10 Best Decentralized Exchanges (DEX) for Crypto Trading

10 best decentralized exchanges (DEX) for crypto trading in 2024. Learn about platforms offering low fees, high security, and seamless trading.

When it comes to crypto trading in 2024, finding the 10 best decentralized exchanges (DEX) is crucial for a seamless, secure, and cost-effective experience. Decentralized crypto markets empower traders with greater control over their assets, offering low fees, enhanced privacy, and high-security measures. Whether you're a seasoned crypto enthusiast or just stepping into decentralized finance (DeFi), the right DEX can redefine your trading journey.

In this article, we delve into the top DEX platforms that cater to diverse needs, from liquidity to user-friendly interfaces. Drawing insights from reputable sources like Bitcoin.com, TastyCrypto, NFTevening, and CryptoNews, we've compiled a comprehensive guide to help you navigate the world of decentralized trading. These platforms and articles have provided valuable insights that we’ve integrated into various sections of this piece.

Explore how these innovative exchanges, such as Uniswap, PancakeSwap, and others, are shaping the future of cryptocurrency trading, and discover which platform suits your trading strategy best.

What is a Decentralized Exchange?

A decentralized exchange, commonly known as a DEX, is a platform that allows users to trade cryptocurrencies directly with each other, bypassing intermediaries like banks or centralized platforms. Unlike traditional exchanges, DEXs operate on blockchain technology, using smart contracts to automate and secure transactions. This decentralized structure ensures that users maintain full control over their funds, making trading more secure and private.

One standout feature of DEXs is their peer-to-peer nature, which eliminates the need for centralized oversight. For instance, on platforms like Uniswap or Curve Finance, trades are facilitated through liquidity pools rather than a traditional order book. This innovative approach not only enhances accessibility but also minimizes the risks associated with centralized exchanges, such as hacks or account freezes.

Users often find DEXs appealing for their ability to trade anonymously and access a wide range of tokens, including newly launched projects. However, navigating these platforms can be challenging for beginners due to the need for understanding wallets and blockchain transactions. Despite this, experienced traders praise DEXs for their transparency, reduced fees, and the empowerment they offer through self-custody of funds.

By leveraging blockchain technology and fostering direct transactions, decentralized finance platforms have become a cornerstone of the evolving crypto landscape, catering to both privacy-focused individuals and DeFi enthusiasts.

Key Features and Benefits of Decentralized Exchanges

Non-custodial exchanges have transformed how cryptocurrency trading works, offering unique features and benefits that appeal to both beginners and seasoned traders. Here’s what sets them apart:

- User Control Over Funds

Blockchain-based exchanges allow traders to retain complete control of their crypto assets. Unlike centralized platforms, users don’t need to deposit funds into the exchange, reducing the risk of hacks or account freezes. - Enhanced Privacy

Trading on a decentralized platform often requires no personal information. This privacy-first approach appeals to users who value anonymity and security. - Broad Access to Tokens

Many decentralized platforms list a wide variety of tokens, including niche and newly launched projects that may not be available on centralized exchanges. This provides traders with more opportunities for diversification and early investments. - Lower Fees

With no middlemen involved, trading fees on decentralized platforms are typically lower. Some exchanges even optimize gas fees for cost-effective transactions. - Transparency

All transactions on decentralized platforms are recorded on the blockchain, ensuring full transparency. Users can verify trades and liquidity data in real time, building trust in the system. - Censorship Resistance

Because they operate without centralized control, decentralized platforms are less vulnerable to censorship or government restrictions. This makes them a reliable choice for users in regions with stringent regulations. - Use Case Example

An experienced trader using Curve Finance to swap stablecoins might benefit from its low slippage and minimal fees. Meanwhile, a DeFi enthusiast exploring Uniswap can easily access emerging tokens and participate in liquidity pools for passive income.

These features make decentralized trading platforms a game-changer, offering greater flexibility, security, and opportunities for users looking to navigate the evolving crypto market.

Risks and Challenges of DEX Platforms

While deFi trading platforms offer significant advantages, they are not without their risks and challenges. Understanding these issues can help users trade more effectively and avoid common pitfalls.

- Lower Liquidity

Many decentralized platforms struggle with liquidity compared to centralized exchanges. This can lead to price slippage, especially for large trades, making it difficult to execute orders at expected prices. - Complexity for Beginners

Navigating decentralized platforms requires a good understanding of wallets, private keys, and blockchain transactions. For newcomers, this steep learning curve can be a barrier to entry. - Smart Contract Vulnerabilities

Decentralized platforms rely on smart contracts to execute trades. While these are designed to be secure, bugs or coding flaws can be exploited, leading to potential loss of funds. Regular audits mitigate this risk but don’t eliminate it entirely. - Lack of Customer Support

Without a central authority, users have no direct support for resolving issues like lost funds or failed transactions. This can be particularly challenging for those unfamiliar with troubleshooting blockchain-related problems. - Network Congestion and Fees

High traffic on blockchains like Ethereum can lead to network congestion, increasing transaction costs and delays. This can make trading inefficient during peak times. - User Experience Example

A trader attempting to swap tokens during a period of high network congestion might face elevated gas fees or a failed transaction. Without recourse to customer support, they are left to resolve the issue independently, underscoring the self-reliant nature of decentralized platforms.

Despite these challenges, many traders view decentralized platforms as essential for their autonomy and innovation, making it crucial to weigh the risks against the benefits before diving in.

Choosing the Right Decentralized Exchange for Your Needs

Selecting the ideal decentralized exchange depends on your trading preferences, goals, and the features you value most. Here are some key factors to consider:

- Supported Tokens

Look for a platform that offers the tokens you want to trade. For example, Uniswap is known for its extensive selection of ERC-20 tokens, while PancakeSwap specializes in Binance Smart Chain assets. - Fees and Costs

Trading and network fees can vary widely. If you’re trading frequently, a platform with low fees, like Curve Finance for stablecoins, can save you significant amounts over time. - Ease of Use

If you’re new to decentralized platforms, choose one with a simple interface, such as SushiSwap. A beginner-friendly platform can make your experience smoother and less intimidating. - Security Features

Ensure the platform has been audited for smart contract vulnerabilities. Opt for exchanges with strong security reputations and minimal history of exploits. - Liquidity and Volume

Higher liquidity means better pricing and faster trade execution. Popular exchanges like Uniswap and PancakeSwap tend to have robust liquidity pools, making them a reliable choice for larger transactions. - Use Case Example

A trader looking to swap stablecoins with minimal slippage might find Curve Finance ideal, while someone exploring multi-chain trading could benefit from the flexibility of 1inch.

By considering these aspects, you can find a decentralized crypto market that aligns with your trading needs, ensuring a more efficient and rewarding experience in the evolving world of cryptocurrency.

10 Best Decentralized Exchanges (DEX) for Crypto Trading in 2024

Decentralized exchanges (DEX) have revolutionized cryptocurrency trading, offering users more control, privacy, and flexibility. Whether you're looking for low fees, diverse token options, or advanced trading tools, choosing the right platform can significantly enhance your trading experience. Here, we review the 10 best DEX platforms in 2024, highlighting their features, benefits, and ideal use cases to help you find the perfect fit for your needs.

| Exchange | Key Features | Best For | Pros | Cons |

|---|---|---|---|---|

| Uniswap | Extensive ERC-20 tokens, governance token (UNI), permissionless trading | Exploring new tokens, liquidity provision | High liquidity, user-friendly interface | High gas fees during congestion |

| PancakeSwap | Low fees, BEP-20 token support, staking and farming | Low-cost swaps, yield farming | Fast transactions, cross-chain trading | Limited token variety compared to Ethereum-based platforms |

| Curve Finance | Optimized for stablecoins, low slippage, governance token (CRV) | Stablecoin swaps, low-risk liquidity provision | Minimal slippage, integration with other DeFi platforms | Complex interface for beginners |

| SushiSwap | Multi-chain support, yield farming, staking with SUSHI rewards | Cross-chain trading, high-yield farming | Community-driven, diverse earning options | Occasional security concerns |

| 1inch | Liquidity aggregator, gas fee optimization, cross-chain functionality | Finding the best token prices across DEXs | Competitive pricing, broad token access | Requires some technical knowledge |

| dYdX | Perpetual contracts, layer-2 solution, professional trading tools | Advanced traders, derivatives trading | Low fees, high leverage options | Not beginner-friendly |

| Balancer | Multi-token pools, portfolio management, governance token (BAL) | Customizable liquidity pools | Flexible pool configurations, multi-chain support | Higher complexity |

| THORChain | Native cross-chain swaps, support for major assets, RUNE incentives | Seamless multi-chain trading | True cross-chain interoperability | Still developing, occasional bugs |

| QuickSwap | Polygon-based AMM, low fees, staking and farming | Low-cost, fast transactions | Efficient and affordable trades | Limited features compared to larger platforms |

| Raydium | Solana-based AMM, integration with Solana projects | Fast Solana ecosystem trades | Lightning-fast transactions | Limited token selection |

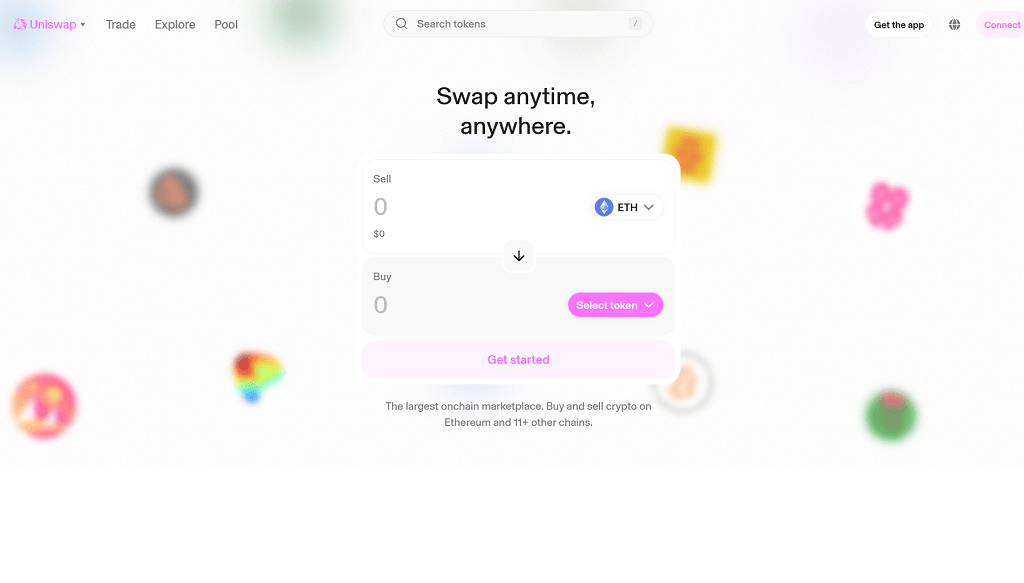

Uniswap

Brief Introduction

Uniswap, launched in 2018, is a trailblazer in decentralized trading. Built on Ethereum, it introduced the Automated Market Maker (AMM) model, enabling users to swap ERC-20 tokens seamlessly without intermediaries.

Key Features

- Permissionless trading with a user-friendly interface.

- Extensive selection of ERC-20 tokens, making it a favorite for DeFi projects.

- Governance token (UNI) allows users to influence the platform’s development.

Pros and Cons

- Pros: High liquidity, robust security, and extensive token support.

- Cons: High gas fees on Ethereum during congestion.

Best Use Cases

Uniswap is ideal for traders looking to explore new tokens or provide liquidity to earn passive income.

User Experience

A trader seeking newly launched tokens found Uniswap’s liquidity pools intuitive and efficient, despite the occasional spike in gas fees.

Conclusion

Uniswap remains a top choice for its pioneering approach, token variety, and integration within the DeFi ecosystem.

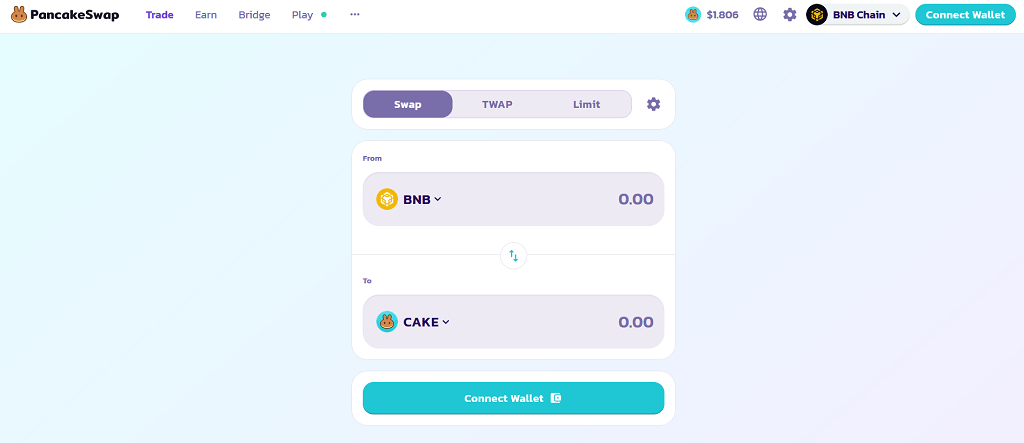

PancakeSwap

Brief Introduction

PancakeSwap, built on Binance Smart Chain, is known for its cost-effective and speedy transactions. Launched in 2020, it caters to users frustrated by Ethereum’s high fees.

Key Features

- Supports BEP-20 tokens with an AMM model.

- Yield farming and staking options to earn CAKE, its native token.

- Cross-chain capabilities for expanded trading opportunities.

Pros and Cons

- Pros: Low fees, fast transactions, and extensive farming opportunities.

- Cons: Limited token variety compared to Ethereum-based platforms.

Best Use Cases

Best suited for traders seeking low-cost swaps and users interested in earning rewards through staking.

User Experience

A DeFi investor praised PancakeSwap for its straightforward interface and fast execution, especially for high-frequency trades.

Conclusion

PancakeSwap excels in affordability and efficiency, making it a go-to platform for Binance Smart Chain users.

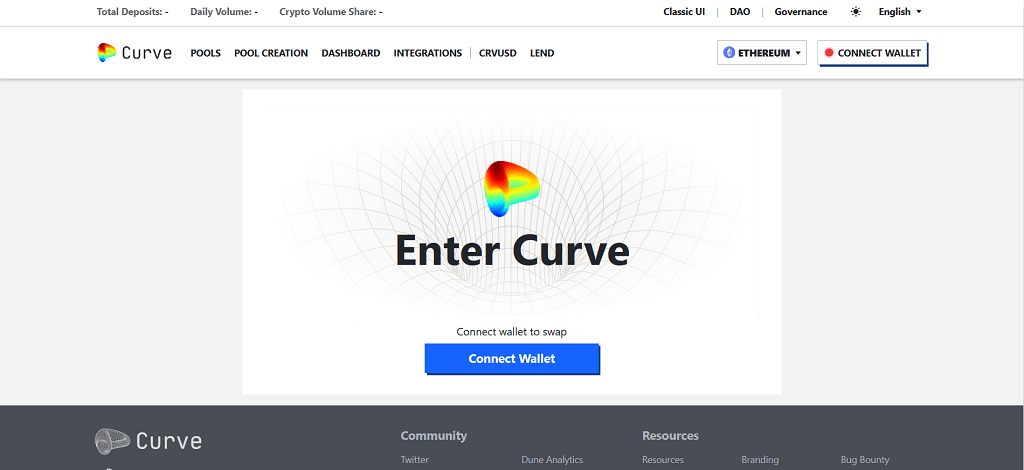

Curve Finance

Brief Introduction

Curve Finance specializes in stablecoin trading, offering a platform optimized for low-slippage transactions. Its focus on stability makes it a cornerstone for many DeFi strategies.

Key Features

- AMM designed for stablecoins and pegged assets.

- Integration with other DeFi platforms for enhanced utility.

- Governance token (CRV) for voting and rewards.

Pros and Cons

- Pros: Minimal slippage and efficient stablecoin swaps.

- Cons: Complex interface for beginners.

Best Use Cases

Curve is perfect for users frequently trading stablecoins or providing liquidity with reduced impermanent loss.

User Experience

A liquidity provider noted consistent returns with Curve’s stablecoin pools, despite needing time to understand its interface.

Conclusion

Curve Finance stands out for stablecoin efficiency, making it a must-use for traders focused on low-risk DeFi strategies.

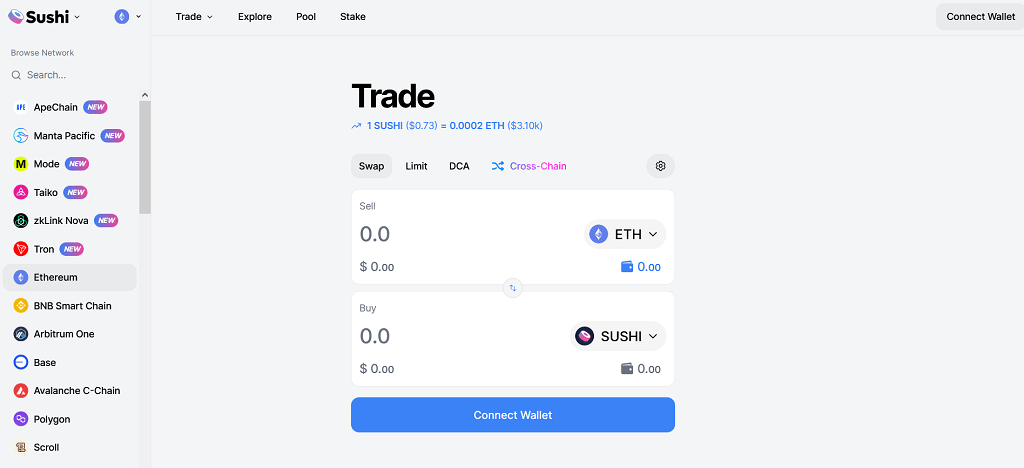

SushiSwap

Brief Introduction

SushiSwap emerged as a Uniswap fork but quickly evolved into a decentralized platform with unique features, including multi-chain capabilities.

Key Features

- Supports token swaps, yield farming, and staking across multiple chains.

- SUSHI token for governance and additional rewards.

- Community-driven development.

Pros and Cons

- Pros: Multi-chain support and high rewards for liquidity providers.

- Cons: Occasional security concerns due to rapid feature rollouts.

Best Use Cases

An excellent choice for traders seeking cross-chain capabilities and higher yield farming opportunities.

User Experience

A liquidity provider highlighted SushiSwap’s diverse earning options, although they recommended monitoring updates for potential risks.

Conclusion

SushiSwap blends innovation and community focus, appealing to both traders and liquidity providers.

1inch

Brief Introduction

1inch is a deFi trading platform aggregator that sources liquidity from various platforms, ensuring users get the best trade rates across multiple exchanges.

Key Features

- Aggregates liquidity from multiple DEXs for optimal pricing.

- Supports limit orders and gas fee optimization.

- Cross-chain functionality for broader token access.

Pros and Cons

- Pros: Competitive pricing and user-friendly interface.

- Cons: May require advanced knowledge for optimal use.

Best Use Cases

Perfect for traders seeking the best token prices across chains without manually comparing platforms.

User Experience

A trader praised 1inch for saving on gas fees during high-volume trades, finding its price optimization invaluable.

Conclusion

1inch simplifies trading by aggregating liquidity, making it indispensable for cost-conscious users.

dYdX

Brief Introduction

dYdX specializes in decentralized derivatives trading, offering advanced tools for experienced traders. Its layer-2 solution ensures lower fees and fast transactions.

Key Features

- Perpetual contracts with up to 20x leverage.

- Layer-2 integration for cost-efficient trades.

- Professional-grade trading tools and charts.

Pros and Cons

- Pros: High-speed transactions and advanced trading features.

- Cons: Not beginner-friendly due to complexity.

Best Use Cases

Ideal for professional traders looking to trade derivatives in a decentralized environment.

User Experience

A derivatives trader appreciated the seamless execution on dYdX but emphasized the need for experience with leverage trading.

Conclusion

dYdX is a powerhouse for advanced traders, offering unmatched tools for perpetual contracts.

Balancer

Brief Introduction

Balancer combines the functionality of a decentralized finance platforms and an automated portfolio manager, allowing users to create customizable liquidity pools.

Key Features

- Multi-token liquidity pools with adjustable weightings.

- BAL token for governance and rewards.

- Supports multiple blockchains, including Ethereum and Polygon.

Pros and Cons

- Pros: Flexible pool configurations and innovative portfolio tools.

- Cons: Higher complexity compared to standard DEXs.

Best Use Cases

A great choice for users looking to create diversified liquidity pools for passive income.

User Experience

A user managing a multi-asset pool praised Balancer’s flexibility but advised others to monitor fees and pool performance closely.

Conclusion

Balancer’s customizable pools make it a unique platform for portfolio management and trading.

THORChain

Brief Introduction

THORChain enables cross-chain token swaps without wrapping assets, making it a leader in true decentralized interoperability.

Key Features

- Native cross-chain swaps.

- Support for major assets like Bitcoin, Ethereum, and Binance Coin.

- Liquidity incentives for RUNE token holders.

Pros and Cons

- Pros: True cross-chain support and decentralized architecture.

- Cons: Still maturing, with occasional bugs reported.

Best Use Cases

Best for traders looking to swap assets across different blockchains seamlessly.

User Experience

A trader swapping Bitcoin for Ethereum praised the platform’s direct interoperability but noted occasional delays during peak times.

Conclusion

THORChain is pioneering cross-chain trading, making it essential for multi-asset traders.

QuickSwap

Brief Introduction

QuickSwap, built on Polygon, offers fast and cost-effective trading with an AMM model similar to Uniswap.

Key Features

- Low fees and fast transactions on the Polygon network.

- Support for a growing list of tokens.

- Staking and yield farming options.

Pros and Cons

- Pros: Affordable trades and a user-friendly interface.

- Cons: Limited features compared to larger DEXs.

Best Use Cases

Ideal for traders seeking low-cost swaps and rapid transactions.

User Experience

A frequent trader highlighted QuickSwap’s speed and affordability, particularly for small trades.

Conclusion

QuickSwap’s efficiency and low fees make it a great option for Polygon network users.

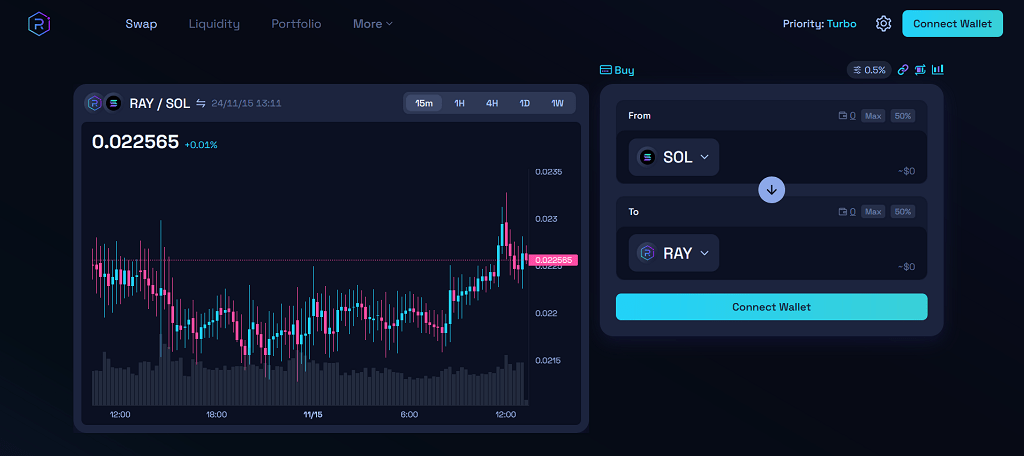

Raydium

Brief Introduction

Raydium is a Solana-based blockchain-based exchange known for its speed and integration with the Solana ecosystem.

Key Features

- AMM with support for Solana-based tokens.

- Fast transaction speeds and low fees.

- Integration with other Solana DeFi projects.

Pros and Cons

- Pros: Lightning-fast transactions and Solana ecosystem support.

- Cons: Limited token selection compared to Ethereum-based DEXs.

Best Use Cases

Great for Solana users looking for fast and cost-effective trading options.

User Experience

A Solana enthusiast noted Raydium’s seamless swaps but wished for broader token availability.

Conclusion

Raydium’s focus on speed and Solana integration makes it a top choice for its ecosystem users.

Conclusion: Why DEXs are Essential for Traders

Decentralized exchanges have become indispensable tools for modern cryptocurrency traders. They offer unparalleled control over funds, enhanced privacy, and access to a vast array of tokens, all without relying on intermediaries. Whether you’re looking to explore niche projects, earn through liquidity pools, or simply trade with lower fees, non-custodial platforms provide solutions that centralized exchanges often cannot.

The flexibility and innovation of platforms like Uniswap, PancakeSwap, and THORChain are redefining the trading landscape. These exchanges empower users to take charge of their financial strategies while contributing to a more decentralized financial ecosystem.

While challenges such as high gas fees or technical complexities exist, the advantages of autonomy, transparency, and inclusivity far outweigh the drawbacks. For traders focused on security, cost-efficiency, and the potential of decentralized finance, DEXs are not just an option—they’re the future of trading.

FAQs on Decentralized Exchanges and Cryptocurrency Trading

Are decentralized crypto markets safe?

DEXs are generally safer than centralized exchanges because users retain control of their funds and private keys. However, risks like smart contract vulnerabilities or phishing attacks remain, so it’s crucial to use audited platforms and follow security best practices.

How do I choose the right DEX?

Selecting the right DEX depends on your needs. If you prioritize low fees, platforms like PancakeSwap are ideal. For diverse token availability, Uniswap is a great choice. Consider factors like supported tokens, fees, security, and ease of use before deciding.

Do blockchain-based exchanges charge fees?

Yes, DEXs typically charge trading fees, and you may also incur blockchain network fees (gas fees) for transactions. Platforms like Curve Finance offer low trading fees, especially for stablecoins.

Can beginners use deFi trading platforms?

While DEXs can be intimidating for beginners due to wallet setup and blockchain knowledge requirements, platforms like SushiSwap offer user-friendly interfaces that make it easier for newcomers to start trading.

What tokens can I trade on a DEX?

Most DEXs support a wide range of tokens. For example, Uniswap specializes in ERC-20 tokens, while PancakeSwap focuses on BEP-20 tokens. Cross-chain platforms like THORChain also allow trading between different blockchains.

What are the main risks of trading on a DEX?

The main risks include high gas fees during network congestion, smart contract exploits, and limited customer support. To mitigate these, choose reputable platforms with robust security measures.

Can I earn passive income on a DEX?

Yes, many DEXs like Curve Finance and SushiSwap allow users to provide liquidity to pools or stake tokens, earning rewards in return. This is a popular way to generate passive income in the DeFi space.

What’s the future decentralized finance platforms?

DEXs are likely to play a pivotal role in the future of cryptocurrency trading, offering more autonomy, inclusivity, and innovation. As blockchain technology evolves, these platforms will likely become more efficient, secure, and user-friendly.

Are non-custodial exchanges regulated?

Most deFi trading platforms operate outside traditional regulatory frameworks due to their decentralized nature. However, users should ensure compliance with local laws regarding cryptocurrency trading and taxation.

What are liquidity pools, and why are they important?

Liquidity pools are collections of tokens locked in smart contracts that facilitate trading on DEXs. They replace traditional order books, ensuring continuous market availability. Users can provide liquidity to these pools and earn rewards.

Do decentralized exchanges support cross-chain trading?

Some DEXs, like THORChain and 1inch, support cross-chain trading, allowing users to trade assets between different blockchains without wrapping tokens. This feature is essential for interoperability in the crypto ecosystem.

What is the cheapest decentralized exchange for trading?

PancakeSwap is one of the cheapest DEXs, with low trading fees (0.25%) and minimal gas costs on Binance Smart Chain. Curve Finance also offers cost-effective stablecoin swaps with low fees and slippage.

Discussion