Top 10 Best DeFi Tokens for High Returns in 2025 Bull Run

Top 10 best DeFi tokens for high returns in 2025 bull run. Discover the growth potential, security, and opportunities driving DeFi investments.

The Top 10 Best DeFi Tokens for High Returns in the 2025 Bull Run are anticipated to lead the decentralized finance (DeFi) market, offering investors growth potential, security, and lucrative opportunities. As DeFi continues to revolutionize the financial landscape, 2025’s projected bull run brings particular attention to tokens that enable users to maximize returns through staking, liquidity, and yield farming. To compile this guide, we referenced top industry insights from CryptoNews, WunderTrading, and Klink Finance to identify tokens set to drive impressive returns and play a pivotal role in the DeFi ecosystem.

In this article, we’ll explore factors like security, innovation, and the unique strengths of each token to help investors make informed choices. The DeFi coins we’ve selected for high returns in 2025 not only embody decentralized financial advancements but also exhibit the robust characteristics needed to stand out during a bullish market. Whether you’re a seasoned crypto enthusiast or a newcomer exploring DeFi, this guide offers valuable insights into the DeFi projects poised for success in the coming year.

What Are DeFi Tokens?

DeFi tokens are digital assets that power decentralized finance protocols, allowing users to access financial services without relying on traditional banks or intermediaries. Unlike conventional finance systems, DeFi assets enable anyone with internet access to participate in a range of financial activities—from lending and borrowing to trading and staking—all within a transparent, peer-to-peer ecosystem. Typically built on Ethereum or similar blockchain networks, DeFi coins are integral to managing decentralized applications (dApps) and smart contracts that automate financial operations securely and autonomously.

These tokens often serve multiple roles within DeFi ecosystems. For instance, they can be used to vote on protocol changes, earn rewards through staking, or provide liquidity to decentralized exchanges. In recent years, DeFi projects have introduced new functionalities through “DeFi 2.0,” enhancing scalability, security, and user experience. Some tokens, like governance tokens, give holders voting rights on project updates, while others support cross-chain swaps, bridging different blockchain networks to enhance user access.

For many users, DeFi coins represent a direct entry into the world of passive income. For example, someone holding tokens in a liquidity pool might earn transaction fees or staking rewards, allowing them to grow their holdings over time. As a result, DeFi projects are attractive to both retail and institutional investors who seek alternatives to traditional finance.

Staking, Liquidity, and Yield Farming in DeFi

Staking, liquidity provision, and yield farming are essential strategies in the DeFi space, offering users unique ways to earn returns on their assets. Here’s a breakdown of each approach:

- Staking

- Users lock up their tokens to support a blockchain network’s security or functionality.

- In return, they earn rewards based on factors like the amount staked and the duration.

- For instance, Ethereum’s transition to proof-of-stake lets users stake ETH to earn returns while helping to secure the network.

- Liquidity Provision

- Users provide tokens to decentralized exchanges or liquidity pools, enabling smoother token swaps.

- Liquidity providers earn a portion of transaction fees proportional to their pool contribution.

- Platforms like PancakeSwap and Balancer offer attractive rewards for those who supply liquidity, making it a popular choice among DeFi participants.

- Yield Farming

- A step beyond basic liquidity provision, yield farming involves moving assets across various DeFi platforms to maximize returns.

- Farmers can deposit tokens into a liquidity pool on one platform, earn rewards, and then reinvest those rewards on another platform.

- This strategy can amplify returns but requires a keen understanding of risks, including impermanent loss.

For many users, these strategies present a way to generate passive income without traditional financial intermediaries. Beginners often start with staking or liquidity provision to understand the basics, while experienced DeFi users gravitate toward yield farming for higher potential gains.

Factors to Consider When Choosing DeFi Projects

When selecting DeFi projects, it’s essential to look beyond market hype and focus on a few key factors that can impact both risk and return. Here are some crucial considerations to help investors make informed choices:

- Use Case and Utility

- A strong DeFi project should offer clear utility within its platform, such as governance rights, staking rewards, or cross-chain functionality. Tokens with solid use cases, like those powering decentralized exchanges or lending platforms, tend to hold more long-term value.

- Tokenomics

- Token supply, issuance, and distribution can significantly influence a token's price stability and growth potential. For instance, tokens with a capped supply or gradual release often attract more interest, as they offer built-in scarcity and less risk of inflationary pressure.

- Security and Audits

- Security is paramount in DeFi, as the space is prone to hacks and smart contract vulnerabilities. It’s wise to look for projects that have undergone third-party audits and have active bug bounty programs to catch potential issues early. High-profile platforms like Aave and Uniswap have been extensively audited, making them more appealing to security-conscious investors.

- Community and Developer Support

- Strong community support and an active development team are often signs of a healthy DeFi project. Platforms with engaged communities, such as those on social media or governance forums, show a commitment to long-term growth and evolution. A vibrant user base can also boost liquidity and increase the token’s functionality.

- Partnerships and Integrations

- Projects with meaningful partnerships or integrations across other DeFi platforms often have a competitive edge. For example, Chainlink’s integration with multiple blockchains and DeFi applications has positioned it as an essential component in the DeFi ecosystem, boosting its token’s relevance and utility.

- Market Liquidity and Accessibility

- Liquidity is a practical consideration, as tokens with high trading volumes are easier to buy and sell, reducing price volatility. Look for tokens listed on major decentralized and centralized exchanges, as this ensures more robust market participation and better price stability.

These factors provide a well-rounded approach for evaluating DeFi assets, helping both newcomers and seasoned investors identify projects that are aligned with their goals and risk tolerance.

Security, Innovation, and Risks in DeFi Investments

Investing in DeFi projects opens the door to unique financial opportunities, but it also comes with specific security considerations and risks. Understanding how security and innovation intersect in DeFi can help investors make safer, smarter decisions.

- Security Measures and Audits

- Security is a top priority in DeFi, where smart contracts, often handling millions of dollars, are vulnerable to bugs or hacking. Reliable DeFi platforms conduct regular, third-party audits and implement bug bounty programs. Projects like Aave and Chainlink, known for their rigorous audits, have established trust by safeguarding their ecosystems against attacks.

- Decentralized Innovation

- DeFi is transforming traditional finance by creating a decentralized, open-access financial system. Through innovations like cross-chain functionality and liquid staking, projects are constantly evolving to offer greater usability and efficiency. For example, Lido DAO offers liquid staking, making staking rewards accessible without locking up assets. This type of innovation makes DeFi more flexible and user-friendly.

- Risks of Smart Contracts and Market Volatility

- Despite innovation, DeFi remains a high-risk sector. Smart contracts, while powerful, can malfunction or be exploited if not well-designed. Additionally, DeFi assets are subject to market volatility, and liquidity can fluctuate significantly. Yield farming, for instance, is highly profitable but also involves risks like impermanent loss, which can reduce a user’s returns if token prices shift unpredictably.

- Regulatory Risks

- As DeFi grows, regulatory scrutiny is increasing, which can impact token prices and project operations. Some governments are exploring regulations for DeFi platforms, which may affect the sector’s flexibility and accessibility in the future.

- User Experiences with Security and Risk Management

- Many users report the importance of starting small, staking, or providing liquidity to test DeFi platforms before committing significant funds. This approach helps investors understand a project’s security, rewards, and potential risks firsthand. Engaging with DeFi communities, reading project updates, and staying informed on security practices are critical steps for those investing in this dynamic space.

By assessing both the innovations and potential risks, DeFi investors can make balanced choices that align with their financial goals while staying prepared for the evolving landscape of decentralized finance.

Top 10 Best DeFi Tokens for High Returns in 2025

The following list highlights the Top 10 Best DeFi Tokens for High Returns in 2025, each offering unique opportunities for growth, staking, or liquidity within the DeFi space. These tokens have been selected based on their innovative use cases, reliable security features, and potential for high returns in the coming year’s bull market. Whether you’re looking for a token with robust staking options, cross-chain capabilities, or governance potential, these tokens stand out for their contributions to the DeFi ecosystem.

| Token | Purpose | Key Features | Tokenomics | Ideal For |

|---|---|---|---|---|

| Lido DAO (LDO) | Liquid staking for Ethereum | Provides liquidity while staking, trusted validators | Fixed supply; governance rights | Long-term investors and ETH stakers |

| Chainlink (LINK) | Decentralized oracle network | Reliable data feeds across DeFi, high security | Limited supply; payment for oracle services | Infrastructure-focused investors |

| PancakeSwap (CAKE) | Decentralized exchange on Binance Smart Chain | Low-fee trading, yield farming, and staking | Inflationary; regular token burns | Yield seekers and Binance Smart Chain users |

| Rocket Pool (RPL) | Decentralized Ethereum staking | Lower ETH staking entry, decentralized nodes | Capped supply; collateral for node operators | Small-scale Ethereum stakers |

| ThorChain (RUNE) | Cross-chain liquidity protocol | Cross-chain asset swaps without wrapping | Limited supply; incentives for liquidity providers | Multi-chain DeFi users |

| Balancer (BAL) | Automated market maker with multi-token pools | Customizable pools, up to 8 tokens per pool | Capped supply; governance rewards | Experienced liquidity providers |

| The Graph (GRT) | Decentralized data indexing | Efficient data querying, critical for dApps | Capped supply; payment for data queries | Long-term Web3 and DeFi investors |

| OlympusDAO (OHM) | Decentralized reserve currency | Staking and bonding mechanisms for stability | Dynamic supply; governed by protocol | Innovative economy investors |

| Convex Finance (CVX) | Yield optimizer for Curve stakers | Boosts Curve rewards without direct staking | Fixed supply; yield enhancement for Curve | Curve liquidity providers |

| Tokemak (TOKE) | Decentralized liquidity provider | Liquidity direction and incentives | Capped supply; directed liquidity model | DeFi users focused on sustainable liquidity |

Lido DAO (LDO)

Overview and Purpose

Lido DAO is a prominent liquid staking solution for Ethereum and other assets, allowing users to earn staking rewards without locking their tokens. This flexibility supports the Ethereum 2.0 staking network while giving users immediate liquidity, as staked tokens are represented by “stETH.”

Key Features and Innovations

Lido enables liquid staking, a game-changer in the staking landscape, as users can earn staking rewards and use stETH tokens across other DeFi protocols. Security is a priority for Lido, as it partners with reputable validators to ensure network stability.

Tokenomics

With a fixed token supply, LDO is used for governance, allowing holders to vote on protocol upgrades, validator management, and fee structures.

Platform and User Experience

Users appreciate Lido’s straightforward interface, which makes staking accessible to those who may be new to DeFi. Many stakers also use Lido’s tokens in yield farming, adding to their earning potential.

Risks and Considerations

As a staking platform, Lido is affected by Ethereum network risks and potential smart contract vulnerabilities.

Conclusion

Lido is well-suited for users seeking both liquidity and staking rewards, appealing to long-term investors who want to support Ethereum’s growth.

Chainlink (LINK)

Overview and Purpose

Chainlink is essential in the DeFi space as a decentralized oracle network, allowing smart contracts to interact with off-chain data. LINK powers these oracle services, providing data accuracy and reliability across DeFi applications.

Key Features and Innovations

Chainlink’s network of decentralized oracles enhances DeFi security by enabling verified data to be integrated into smart contracts. This unique role makes LINK indispensable across various protocols.

Tokenomics

LINK has a limited supply and is used to pay oracle service providers, incentivizing data accuracy. Its usage in numerous DeFi projects strengthens its value proposition.

Platform and User Experience

Chainlink’s data integrations are highly respected within DeFi, with numerous projects relying on its oracles. Users trust the network’s data reliability, particularly for price feeds.

Risks and Considerations

The primary risk is dependency: as many DeFi projects rely on Chainlink, any disruption could impact multiple protocols.

Conclusion

Chainlink is ideal for those looking to invest in essential infrastructure that underpins the DeFi ecosystem, offering stable, long-term utility.

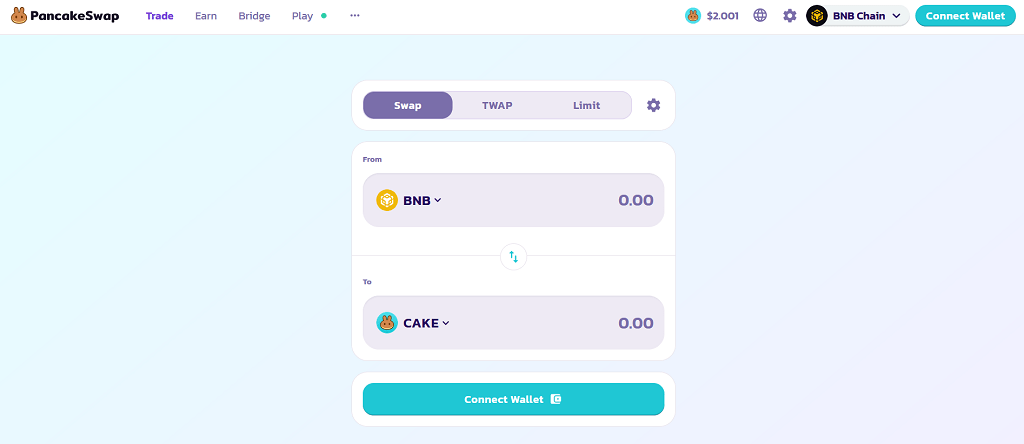

PancakeSwap (CAKE)

Overview and Purpose

PancakeSwap is a leading decentralized exchange on Binance Smart Chain, known for low-fee transactions and high-speed trading. CAKE is the platform’s native token and can be used for staking, liquidity mining, and voting on governance proposals.

Key Features and Innovations

PancakeSwap’s unique feature is its fast, cost-effective transactions compared to Ethereum-based exchanges. The platform supports a wide array of DeFi features, including yield farming and lotteries.

Tokenomics

CAKE has an inflationary supply, encouraging token burning to control the circulating amount. Users earn CAKE through staking and liquidity mining, making it highly appealing for yield seekers.

Platform and User Experience

PancakeSwap is user-friendly, especially for those new to DeFi. It provides an accessible entry point for Binance Smart Chain users, with CAKE holders able to participate in governance decisions.

Risks and Considerations

The primary risk is competition, as PancakeSwap faces challenges from newer exchanges on other blockchains.

Conclusion

CAKE appeals to investors interested in a broad DeFi experience on Binance Smart Chain with ample opportunities for passive income.

Rocket Pool (RPL)

Overview and Purpose

Rocket Pool is a decentralized Ethereum staking protocol, designed for users who want to stake ETH with minimal capital. RPL is used for node operator incentives and governance.

Key Features and Innovations

Rocket Pool stands out with its lower entry requirements for staking, enabling small-scale investors to participate in Ethereum staking. Its decentralization makes it resilient and aligns with Ethereum’s ethos.

Tokenomics

RPL has a capped supply and is used as collateral by node operators. This model supports network stability while providing staking rewards for users.

Platform and User Experience

Rocket Pool’s interface is accessible, and its pooled staking lowers barriers for users who can’t meet Ethereum’s full staking requirement. It’s popular among smaller investors seeking staking rewards without full ETH holdings.

Risks and Considerations

As a staking-focused platform, Rocket Pool’s risks are tied to Ethereum’s performance and market fluctuations in staked ETH.

Conclusion

Rocket Pool is ideal for investors seeking a decentralized, lower-cost staking option for Ethereum.

ThorChain (RUNE)

Overview and Purpose

ThorChain is a cross-chain liquidity protocol, allowing users to swap assets across different blockchains seamlessly. RUNE is the native token that facilitates these swaps and ensures liquidity.

Key Features and Innovations

ThorChain’s cross-chain functionality is unique, as it enables decentralized swaps without relying on wrapped tokens or custodians. This makes it highly versatile and valuable in multi-chain DeFi.

Tokenomics

RUNE has a limited supply, with part of its tokenomics designed to incentivize liquidity providers and validators.

Platform and User Experience

ThorChain offers a straightforward swapping experience, often praised for its efficiency in managing multi-chain liquidity. Users find value in RUNE’s ability to facilitate cross-chain interactions.

Risks and Considerations

Cross-chain operations introduce complexity, and security risks are higher, especially with recent hacks in cross-chain protocols.

Conclusion

ThorChain is appealing to investors interested in multi-chain DeFi solutions and in providing liquidity across networks.

Balancer (BAL)

Overview and Purpose

Balancer is a decentralized automated market maker that allows users to create multi-token liquidity pools. BAL is the governance token and incentivizes liquidity providers.

Key Features and Innovations

Balancer is unique with its customizable pools, supporting up to eight tokens in a single pool. This flexibility allows users to balance their portfolios within one protocol.

Tokenomics

BAL has a capped supply, distributed as rewards to liquidity providers and used for governance purposes.

Platform and User Experience

Users appreciate Balancer’s flexibility and customization in liquidity pools, allowing for varied investment strategies. It’s particularly popular among advanced DeFi users.

Risks and Considerations

The complexity of Balancer’s pools can introduce higher fees and impermanent loss risks, particularly for new users.

Conclusion

Balancer is suitable for experienced investors interested in flexible, multi-asset liquidity pools.

The Graph (GRT)

Overview and Purpose

The Graph is a decentralized indexing protocol, simplifying data access for DeFi and Web3 applications. GRT is used to pay for data queries, facilitating smooth interactions between dApps and blockchains.

Key Features and Innovations

The Graph’s indexing technology enables efficient data retrieval, which is crucial for dApps needing quick access to blockchain data. This infrastructure supports the DeFi ecosystem widely.

Tokenomics

GRT has a capped supply and is used as a payment for querying data, incentivizing indexers and developers.

Platform and User Experience

The Graph is widely respected for its reliability in data indexing, making it a core part of many DeFi protocols. Developers rely on it to build efficient applications.

Risks and Considerations

The Graph’s main risks relate to dependency on indexers and overall Web3 adoption rates.

Conclusion

GRT is well-suited for long-term investors who believe in the expansion of DeFi and Web3.

OlympusDAO (OHM)

Overview and Purpose

OlympusDAO offers a decentralized reserve currency backed by a treasury of assets, aiming to create a stable value token. OHM is used for governance and staking within the protocol.

Key Features and Innovations

OlympusDAO is innovative with its unique reserve currency model, aiming to reduce dependency on traditional stablecoins.

Tokenomics

OHM has a dynamic supply model based on bonding and staking, designed to encourage stability rather than volatility.

Platform and User Experience

OlympusDAO provides staking opportunities, with OHM holders earning rewards as part of the protocol’s growth strategy.

Risks and Considerations

OHM’s model is experimental, with some users concerned about sustainability during high market volatility.

Conclusion

OlympusDAO is ideal for investors intrigued by new economic models within DeFi.

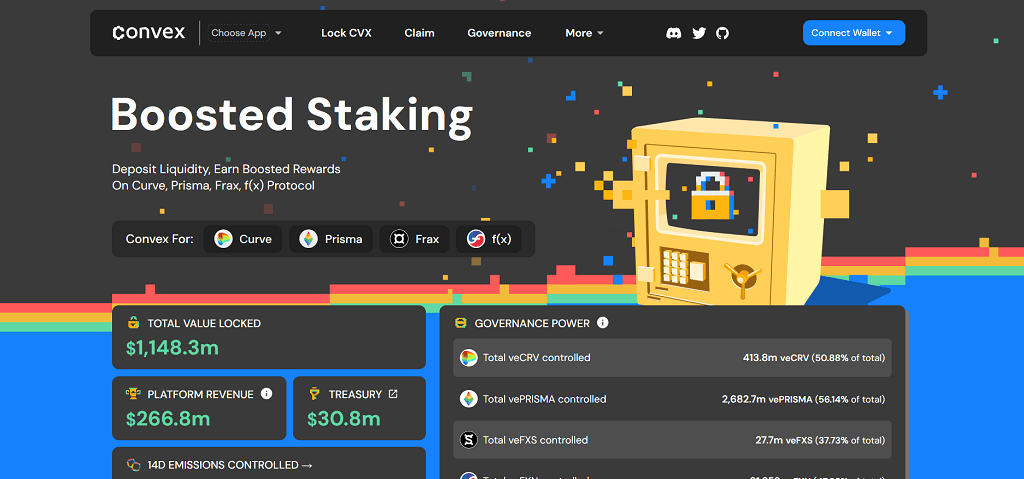

Convex Finance (CVX)

Overview and Purpose

Convex Finance optimizes yield for Curve Finance stakers and liquidity providers, allowing users to earn enhanced rewards on Curve. CVX incentivizes holders and supports Curve’s liquidity infrastructure.

Key Features and Innovations

Convex aggregates rewards and boosts yield without users needing to lock up CRV tokens themselves, making it highly popular among liquidity providers.

Tokenomics

CVX has a capped supply and is used to enhance yield for Curve stakers and liquidity providers.

Platform and User Experience

Users benefit from Convex’s ease of use, maximizing rewards on Curve without direct involvement in staking.

Risks and Considerations

The success of CVX depends heavily on Curve’s performance, posing dependency risks.

Conclusion

CVX is attractive to liquidity providers on Curve seeking maximized rewards with minimal effort.

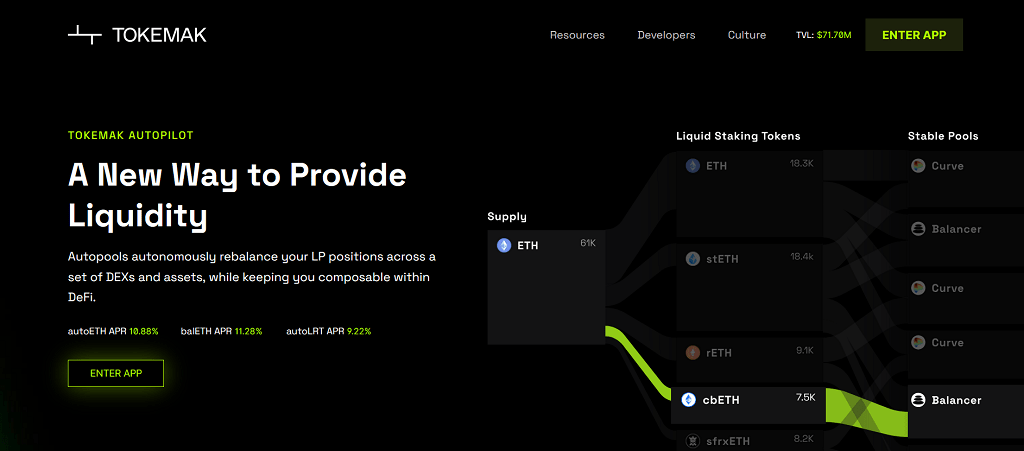

Tokemak (TOKE)

Overview and Purpose

Tokemak is a decentralized liquidity protocol focused on optimizing and decentralizing liquidity provision across DeFi. TOKE is used to govern the network and incentivize liquidity providers.

Key Features and Innovations

Tokemak introduces a sustainable model for liquidity by allowing users to direct liquidity to desired pools, enhancing efficiency and stability in DeFi.

Tokenomics

TOKE has a limited supply, with its value tied to its ability to provide directed liquidity in DeFi.

Platform and User Experience

Tokemak is user-friendly for those managing liquidity across multiple DeFi protocols, and it’s well-regarded by liquidity providers for its strategic model.

Risks and Considerations

The platform’s success hinges on consistent demand for liquidity across DeFi, making it sensitive to market conditions.

Conclusion

TOKE is suitable for DeFi users seeking to influence and benefit from sustainable liquidity strategies.

Conclusion: Unlocking High Returns with Top DeFi Tokens in 2025

The potential for high returns in the 2025 bull run makes DeFi tokens an exciting opportunity for both new and seasoned investors. With their diverse use cases—from staking and liquidity provision to cross-chain capabilities—these tokens embody the innovation and flexibility driving DeFi’s rapid growth. By focusing on security, utility, and user experience, tokens like Lido DAO, Chainlink, and PancakeSwap continue to redefine what’s possible in decentralized finance.

Investors who evaluate DeFi coins carefully, considering factors like tokenomics, community support, and long-term usability, are well-positioned to make the most of this dynamic market. While DeFi carries risks, the growth of security measures and sustainable reward models provides a stronger foundation for future gains. As 2025 approaches, these top DeFi projects offer promising avenues for those looking to maximize returns while actively participating in the evolving landscape of finance.

FAQs about DeFi Projects, Coins, Tokens and Investments

What are DeFi cryptos, and how do they differ from traditional cryptocurrencies?

DeFi cryptos are digital assets specifically designed to power decentralized finance platforms, enabling various financial activities such as lending, borrowing, and staking without a central authority. Unlike traditional cryptocurrencies like Bitcoin, which primarily serve as stores of value or means of exchange, DeFi coins provide specific functionalities within DeFi protocols, including governance, liquidity provision, and yield farming.

How can I earn income through DeFi projects?

There are several ways to earn income with DeFi projects, including staking, liquidity provision, and yield farming. By staking tokens, users can lock their assets to support network security or participate in governance, earning rewards in return. Liquidity provision involves depositing tokens into decentralized exchanges or pools, allowing users to earn transaction fees. Yield farming takes this a step further by moving assets across platforms to find the best returns, though it requires more active management.

Are DeFi investments safe?

DeFi investments carry risks, particularly related to smart contract vulnerabilities, market volatility, and, increasingly, regulatory changes. While many DeFi platforms undergo third-party audits to enhance security, it’s essential to research and consider the risks of each project. Some users recommend starting small or experimenting with well-established platforms to get a feel for the ecosystem before investing more significantly.

What is “impermanent loss,” and how does it affect liquidity providers?

Impermanent loss occurs when the price of tokens in a liquidity pool changes relative to when they were deposited. This price shift can result in a lower dollar value upon withdrawal, affecting liquidity providers’ returns. Although transaction fees and incentives can offset impermanent loss, it’s a risk factor to consider when adding tokens to liquidity pools, especially in volatile markets.

How do I choose the best DeFi protocols for investment?

Selecting the right DeFi protocol depends on various factors, such as the project’s use case, tokenomics, security measures, and community support. Researching each token’s role within its protocol—such as staking, governance, or liquidity provision—helps align investments with your goals. Look for projects with meaningful partnerships, sustainable incentives, and active developer communities to increase the chances of long-term success.

What is “DeFi 2.0,” and how is it different from traditional DeFi?

DeFi 2.0 refers to a newer generation of DeFi projects aimed at addressing some limitations of early DeFi platforms, such as scalability, security, and sustainability of incentives. These advancements, including innovations like liquid staking and more efficient cross-chain functionality, have improved the user experience, making DeFi more accessible and robust.

Can beginners get involved in DeFi, or is it only for advanced users?

While DeFi may seem complex, there are many beginner-friendly platforms that simplify staking, yield farming, and other DeFi activities. Many users suggest starting with staking or basic liquidity provision on reputable platforms to learn the basics. By engaging with the community and using educational resources, beginners can gradually build confidence and expertise in the DeFi space.

How do governance tokens work in DeFi?

Governance tokens give holders voting rights on important decisions within a DeFi protocol, allowing them to influence updates, fee structures, and development roadmaps. For example, holders of governance tokens like Compound (COMP) or Uniswap (UNI) can propose and vote on protocol changes, making governance tokens central to decentralized decision-making.

What is “cross-chain functionality” in DeFi?

Cross-chain functionality enables assets and data to move seamlessly between different blockchain networks. DeFi projects like ThorChain (RUNE) and Polkadot support cross-chain transactions, enhancing interoperability and allowing users to transfer tokens across multiple blockchains. This functionality is particularly beneficial as it widens accessibility and liquidity across platforms.

How do DeFi projects rewards differ across platforms?

Rewards can vary based on the platform’s model, tokenomics, and staking or liquidity requirements. For instance, some platforms may offer high staking rewards but require long lock-up periods, while others focus on providing immediate liquidity with smaller returns. It’s helpful to compare potential rewards alongside factors like token volatility and platform stability.

What is “bonding” in DeFi, and how does it work?

Bonding is a mechanism used by some DeFi protocols (e.g., OlympusDAO) where users can buy tokens at a discount by providing liquidity assets in return. The protocol benefits from an increase in assets in its treasury, while users receive discounted tokens that can be staked or held. Bonding supports token stability by diversifying treasury holdings and reducing dependency on external liquidity.

What role does community support play in the success of DeFi project?

A strong, engaged community often indicates a healthy project and contributes to its resilience. Active communities promote organic growth, provide feedback, and support protocol updates. This community involvement also enhances liquidity, as more users stake, trade, or provide liquidity for the token, contributing to its stability and growth.

Can DeFi coins be used outside DeFi ecosystems?

Some DeFi coins, particularly those with broad utility like Chainlink (LINK) or The Graph (GRT), are increasingly being integrated beyond DeFi ecosystems, in Web3 applications and other blockchain networks. This growing interoperability makes certain tokens versatile and adds value beyond their immediate platform use.

Are there tax implications for earning rewards on DeFi protocols?

Yes, earning rewards through staking, yield farming, or liquidity provision may have tax implications depending on local laws. In many countries, rewards are considered income and may be taxed upon receipt. It's important to stay informed about local regulations and keep records of transactions to report earnings accurately.

How can I monitor the performance of my DeFi coin investments?

There are numerous portfolio tracking tools, such as Zapper, Zerion, and DeBank, which allow users to monitor DeFi assets, track yields, and assess portfolio health. Additionally, on-chain analytics sites like DeFi Pulse and DappRadar can provide insights into protocol performance and market trends, helping users make more informed decisions.

Discussion