10 Best DeFi Coins to Invest in for the 2025 Bull Run

10 Best DeFi coins to invest in for the 2025 bull run. Find high-potential projects in decentralized finance primed for growth and profit.

Looking to find the 10 best DeFi coins to invest in for the 2025 bull run? With decentralized finance (DeFi) poised for explosive growth, savvy investors are eyeing high-potential DeFi projects set to thrive in the next market cycle. In this article, we explore top-performing DeFi coins primed for growth, bringing insights from industry leaders like InsideBitcoins, Koinly, and TastyCrypto. These resources provide valuable perspectives on decentralized exchanges, lending platforms, and other cutting-edge DeFi applications. From well-established platforms to emerging projects, we’ll cover the DeFi tokens that combine real-world use cases and growth potential, helping you make informed investment choices for the upcoming bull run. Dive in to discover which DeFi tokens could yield impressive returns and how they stand to benefit from the ongoing DeFi revolution.

What is Decentralized Finance and What Do DeFi Coins Do?

Decentralized Finance, or DeFi, is reshaping finance by transitioning traditional banking services to blockchain-powered, open networks. Through DeFi, financial activities like lending, borrowing, and trading are carried out using smart contracts, which are self-executing agreements on blockchain platforms such as Ethereum. This eliminates the need for banks or intermediaries, making financial services accessible to anyone with an internet connection.

DeFi coins power these decentralized ecosystems, each supporting its platform's unique features and operations. Many DeFi tokens provide governance rights, allowing holders to vote on key protocol changes. For example, tokens like Maker (MKR) and Aave (AAVE) empower users to participate in decision-making, while others, like Curve (CRV), incentivize users to add liquidity to decentralized exchanges (DEXs) where peer-to-peer cryptocurrency trading takes place.

Users often appreciate DeFi’s transparency and accessibility. Investors can lend or stake their assets on platforms like Compound to earn real-time interest, bypassing traditional banking entirely. Likewise, decentralized exchanges allow seamless, direct trades without intermediaries, creating flexible investment options.

This combination of financial utility and blockchain security has positioned DeFi assets as a compelling investment opportunity as the DeFi sector continues to expand and mature.

Understanding the DeFi Market and Its Growth Potential

The DeFi market has seen substantial growth, transforming how financial services are accessed and managed. With DeFi, financial activities—lending, borrowing, staking, and trading—are accessible globally without intermediaries, creating a more open, efficient financial landscape. The potential for DeFi continues to expand as new platforms address issues like scalability and transaction speed, previously limiting blockchain-based finance.

DeFi projects operate primarily on networks like Ethereum, though new entrants, such as Avalanche and Solana, have emerged to improve efficiency and lower costs. These newer platforms are helping broaden DeFi’s appeal, enabling faster transactions and cheaper fees, which appeals to both developers and users. As a result, more people are adopting DeFi as an alternative to traditional finance, encouraged by opportunities for high returns, transparency, and flexibility.

One significant draw of the DeFi market is its passive income potential. Many users have embraced liquidity provision and staking, where digital assets are locked up to earn interest or rewards. This real-time earning potential, along with options for yield farming, has attracted a diverse group of investors, from individuals to large-scale institutions.

As DeFi gains traction, its future growth appears promising, especially as protocols improve user experience and expand functionality. The sector’s rapid innovation and decentralized nature make DeFi a significant force, with high growth potential as it becomes more user-friendly and accessible to everyday investors.

Key Factors for Evaluating DeFi Coins for the 2025 Bull Run

When evaluating DeFi assets for the 2025 bull run, several key factors can help investors identify projects with strong growth potential and long-term resilience. While DeFi tokens vary in functionality and purpose, a few core considerations can guide investment decisions.

- Utility and Use Case

A DeFi asset’s functionality within its ecosystem is crucial. Coins that power essential operations, such as governance, lending, or liquidity provision, tend to have a more stable demand. For instance, coins used in decentralized lending platforms or for staking rewards often see steady use, even during market fluctuations. - Platform Security and Stability

Security is paramount in DeFi. Investors should assess whether the project has undergone extensive auditing and security reviews. With hacks and vulnerabilities occasionally affecting DeFi platforms, coins backed by well-audited smart contracts and experienced teams are often more reliable. Projects with strong security measures and transparency can earn greater user trust and experience fewer disruptions. - Community and Governance

Many DeFi tokens offer governance rights, allowing users to vote on protocol changes. A robust, active community behind a DeFi asset can drive innovation, provide funding for updates, and create a more resilient ecosystem. Coins with strong communities tend to foster more sustainable, user-driven platforms, where holders actively shape the project’s direction. - Partnerships and Ecosystem Growth

DeFi projects integrated into larger networks or partnered with other platforms can enhance their market relevance. Collaborations with decentralized exchanges, yield farming protocols, and even traditional financial firms often bring greater liquidity and utility. A growing network of partnerships can boost a coin’s use cases, market reach, and investor confidence. - Market Performance and Resilience

Finally, reviewing a coin’s past market performance can offer insights into its resilience. Projects that have weathered previous market cycles or shown consistent growth are often better positioned for future success. Coins with a track record of stable performance tend to attract long-term holders, which can support stability during market downturns.

Considering these factors provides a more comprehensive view of a DeFi token's potential, helping investors select assets that align with both market trends and individual risk tolerance.

10 Best DeFi Coins for the 2025 Bull Run

As the decentralized finance (DeFi) sector continues to evolve, certain coins have established themselves as promising choices for the next major market surge. For investors preparing for the 2025 bull run, understanding the top DeFi tokens and what sets them apart can provide a significant edge. From lending platforms and decentralized exchanges to high-speed blockchains, these DeFi projects offer a range of unique benefits and growth potential. Here’s a look at the 10 best DeFi coins poised to lead the charge in the next bull market.

| DeFi Assets | Main Purpose | Key Features | Market Position |

|---|---|---|---|

| Maker (MKR) | Stablecoin Creation | Governance, supports DAI stablecoin | Established, widely adopted in DeFi lending |

| Aave (AAVE) | Lending & Borrowing | Flash loans, governance, staking rewards | Top-ranked lending protocol by TVL |

| Uniswap (UNI) | Decentralized Exchange (DEX) | Automated Market Maker (AMM), low fees | Leading DEX with high trading volumes |

| Curve (CRV) | Stablecoin Trading | Low slippage, liquidity provider rewards | Highly regarded for stablecoin trades |

| Compound (COMP) | Money Market | Interest-based lending, governance token | Well-established in decentralized lending |

| Synthetix (SNX) | Synthetic Asset Creation | Collateralized synthetic assets, staking | Strong growth in asset tokenization |

| SushiSwap (SUSHI) | Decentralized Exchange & Yield Farming | Liquidity provider rewards, lending options | Popular for user rewards and yield farming |

| DYDX (DYDX) | Leveraged Trading | Perpetual contracts, governance | Top choice for advanced traders |

| Avalanche (AVAX) | High-Speed Blockchain | Low fees, rapid transactions, staking | Growing adoption among DeFi developers |

| Loopring (LRC) | Layer-2 Scaling for DEXs | zkRollups, fast transactions, low fees | Popular Layer-2 solution for Ethereum DEXs |

Maker (MKR): The Stablecoin Pioneer

Introduction to Maker (MKR)

MakerDAO’s MKR token has a prominent role in DeFi as one of the earliest decentralized lending platforms. It serves a critical function by supporting DAI, a stablecoin pegged to the US dollar.

Key Features of Maker (MKR)

MKR holders participate in the governance of MakerDAO, influencing risk parameters and the future of the platform. The system allows users to create DAI by locking collateral, making MKR essential for those seeking stability in the volatile crypto market.

Market Position and Performance

Maker has experienced considerable growth due to its stability-focused approach. The platform’s reliability and transparency have helped it maintain a strong position in DeFi rankings.

Pros and Cons of Maker (MKR)

Pros include its strong utility in stablecoin creation and governance. However, as a governance token, it’s highly influenced by protocol changes, which can impact its value.

User Experience and Adoption

Maker is well-regarded for its seamless user experience in collateralized debt positions. Its stability appeals to those looking for a hedge against volatility, especially during bull and bear markets.

Future Outlook for Maker (MKR)

As DeFi grows, Maker’s role in stablecoin issuance is likely to strengthen, positioning MKR well for the next bull run.

Aave (AAVE): Leading DeFi Lending Platform

Introduction to Aave (AAVE)

Aave is a decentralized lending platform enabling users to lend and borrow assets. It’s recognized for its innovation in flash loans, where users borrow without requiring collateral under specific conditions.

Key Features of Aave (AAVE)

AAVE provides governance rights, staking rewards, and access to Aave’s borrowing and lending services. Flash loans offer unique financial strategies, while the protocol’s transparency attracts investors.

Market Position and Performance

Aave’s total value locked (TVL) ranks among the highest in DeFi, thanks to its comprehensive asset support and innovation in lending. This growth is driven by continuous updates and active governance.

Pros and Cons of Aave (AAVE)

AAVE’s flexibility and earning potential attract investors, while risks include lending pool fluctuations and regulatory concerns around borrowing protocols.

User Experience and Adoption

Users appreciate Aave’s intuitive interface and low borrowing fees. Its flexibility with both fixed and variable interest rates is a strong draw.

Future Outlook for Aave (AAVE)

As the demand for decentralized lending grows, Aave’s innovative features and expanding ecosystem position it as a DeFi mainstay for the 2025 bull market.

Uniswap (UNI): Popular Decentralized Exchange

Introduction to Uniswap (UNI)

Uniswap, a leading decentralized exchange (DEX), allows peer-to-peer cryptocurrency trading without intermediaries. UNI serves as its governance token.

Key Features of Uniswap (UNI)

The platform’s automated market maker (AMM) technology enables decentralized, seamless trades, and its low fees appeal to traders.

Market Position and Performance

Uniswap remains one of the most widely used DEXs, with a high market share in trading volumes. Its adoption is driven by ease of use and flexible liquidity pools.

Pros and Cons of Uniswap (UNI)

Uniswap’s pros include autonomy in trading and robust liquidity. However, fees can fluctuate with network congestion, impacting smaller trades.

User Experience and Adoption

Uniswap’s straightforward design and user-friendly swaps have led to high adoption rates, especially among those new to DeFi.

Future Outlook for Uniswap (UNI)

With DeFi’s expanding reach, Uniswap’s role as a go-to DEX makes UNI an appealing long-term investment.

Curve (CRV): Stablecoin-Focused DEX

Introduction to Curve (CRV)

Curve Finance specializes in stablecoin trading, providing low-fee, low-slippage transactions. CRV is its governance and reward token.

Key Features of Curve (CRV)

The protocol’s efficient swaps between stablecoins and tokens help reduce fees and slippage. Its governance rewards liquidity providers, creating a solid incentive structure.

Market Position and Performance

Curve’s unique stablecoin focus secures its niche, attracting high trading volumes. The platform’s TVL remains competitive.

Pros and Cons of Curve (CRV)

Curve’s stability and user rewards are strong advantages, though its specialized focus on stablecoins may limit expansion potential.

User Experience and Adoption

Its low-cost, stablecoin-centric approach is popular among liquidity providers, making Curve a preferred choice for steady earnings.

Future Outlook for Curve (CRV)

With growing stablecoin use, Curve’s specialized DEX and its CRV token have substantial potential in the 2025 market.

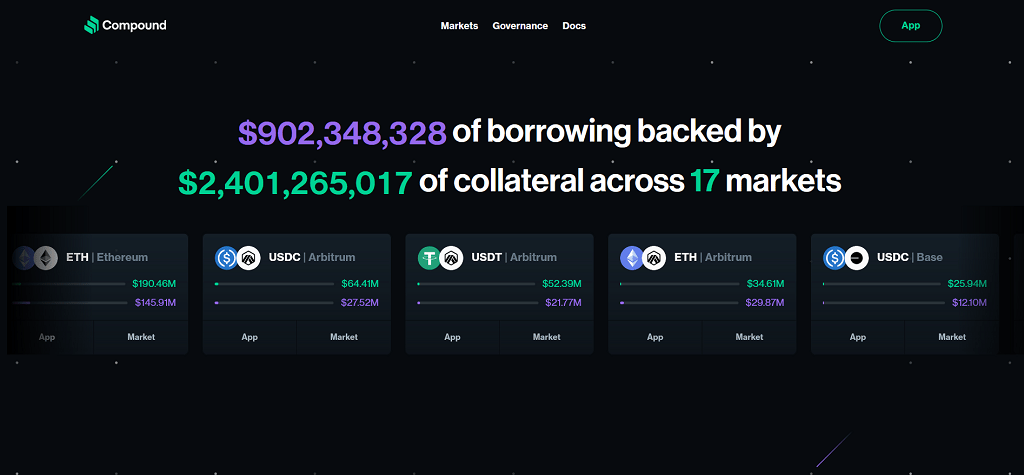

Compound (COMP): Decentralized Money Market

Introduction to Compound (COMP)

Compound enables users to lend or borrow crypto assets, with COMP serving as its governance token.

Key Features of Compound (COMP)

The protocol’s automated money markets provide interest rates based on supply and demand, with COMP token rewards for participation in governance.

Market Position and Performance

Compound’s role as a decentralized money market has helped it achieve high TVL, driven by transparency and consistent returns.

Pros and Cons of Compound (COMP)

Compound’s key benefits are its passive income opportunities and strong liquidity, though borrowing risks and protocol changes can influence returns.

User Experience and Adoption

The platform’s accessibility and fair interest rates make it popular for both borrowers and lenders.

Future Outlook for Compound (COMP)

The demand for decentralized lending is expected to grow, positioning COMP as a promising choice for the next bull market.

Synthetix (SNX): Synthetic Asset Protocol

Introduction to Synthetix (SNX)

Synthetix allows users to trade synthetic assets, which mirror the value of real-world assets like stocks and commodities. SNX powers this ecosystem.

Key Features of Synthetix (SNX)

Synthetix enables exposure to assets without owning them physically. SNX is used as collateral, generating synthetic assets and earning staking rewards.

Market Position and Performance

Synthetix’s unique model attracts both crypto and traditional investors. The platform’s growth reflects strong demand for synthetic assets.

Pros and Cons of Synthetix (SNX)

SNX offers high staking rewards and diversified asset exposure, but risks include market volatility and synthetic asset complexity.

User Experience and Adoption

Synthetix’s synthetic assets are favored by investors seeking traditional market exposure through DeFi.

Future Outlook for Synthetix (SNX)

The demand for asset tokenization supports Synthetix’s growth potential, making SNX a strong candidate for the 2025 bull run.

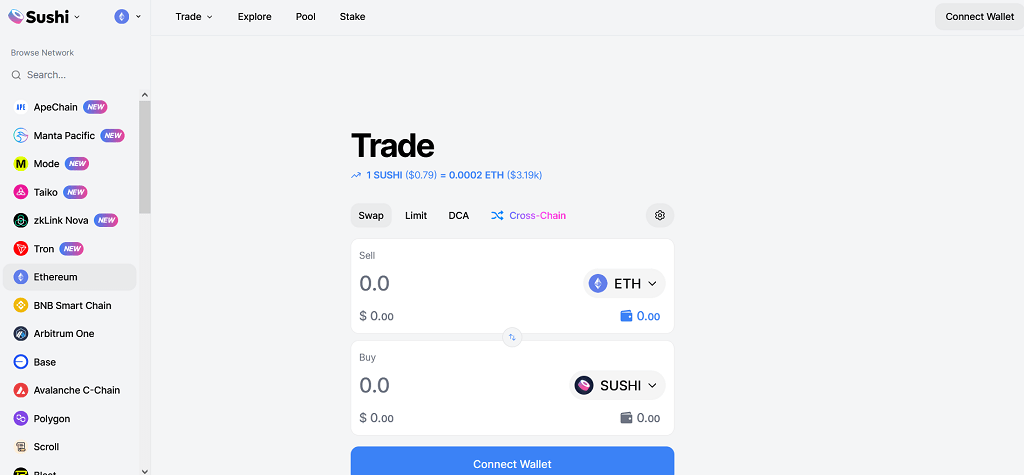

SushiSwap (SUSHI): Innovative DEX and Yield Farming

Introduction to SushiSwap (SUSHI)

SushiSwap is a decentralized exchange known for yield farming and liquidity rewards, with SUSHI as its governance token.

Key Features of SushiSwap (SUSHI)

SushiSwap incentivizes liquidity providers with SUSHI rewards. Its diverse features include lending and yield farming options, appealing to a wide user base.

Market Position and Performance

SushiSwap’s position as a leading DEX has grown due to its innovative approach to user rewards, maintaining significant market share.

Pros and Cons of SushiSwap (SUSHI)

The platform’s yield opportunities are a major benefit, while risks include high competition and volatility in reward rates.

User Experience and Adoption

SushiSwap’s user-friendly farming tools and competitive rewards make it popular among active traders.

Future Outlook for SushiSwap (SUSHI)

As DeFi evolves, SushiSwap’s flexibility and community-driven model position it well for future growth.

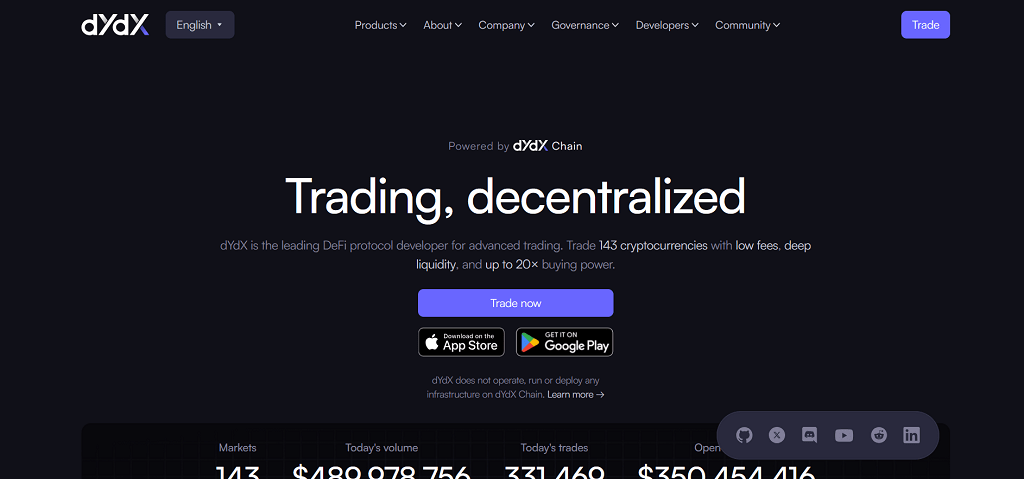

DYDX (DYDX): Layer-2 DEX with Leveraged Trading

Introduction to DYDX (DYDX)

dYdX is a decentralized exchange offering leveraged trading on Ethereum’s Layer 2. DYDX is its governance and utility token.

Key Features of DYDX (DYDX)

The platform supports advanced trading features, including perpetual contracts, and provides DYDX rewards for liquidity and governance.

Market Position and Performance

dYdX’s focus on leveraged trading has garnered a niche user base, with solid growth among experienced traders.

Pros and Cons of DYDX (DYDX)

DYDX offers unique trading tools, though its complexity may limit appeal among beginners.

User Experience and Adoption

The exchange’s advanced trading tools attract experienced traders looking for leverage options.

Future Outlook for DYDX (DYDX)

With increasing demand for decentralized derivatives, DYDX could perform well in the next market uptrend.

Avalanche (AVAX): High-Speed Blockchain for DeFi Apps

Introduction to Avalanche (AVAX)

Avalanche is a high-performance blockchain platform known for low fees and rapid transaction speeds, with AVAX as its native token.

Key Features of Avalanche (AVAX)

Avalanche’s interoperability and scalability support diverse DeFi applications, while AVAX is used for staking and transaction fees.

Market Position and Performance

Avalanche’s technology has made it a favorite among developers and investors, boosting its adoption across DeFi ecosystems.

Pros and Cons of Avalanche (AVAX)

Pros include high scalability and low fees, but the platform faces competition from similar blockchains.

User Experience and Adoption

Users and developers benefit from fast transactions and cost efficiency, driving Avalanche’s popularity.

Future Outlook for Avalanche (AVAX)

As more DeFi projects seek scalable solutions, Avalanche’s growth potential remains strong for the 2025 bull market.

Loopring (LRC): Layer-2 Solution for DEXs

Introduction to Loopring (LRC)

Loopring provides a Layer-2 scaling solution for Ethereum-based DEXs, with LRC powering its protocol.

Key Features of Loopring (LRC)

Loopring’s zkRollups technology enables faster, cheaper transactions on Ethereum, making it ideal for DEXs and traders.

Market Position and Performance

Loopring’s market position as a scaling solution has grown as Ethereum fees remain high, attracting steady adoption.

Pros and Cons of Loopring (LRC)

Its scalability and low fees are significant advantages, though competition in Layer-2 scaling is a consideration.

User Experience and Adoption

Traders benefit from reduced transaction costs and enhanced speed, making Loopring popular for Ethereum users.

Future Outlook for Loopring (LRC)

With the ongoing demand for Ethereum scalability, Loopring’s Layer-2 solution positions LRC for solid growth.

Risks and Rewards of Investing in DeFi Tokens and Tips for Managing Your Investments

Investing in DeFi tokens can be both highly rewarding and risky. The decentralized finance landscape is full of opportunities to earn, but it also requires careful risk management. Below are some of the primary rewards, risks, and strategies to help you navigate DeFi investments effectively.

Rewards of Investing in DeFi Tokens

- Passive Income Opportunities: By staking, lending, or providing liquidity, investors can earn yields that often exceed traditional bank returns.

- Governance Participation: Many DeFi tokens, like those from Aave and Maker, offer governance rights, allowing holders to participate in decision-making for protocol changes and upgrades.

- High Liquidity: DeFi tokens can be traded on decentralized exchanges 24/7, providing flexibility to enter or exit positions quickly.

- Innovation and Growth: As the DeFi sector expands, well-chosen tokens may benefit from increasing adoption, driving both token value and user engagement.

Risks of Investing in DeFi Tokens

- Smart Contract Vulnerabilities: Bugs or weaknesses in smart contract code can expose platforms to hacks, leading to potential losses for users.

- Price Volatility: DeFi tokens are prone to large price swings due to market sentiment and platform-specific events, making them a higher-risk asset class.

- Regulatory Uncertainty: Governments are still determining how to regulate DeFi, which could impact token values or restrict access to certain services in the future.

- Protocol and Project Risk: DeFi projects are relatively new, and some may lack thorough testing or security measures, especially those in their early stages.

Tips for Managing DeFi Investments

- Diversify Your Portfolio: Spread investments across multiple DeFi tokens to minimize exposure to the volatility of any single asset.

- Choose Well-Audited Projects: Focus on platforms that have undergone rigorous security audits and have active, engaged communities for added reliability.

- Use Secure Storage: Consider using a hardware wallet to store DeFi assets safely and reduce the risk of hacks or cyber threats.

- Stay Updated: DeFi is an evolving sector. Following protocol updates, regulatory news, and community feedback can help you make timely decisions and protect your investments.

By balancing these rewards with an understanding of the risks and following best practices, investors can confidently explore DeFi tokens while managing their potential exposure to the sector's volatility.

Conclusion: Preparing for DeFi Growth in 2025

As DeFi continues to reshape the financial landscape, the potential for growth in 2025 is substantial. With innovative projects driving decentralized lending, trading, and earning opportunities, DeFi is poised to attract an even broader user base, both within the crypto world and from traditional finance. The 10 DeFi coins we’ve explored each offer unique advantages—whether in governance, passive income, or scalability—that align with the evolving needs of DeFi investors.

To prepare for DeFi’s growth in 2025, investors can focus on diversifying across high-potential tokens, staying informed about protocol updates, and managing risks effectively. The success of platforms like Aave, Uniswap, and Curve underscores the importance of utility, security, and community engagement in DeFi projects. With careful selection and risk management, investors can capitalize on the benefits of this rapidly expanding sector while positioning themselves for potential long-term gains.

The path ahead for DeFi is one of continuous innovation, and those who approach it with informed strategies will be best equipped to harness the opportunities in the upcoming bull market.

FAQs: DeFi Assets, Tokens and the 2025 Bull Run

What are DeFi assets, and why are they significant?

DeFi tokens power decentralized finance platforms, enabling services like lending, borrowing, and trading without intermediaries. They’re pivotal for decentralized applications that aim to create a transparent and accessible financial ecosystem.

Which are the top DeFi tokens to consider for the 2025 bull run?

Some top choices include Maker, Aave, Uniswap, and Curve, among others. These coins represent various DeFi functionalities, from lending platforms to decentralized exchanges.

How do DeFi assets differ from traditional cryptocurrencies?

Unlike traditional cryptocurrencies primarily used for transactions or value storage, DeFi tokens often have specific uses within decentralized finance platforms, such as governance, staking, or liquidity provision.

What are the potential rewards of investing in DeFi tokens?

DeFi tokens offer multiple benefits, including passive income from staking, governance rights, and access to decentralized financial services. Many investors are attracted to DeFi’s high growth potential and passive income opportunities.

What risks should I be aware of with DeFi investments?

Key risks include smart contract vulnerabilities, high market volatility, and regulatory uncertainty. Additionally, the lack of intermediaries means there’s no protection if a protocol fails.

How can I evaluate the best DeFi assets for my portfolio?

Focus on factors like the coin’s utility, market position, platform security, and community support. Diversifying investments across established and promising new DeFi tokens can also mitigate risk.

What role do governance tokens play in DeFi?

Governance tokens, such as Aave and MKR, allow holders to vote on protocol changes. They empower users to shape the platform’s future and often enhance user engagement and loyalty.

How do DeFi platforms generate income for users?

Many DeFi platforms offer income through staking, yield farming, and liquidity provision. Users earn rewards or fees by locking their assets in the platform’s ecosystem.

Are DeFi tokens a good choice for long-term investment?

DeFi tokens with solid use cases and active communities tend to have stronger long-term potential. However, as with any investment, careful evaluation of each coin’s growth prospects and risks is crucial.

How do Layer-2 solutions like Loopring contribute to DeFi growth?

Layer-2 solutions improve transaction speed and reduce costs, making DeFi platforms more efficient. Loopring’s zkRollups, for example, allow faster trading on Ethereum-based decentralized exchanges.

What makes Uniswap different from other decentralized exchanges?

Uniswap uses an automated market maker (AMM) model, enabling trades without traditional order books. Its focus on user-friendly, decentralized trading has made it one of the most popular DEXs.

Why is stablecoin-focused trading significant in DeFi, like on Curve?

Stablecoin-focused platforms like Curve help minimize volatility during trades, offering a more stable and predictable DeFi experience. This appeals to investors looking for consistency in their transactions.

How are DeFi tokens stored safely?

Many users store DeFi tokens in secure hardware wallets, keeping them offline and protected from online threats. It’s essential to choose wallets compatible with the specific tokens.

What impact could regulation have on DeFi?

Regulatory developments could affect DeFi growth, access, and user protections. However, regulation might also boost trust and attract more mainstream adoption over time.

What should new investors know before entering the DeFi market?

New investors should understand DeFi’s core concepts, evaluate coins carefully, and start with well-established tokens. Diversification, secure storage, and ongoing research are key to managing risks in the evolving DeFi space.

Discussion