ethereum (ETH), Solana (SOL), Tezos (XTZ), and Polkadot (DOT). It offers a diverse selection that appeals to both new and experienced users.

Staking Options and Flexibility

Kraken offers flexible staking options with the ability to unstake your assets at any time. It also provides rewards for both on-chain and off-chain staking, adding versatility for users.

Staking Profits (APY)

APYs on Kraken vary by asset, with some coins offering up to 21% in staking earnings. These competitive rates make Kraken an attractive option for users looking for high returns.

Security and Trustworthiness

Kraken is one of the most secure crypto platforms, known for its regulatory compliance and industry-leading security measures. Users can trust Kraken with their assets, thanks to features like cold storage and regular audits.

Pros:

- Strong security and regulatory compliance

- Competitive staking yields

- Flexible staking options

Cons:

- Not available in all regions for staking

- Lower APYs for certain coins

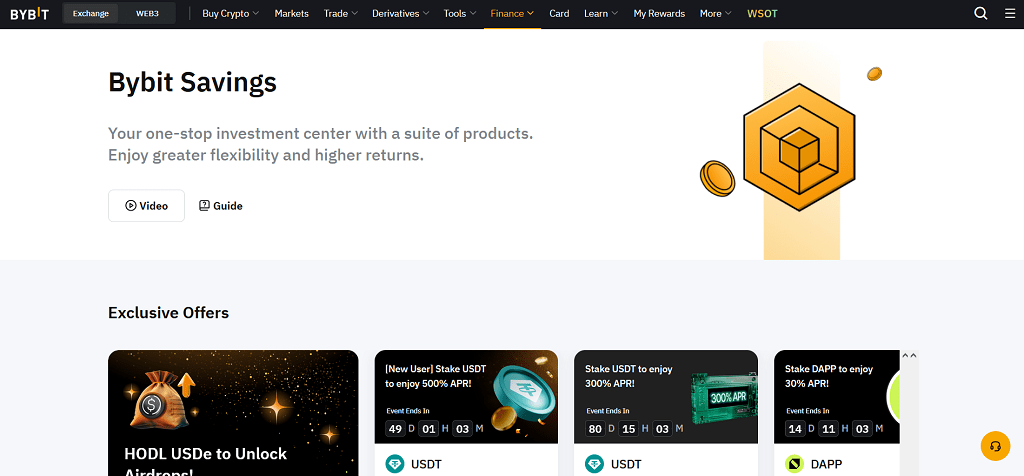

ByBit

Platform Overview

ByBit is a well-established platform that offers a variety of ways for users to earn passive income, including staking. It's known for its wide selection of cryptocurrencies and flexible staking options, making it a favorite among those who want to maximize their returns.

Supported Cryptocurrencies

ByBit supports staking for over 160 cryptocurrencies, including popular assets like Ethereum (ETH) and Bitcoin (BTC). The platform provides flexibility for users looking to stake both major and minor coins.

Staking Options and Flexibility

ByBit offers several staking options, including flexible staking, where users can stake and unstake assets without fixed lock-up periods. This flexibility is especially appealing to users who want liquidity alongside their staking yields.

Staking Profits (APY)

ByBit offers competitive APYs, with rates as high as 50% for some assets. Additionally, the platform frequently runs promotions offering enhanced rewards for a limited time.

Security and Trustworthiness

ByBit is known for its strong security measures, including two-factor authentication and cold storage. It offers a transparent proof-of-reserves system, adding to its trustworthiness. However, it is not available for U.S. users, which limits its accessibility.

Pros:

- High APYs for certain assets

- Wide range of supported cryptocurrencies

- Flexible staking options

Cons:

- Not available in the U.S.

- Promotional APYs can be temporary

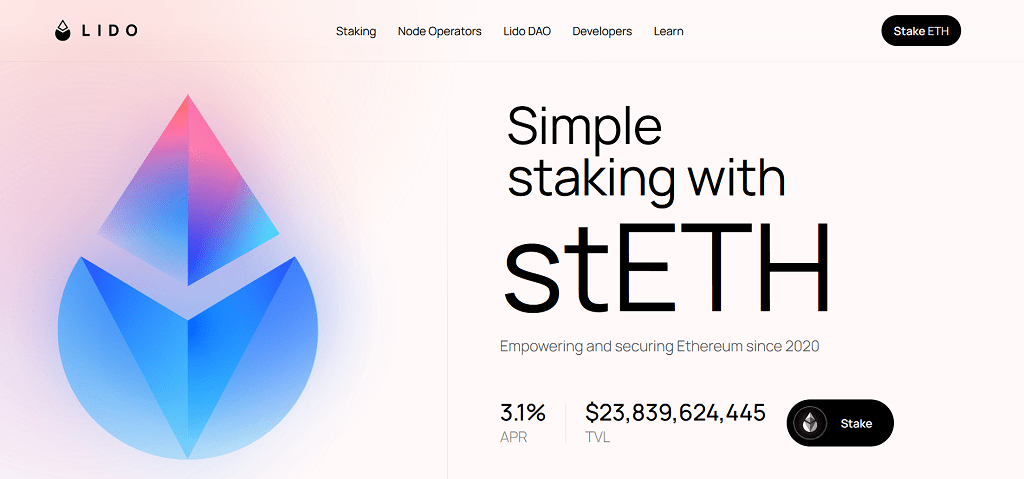

Lido

Platform Overview

Lido is a decentralized platform that specializes in liquid staking, particularly for Ethereum (ETH). It allows users to stake their assets while maintaining liquidity, making it a popular choice for those who want flexibility without sacrificing rewards.

Supported Cryptocurrencies

Lido focuses on liquid staking for Ethereum (ETH), but it also supports staking for other PoS coins like Solana (SOL) and Polkadot (DOT). The platform is continuously expanding its list of supported assets.

Staking Options and Flexibility

Lido’s standout feature is liquid staking, where users receive staked Ethereum (stETH) tokens in return for staking ETH. These stETH tokens can be used across DeFi platforms while still earning staking yields, giving users both liquidity and yield.

Staking Profits (APY)

Lido offers competitive staking rewards, typically around 3-5% APY for Ethereum. While the APY is slightly lower than some centralized platforms, the flexibility and liquidity it offers make up for it.

Security and Trustworthiness

As a decentralized platform, Lido relies on a network of validators and smart contracts. It has undergone multiple security audits and is considered one of the most trusted decentralized staking solutions in the market.

Pros:

- Liquid staking for Ethereum

- Flexibility to use staked tokens in DeFi

- Strong decentralization and security

Cons:

- APY lower compared to centralized platforms

- Limited to specific cryptocurrencies

Nexo

Platform Overview

Nexo is a versatile platform that allows users to earn interest on their cryptocurrency holdings, including through staking. Known for its high APYs and comprehensive crypto services, Nexo is ideal for users looking to maximize returns while maintaining access to other financial tools like loans.

Supported Cryptocurrencies

Nexo supports over 38 assets for staking, including major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins. Its wide variety of supported assets makes it a versatile platform for staking and earning.

Staking Options and Flexibility

Nexo offers both fixed and flexible staking options, allowing users to choose between higher yields for locked assets or more flexibility with unstaked coins. Additionally, users can increase their earnings by choosing to receive rewards in NEXO, the platform’s native token.

Staking profits (APY)

Nexo offers highly competitive staking yields, with APYs reaching up to 16% on certain assets. Users holding NEXO tokens or those in higher loyalty tiers can earn even greater returns.

Security and Trustworthiness

Nexo is a trusted platform with strong security measures, including insurance on assets and regular security audits. It has built a reputation for reliability, making it a safe option for staking.

Pros:

- High APYs, especially for NEXO token holders

- Wide range of supported cryptocurrencies

- Flexible and fixed staking options

Cons:

- Higher rewards depend on holding NEXO tokens

- Limited features in some regions

Rocket Pool

Platform Overview

Rocket Pool is a decentralized Ethereum staking tool that offers users the ability to run their own node or stake with as little as 0.01 ETH. It's designed to be accessible to both technical and non-technical users, making Ethereum staking more inclusive.

Supported Cryptocurrencies

Rocket Pool focuses exclusively on Ethereum (ETH) staking. Users can either stake ETH themselves or delegate it to a network of node operators.

Staking Options and Flexibility

Rocket Pool’s key feature is its low minimum staking requirement. Users can stake as little as 0.01 ETH and receive rETH tokens, which represent their stake and can be used in decentralized finance (DeFi) applications, offering both liquidity and staking yields.

Staking Profits (APY)

Rocket Pool offers competitive rewards for Ethereum staking, with APYs typically around 3-4%. Users who run their own nodes can potentially earn higher rewards by validating transactions.

Security and Trustworthiness

Rocket Pool uses a decentralized approach with distributed node operators, reducing the risk of centralization. Its smart contracts have undergone multiple audits, making it a secure option for decentralized Ethereum staking.

Pros:

- Low minimum staking requirement

- Liquid staking with rETH tokens

- Decentralized and transparent

Cons:

- Only supports Ethereum staking

- APY is lower compared to some centralized platforms

Gemini

Platform Overview

Gemini is a regulated U.S.-based cryptocurrency exchange known for its strong security features and regulatory compliance. Although its staking options are limited compared to other platforms, Gemini offers a solid choice for users looking for a secure and compliant environment.

Supported Cryptocurrencies

Gemini supports staking for Ethereum (ETH), Solana (SOL), and Polygon (MATIC). While the selection is smaller than some other platforms, it focuses on high-demand assets.

Staking Options and Flexibility

Gemini offers flexible staking with no lock-up periods, allowing users to access their staked assets anytime. This flexibility is ideal for users who want to maintain liquidity.

Staking Profits (APY)

Gemini offers competitive APYs, with rewards typically around 2-5%, depending on the cryptocurrency. It charges a relatively low fee on staking earnings, making it an attractive option for those seeking lower costs.

Security and Trustworthiness

Gemini is highly regarded for its regulatory compliance and security. It uses advanced security features like cold storage, multi-factor authentication, and insurance to protect users' assets, making it one of the safest platforms available.

Pros:

- Strong regulatory compliance and security

- Low fees on staking yields

- No lock-up periods

Cons:

- Limited selection of staking coins

- APYs are lower than some other platforms

Decentralized vs Centralized Staking Tools: Which Is Best?

When deciding where to stake your crypto, you can choose between centralized staking tools and decentralized staking services. Both offer unique advantages depending on your priorities—whether it’s ease of use, control over your assets, or maximizing rewards. Here's how the two types of platforms compare to help you make an informed decision.

Centralized Staking Platforms

Centralized platforms like Binance, Coinbase, Crypto.com, and Gemini are popular because they simplify the staking process. These platforms act as custodians, meaning they handle the technical aspects of staking for you, which is ideal for users who are new to crypto or want a more hands-off approach.

Advantages:

- Ease of Use: Centralized platforms make it easy for users to stake with just a few clicks. They handle everything from network participation to distributing rewards, making them perfect for beginners.

- Liquidity: Some centralized platforms, such as Coinbase and Crypto.com, offer flexible staking options where you can withdraw your assets at any time, providing liquidity when needed.

- Security and Support: Platforms like Coinbase are known for their regulatory compliance and strong security features, including insurance for staked assets and cold storage. They also offer customer support for troubleshooting.

Drawbacks:

- Less Control: By staking through a centralized platform, you're trusting a third party with your assets. In the event of a platform failure or regulatory issues, accessing your staked funds could be delayed.

- Lower Rewards: Centralized platforms may charge fees for staking, which can reduce your overall returns compared to decentralized options.

User Experience:

A user staking Ethereum on Coinbase appreciated the simplicity of the process. With no technical setup required, they were able to stake their assets and receive rewards with minimal effort. The platform's security and ease of access made it a hassle-free experience.

Decentralized Staking Platforms

Decentralized platforms like Lido and Rocket Pool allow users to stake directly on the blockchain without relying on a centralized service. These platforms offer more control over your assets since you remain the sole custodian of your private keys.

Advantages:

- Greater Control: With decentralized platforms, you retain control over your assets. For instance, Rocket Pool allows users to stake Ethereum with a low minimum requirement, while still keeping control of their private keys.

- Higher Rewards: Decentralized platforms typically offer higher APYs since there are no middleman fees. Additionally, Lido provides liquid staking, where users can stake ETH and receive stETH tokens in return, allowing them to use their staked assets in other DeFi protocols while still earning rewards.

- Decentralization: By staking through decentralized platforms, you're contributing to the security and health of the blockchain network without relying on third-party services.

Drawbacks:

- Complexity: Decentralized platforms often require a better understanding of blockchain technology, which can be challenging for beginners. You’ll also need to manage your own private keys, which comes with its own risks.

- Limited Support: Unlike centralized platforms, decentralized platforms may not offer customer support, so users need to troubleshoot any issues themselves.

User Experience:

A user staking through Lido found the liquid staking option highly beneficial. They received stETH tokens in exchange for staking Ethereum, which could be used across various DeFi applications. This gave them flexibility and liquidity, while still earning staking earnings.

Which Is Best?

Choosing between centralized and decentralized staking solutions depends on your priorities. If you're looking for simplicity, customer support, and peace of mind with security, centralized platforms like Binance or Crypto.com are excellent options. However, if you’re more experienced and prefer more control over your assets and potentially higher rewards, decentralized platforms like Lido or Rocket Pool might be a better fit.

Ultimately, the best platform for you depends on whether you prioritize convenience or control. For beginners or those who prefer a hands-off experience, centralized platforms are a great choice, while experienced users may find the flexibility and autonomy of decentralized platforms more appealing.

How to Maximize Staking Earnings on Crypto Platforms

Maximizing your staking earnings requires more than just selecting the right platform. While choosing a reputable staking tool is important, you can take additional steps to ensure you’re getting the highest returns possible. Here are some strategies to help you boost your earnings while staking crypto.

1. Choose the Right Cryptocurrency to Stake

Not all cryptocurrencies offer the same rewards for staking. Some coins, like Ethereum (ETH), Cardano (ADA), and Polkadot (DOT), provide competitive returns, while others might offer lower yields. It's crucial to research the potential staking earnings for each cryptocurrency before making a decision. Typically, the annual percentage yield (APY) for staking varies based on the coin’s market demand, supply, and network needs.

For example, staking Cardano can offer around 5% APY, while Polkadot may provide up to 12%. Staking smaller, less-known coins may also offer higher returns but often come with higher risks. Therefore, diversifying your staking portfolio across different coins can be an effective strategy for managing risk while maximizing returns.

2. Take Advantage of Promotional APYs

Many staking providers, such as Binance and Crypto.com, offer promotional periods where they provide enhanced APYs for staking specific coins. These limited-time offers can significantly increase your earnings during the promotional period. If you're flexible and can move your assets around, it’s worth keeping an eye on these opportunities.

For instance, users who took advantage of a promotional offer on Binance for staking Solana (SOL) earned up to 14% APY, much higher than the standard rate. Monitoring these offers and being proactive can help you capitalize on short-term, high-yield opportunities.

3. Consider Locked Staking for Higher Rewards

While flexible staking allows you to withdraw your assets at any time, locked staking typically offers higher rewards. This option requires you to commit your assets for a set period (e.g., 30, 60, or 90 days), but in return, you’ll receive a higher APY. If you don’t need immediate access to your funds, opting for locked staking can significantly increase your earnings.

For example, staking Ethereum on Crypto.com for a 90-day lock-up can yield higher returns than choosing flexible staking. However, it’s essential to evaluate how long you’re willing to lock up your assets, as you won’t be able to withdraw them during that period.

4. Leverage Auto-Staking Features

Some platforms, like Binance and KuCoin, offer auto-staking features that allow you to automatically compound your rewards. With auto-staking, your earned rewards are automatically restaked, allowing you to benefit from compound interest. This is especially useful for long-term holders who plan to stake their assets for an extended period, as compounding can lead to exponential growth over time.

A user staking Binance Coin (BNB) on Binance for over a year shared their experience of leveraging auto-staking. By reinvesting their rewards consistently, they saw a noticeable increase in their overall holdings thanks to the power of compounding.

5. Monitor APY Fluctuations

Staking APYs are not fixed and can fluctuate based on market conditions, network demand, and the specific platform you’re using. Regularly monitoring the APYs on your staking service can help you adjust your strategy to optimize returns. Some platforms, like KuCoin, allow users to switch between flexible and locked staking based on current APYs, giving you the flexibility to adjust your strategy as needed.

Keeping an eye on market trends and knowing when to adjust your staking strategy can prevent you from missing out on better opportunities.

6. Diversify Across Platforms

Different platforms offer different APYs for the same cryptocurrencies. For instance, staking Ethereum on Lido may offer slightly lower rewards than on Binance, but Lido provides liquidity in the form of stETH tokens, which can be used in decentralized finance (DeFi) applications. By spreading your staking activities across multiple platforms, you can take advantage of the unique benefits each one offers, such as liquidity, higher APYs, or added security.

Diversifying across platforms like Crypto.com, KuCoin, and Rocket Pool can allow you to optimize returns without being locked into one ecosystem.

Maximizing your staking earnings requires a combination of smart choices, such as selecting the right cryptocurrency, taking advantage of promotional offers, and leveraging locked staking for higher rewards. Additionally, using features like auto-staking and monitoring market conditions will help you make the most of your staking experience. Whether you’re a long-term investor or looking for short-term gains, these strategies can ensure you’re maximizing your potential earnings while staking crypto.

Staking Rewards vs Mining: Which Is More Profitable?

In the world of cryptocurrency, both staking and mining offer opportunities to earn passive income. However, as the landscape of blockchain evolves, investors often wonder: which is more profitable—staking earnings or mining? The answer largely depends on several factors, including your investment, the coin you're dealing with, and your access to resources.

Understanding Mining

Mining refers to the process of validating transactions and securing the network on a proof-of-work (PoW) blockchain, like Bitcoin. Miners use powerful hardware to solve complex mathematical problems, and the first one to solve the problem gets rewarded with new coins. This method is energy-intensive, requiring significant computational power, cooling systems, and, often, large investments in specialized equipment (like ASIC miners). Miners also need access to affordable electricity, as energy costs are one of the largest ongoing expenses.

While mining Bitcoin can be profitable, it’s competitive. As more miners join the network, it becomes harder to solve blocks, and the rewards are halved every four years in an event known as the halving. This means that for small-scale miners, profitability can be squeezed, especially if electricity costs are high.

Pros of Mining:

- High reward potential, especially in the early stages of a coin’s life.

- Control over hardware and mining setup.

- Long-term miners can benefit significantly from price increases of mined coins like Bitcoin.

Cons of Mining:

- High initial investment for hardware.

- High ongoing energy costs.

- Environmental impact due to heavy energy consumption.

Case Study:

A small-scale miner who invested in mining hardware for Ethereum before it switched to proof-of-stake shared that while the initial returns were promising, the increasing network difficulty and rising electricity costs significantly cut into profits over time.

Understanding Staking

On the other hand, staking is associated with proof-of-stake (PoS) networks like Ethereum 2.0, Cardano, and Polkadot. Rather than using hardware to validate transactions, staking involves holding a certain amount of cryptocurrency in a wallet to support the network. In return, users receive staking profits, typically paid out in the form of more cryptocurrency. Staking is much more energy-efficient and doesn't require expensive equipment, making it more accessible for the average investor.

staking profits vary depending on the cryptocurrency and platform. For example, staking Ethereum or Cardano can provide annual percentage yields (APYs) of 4-8%, depending on the platform. The barrier to entry is also much lower than mining; you don’t need to invest in specialized hardware or worry about energy costs. However, the rewards are usually smaller compared to early mining days unless you stake a significant amount of coins.

Pros of Staking:

- Lower upfront investment and no hardware requirements.

- Environmentally friendly and energy-efficient.

- Consistent returns, even though they tend to be smaller than mining.

Cons of Staking:

- Lower reward potential compared to early mining.

- Returns depend on the staking duration and amount staked.

- Some coins require locking up your funds for extended periods, which limits liquidity.

User Experience:

A user staking Polkadot on Binance shared that they enjoyed the simplicity of staking, especially compared to mining. With no need for hardware or energy consumption, they were able to consistently earn rewards without worrying about operational costs or technical issues. Over time, their staking returns helped grow their crypto holdings passively.

Which Is More Profitable?

In terms of pure profitability, mining was historically more lucrative, especially in the early days of cryptocurrencies like Bitcoin. However, as mining has become more competitive and energy-intensive, it has become less accessible for individual miners without significant investment.

Staking, on the other hand, offers a more predictable and accessible way to earn passive income, though with typically lower rewards. For most casual investors or those looking for a less resource-intensive way to earn, staking is often the better option.

Here’s a quick comparison:

- Initial Investment: Mining requires significant upfront costs for hardware and electricity, while staking only requires holding a certain amount of cryptocurrency.

- Energy Costs: Mining consumes large amounts of electricity, while staking is much more energy-efficient.

- Rewards: Mining rewards can be higher, especially when coins are in the early stages, but the competition and cost of maintaining hardware reduce profits over time. Staking offers smaller, consistent rewards but without the operational costs.

- Environmental Impact: Staking is far more environmentally friendly, as it doesn’t require the massive energy consumption that mining does.

If you're looking for long-term, steady, and environmentally friendly returns, staking is the better option for most people. Mining can still be profitable but often requires a larger upfront investment and ongoing operational expenses, making it less feasible for small-scale investors today.

Staking Risks and How to Avoid Them

While staking can be a great way to earn passive income in the crypto space, it is not without its risks. Understanding these risks and how to minimize them is key to ensuring that your staking journey is both profitable and secure. Below are some common staking risks and strategies for avoiding them.

1. Market Volatility

Cryptocurrencies are inherently volatile, and their prices can fluctuate dramatically over short periods. When you stake your assets, you’re still exposed to these market changes. Even if you’re earning staking returns, a significant drop in the price of the cryptocurrency you’ve staked can lead to a net loss in value.

How to Avoid:

Diversifying your staking portfolio across different assets can help mitigate this risk. Instead of staking all your funds in one coin, consider spreading your investments across several stable and promising cryptocurrencies like Ethereum, Polkadot, and Cardano. Additionally, keep an eye on the market and be prepared to adjust your strategy if you notice significant shifts in price trends.

User Experience:

A user who staked Solana (SOL) in 2022 saw the price of SOL drop sharply during a market downturn. While they continued to earn staking rewards, the overall value of their holdings decreased. Diversifying with other coins like Polkadot helped them balance the loss and maintain a more stable portfolio.

2. Slashing Risks

Many proof-of-stake (PoS) networks have a penalty mechanism known as slashing. If a validator behaves maliciously or fails to perform its duties (like going offline or validating false transactions), a portion of their staked funds can be “slashed,” or taken away, as a penalty. If you’re delegating your stake to a validator, you share in this risk.

How to Avoid:

Choose reliable validators with a strong track record. Most staking providers provide transparency about their validators, including their uptime, performance, and slashing history. Staking services like Binance and KuCoin often do a good job of vetting their validators, minimizing the risk of slashing for users.

3. Lock-Up Periods

Some staking services require you to lock up your assets for a set period. During this time, your funds are illiquid, meaning you can’t access or sell them. If the price of the coin drops during the lock-up period, you won’t be able to react to market changes, potentially leading to losses.

How to Avoid:

If you need flexibility, opt for flexible staking rather than locked staking. Platforms like Crypto.com and Coinbase offer flexible staking options where you can unstake your assets at any time. For those willing to lock up funds for higher returns, it’s important to only commit funds you can afford to keep illiquid for the staking period.

4. Validator Centralization

In some PoS networks, a large portion of the staking power may be concentrated among a few validators. This centralization can pose a risk to the security of the network, and in extreme cases, it may even affect the fairness of the reward distribution.

How to Avoid:

Support decentralization by delegating your stake to smaller, well-performing validators. Many platforms, such as Lido and Rocket Pool, are designed to support decentralized staking, which encourages a more balanced and secure network.

5. Platform Security

Using a staking site that lacks strong security measures can expose your funds to theft or hacks. If the platform experiences a security breach, you could lose your staked assets.

How to Avoid:

Choose well-established platforms with proven security track records. Platforms like Kraken and Gemini prioritize security by using cold storage, two-factor authentication, and insurance policies to protect users’ funds. It’s always a good idea to use platforms that implement strong security measures and offer insurance in case of breaches.

6. Liquidity Risk

Staking often involves locking up your crypto for a set period, making it inaccessible for a certain amount of time. This lack of liquidity can be a problem if you need to access your funds quickly or if you want to capitalize on market opportunities.

How to Avoid:

Consider platforms offering liquid staking, like Lido, where users receive liquid tokens (e.g., stETH) in exchange for staking. These tokens can be used in decentralized finance (DeFi) applications while you continue to earn staking returns, giving you access to liquidity even while your assets are staked.

Understanding the risks of staking is essential for maximizing returns while keeping your assets safe. By diversifying your staking portfolio, selecting reliable validators, and using platforms with robust security features, you can enjoy the benefits of staking while minimizing potential downsides. Whether you’re a beginner or an experienced crypto investor, taking these precautions will help you stake confidently and profitably.

Conclusion: Finding Best Crypto Staking Platforms for Your Needs

Digital asset staking has emerged as a popular way for investors to earn passive income by supporting blockchain networks. By staking their assets, users can contribute to network security while earning staking yields in return. Throughout this article, we’ve explored the ins and outs of digital assets staking, how it works, and how to choose the right platform for your needs.

We started by explaining the basics of blockchain staking, showing how it differs from mining and why it’s an eco-friendly, accessible option for growing your cryptocurrency holdings. We then reviewed key factors to consider when selecting a staking solution, such as security, supported cryptocurrencies, APYs, and staking flexibility. Additionally, we discussed the differences between centralized and decentralized staking sites, helping you understand which model suits your style of investing.

Our top picks for the best crypto platforms for staking in 2024, including Binance, Coinbase, Crypto.com, and Lido, provide diverse options based on user preferences. Some platforms offer high rewards for locked staking, while others, like Lido, focus on liquid staking, providing flexibility with liquidity.

When it comes to maximizing your staking earnings, we covered strategies such as choosing the right cryptocurrency, taking advantage of promotional APYs, and using auto-staking features to compound your returns. We also examined the risks associated with staking, such as market volatility and validator issues, and how to mitigate them through careful planning and diversification.

In the end, finding the best platform for cryptocurrency staking depends on your individual goals. For newcomers, a platform with strong security and ease of use like Coinbase might be the best choice. More advanced users, however, may benefit from platforms like Binance or Crypto.com, which offer higher APYs and a broader range of staking options. If decentralization is a priority, platforms like Lido or Rocket Pool are excellent choices.

By understanding your personal investment strategy and considering the factors discussed in this article, you can confidently choose a platform that aligns with your needs and helps you make the most of your staking efforts in 2024 and beyond.

FAQs About Digital assets Staking Services

As blockchain staking continues to gain popularity, many investors have questions about how staking tools work and what to consider before staking their assets. Below, we’ve answered some of the most frequently asked questions to help you better understand the world of digital asset staking and make informed decisions.

What Is Token Staking and How Does It Work?

Token staking allows users to earn rewards by locking up their cryptocurrency to support a blockchain network’s security and operations. It operates on a Proof of Stake (PoS) model, where participants "stake" their assets to validate transactions on the network. In return, stakers earn rewards, typically in the form of more cryptocurrency. The more coins you stake, the higher your chances of being selected as a validator, which increases your earning potential.

Unlike mining, which requires energy-intensive hardware, staking is eco-friendly and accessible to almost anyone. Platforms like Binance and Crypto.com make the staking process simple, allowing users to select a cryptocurrency and stake it with just a few clicks.

What Are the Benefits of Using a Blockchain Staking Service?

Coin staking sites offer several advantages:

- Passive income: Staking provides a way to grow your holdings without actively trading or selling your assets.

- User-friendly: Most platforms simplify the staking process with easy-to-navigate interfaces, making it accessible even for beginners.

- Diverse options: Platforms like KuCoin and Kraken support a wide range of cryptocurrencies, giving users the opportunity to stake different assets and diversify their portfolio.

- Flexible or locked staking: Depending on your investment style, you can choose between flexible staking, which offers liquidity, or locked staking for higher rewards.

Is Staking Crypto Safe?

Staking crypto is generally safe, but it’s important to consider a few factors:

- Platform security: Choose a trusted staking provider with strong security features like cold storage, multi-factor authentication, and insurance on assets. Platforms like Coinbase and Gemini are known for their strong regulatory compliance and security measures.

- Slashing risk: In some PoS networks, poor validator performance can result in penalties, including losing a portion of staked assets (known as "slashing"). To avoid this, select reliable validators with a strong uptime record.

What Is the Difference Between Flexible and Locked Staking?

- Flexible staking allows you to unstake your assets at any time, providing liquidity and the ability to react to market changes. However, the rewards are usually lower compared to locked staking.

- Locked staking requires you to commit your assets for a specific period (e.g., 30, 60, or 90 days) in exchange for higher APYs. While it offers better returns, you won’t be able to access or withdraw your staked assets during the lock-up period.

For example, on Crypto.com, staking Ethereum for 90 days offers a higher APY than flexible staking, making it an attractive option for long-term holders looking for increased returns.

What Happens if the Price of My Staked Crypto Drops?

When you stake crypto, you're still exposed to market volatility. If the price of your staked cryptocurrency falls, the value of your rewards will also decrease. Even though you're earning staking yields, a significant drop in the asset's value could lead to a net loss.

To mitigate this, consider staking stable coins or diversifying your staking assets across different platforms and cryptocurrencies. This can help balance the risks of price fluctuations.

Which Cryptocurrencies Can I Stake?

Not all cryptocurrencies can be staked—only those that operate on PoS or similar consensus mechanisms. Popular staking coins include:

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Solana (SOL)

- Tezos (XTZ)

Platforms like Binance, Kraken, and Lido support a variety of staking coins, offering both major assets and altcoins for users to choose from.

How Much Can I Earn from Staking?

The amount you earn from staking depends on several factors, including the cryptocurrency, the platform’s APY, and whether you’re using flexible or locked staking. Generally, staking yields range from 2% to 20% APY. Some promotional periods offer even higher rewards.

For instance, Binance often runs promotional offers that temporarily boost the APY on certain assets, allowing users to maximize their staking earnings during the promotion.

Are There Any Fees Associated with Staking?

Yes, some platforms charge fees for staking services. These fees can include transaction fees, withdrawal fees, or a percentage of your rewards. It's important to check the fee structure of each platform before staking. Platforms like ByBit and Crypto.com are known for offering competitive rates, but fees can vary depending on the coin and platform.

Can I Stake on Multiple Platforms?

Yes, you can stake on multiple platforms, and it can be a smart strategy to diversify your assets. Different platforms offer varying APYs for the same cryptocurrencies, so spreading your stake across multiple platforms can help you optimize your rewards while balancing risks.

For example, you might choose to stake Ethereum on Lido for liquid staking while staking Polkadot on Binance for locked staking, giving you both flexibility and higher returns.

Can I Lose Money While Staking?

Yes, while staking offers the potential to earn rewards, there are ways you can lose money:

- Market volatility: If the price of the cryptocurrency you’ve staked falls significantly, you may end up with less overall value even after earning rewards.

- Slashing penalties: In some networks, poor validator performance can lead to a loss of a portion of your staked funds.

- Lock-up periods: In locked staking, you can’t access your assets during the lock-up period. If the market crashes, you won’t be able to sell your staked assets until the lock-up period ends.

Diversifying your staking investments and choosing reliable platforms and validators can help reduce these risks.

How Long Do I Need to Stake My Crypto?

The staking period varies depending on the platform and the staking option you choose:

- Flexible staking: You can usually unstake your assets at any time, giving you more control over your funds.

- Locked staking: This can range from 7 days to several months, depending on the platform and the cryptocurrency. For example, on Crypto.com, you can lock your assets for periods of 30, 60, or 90 days, with longer lock-ups offering higher rewards.

What Is Liquid Staking and How Does It Work?

Liquid staking allows you to stake your assets while still retaining liquidity. When you stake on platforms like Lido or Rocket Pool, you receive a liquid token (e.g., stETH or rETH) that represents your staked assets. These liquid tokens can be used in decentralized finance (DeFi) applications, enabling you to earn additional yields or participate in the broader DeFi ecosystem while continuing to receive staking earnings.

This option is ideal for users who want to stake without locking up their assets entirely.

Do I Need to Be a Validator to Stake?

No, you don’t need to be a validator to stake. Most platforms allow users to delegate their assets to professional validators who take care of the technical aspects. By delegating your crypto, you can earn staking profits without having to run the hardware or manage the node yourself.

Platforms like Lido, Rocket Pool, and Binance allow you to delegate your stake while offering transparency on the validators’ performance.

What Is Auto-Staking?

Auto-staking is a feature offered by some platforms, such as Binance and KuCoin, that automatically restakes your rewards. Instead of manually claiming your rewards and staking them again, auto-staking compounds your earnings, allowing you to grow your holdings more efficiently over time. This is especially useful for long-term investors looking to maximize their rewards without constant monitoring.

Discussion