10 Best Free AI Crypto Trading Bots to Try in 2024

10 best free AI crypto trading bots in 2024, leveraging artificial intelligence to automate trades, optimize strategies & maximize profits 24/7.

The 10 best free AI crypto trading bots in 2024 offer traders powerful tools to automate trades, optimize strategies, and maximize profits 24/7. With the rise of artificial intelligence in crypto trading, these bots have become essential for managing portfolios and executing data-driven trades automatically. This article features the top AI trading bots available for free, curated using insights from reputable sources like CoinGape, Coin Bureau, EvaCodes, and Unite.AI.

Whether you’re new to trading or a seasoned investor, these AI-powered crypto trading bots provide advanced features to make trading more efficient and profitable across popular exchanges. Dive in to explore the best free options to consider in 2024, and learn how AI can transform your approach to cryptocurrency trading with smarter, round-the-clock solutions.

What Are AI Crypto Trading Bots?

AI crypto automated trading tools are automated software programs designed to manage cryptocurrency trades on behalf of users. Using artificial intelligence, these bots analyze market data, predict price movements, and execute trades based on pre-set strategies, all without human intervention. This enables traders to benefit from timely, data-driven decisions, even in volatile markets.

These bots operate by connecting to exchanges through APIs, where they continuously monitor trends, identify profitable opportunities, and execute trades according to user-defined criteria or AI-driven insights. For example, many bots are programmed with strategies like grid trading, arbitrage, or dollar-cost averaging to respond to market fluctuations and capitalize on price differences.

One major advantage is the 24/7 nature of AI trading bots, which means they never miss a potential opportunity—especially valuable in the crypto market, which operates around the clock. Additionally, AI bots remove emotion from trading decisions, helping traders stick to a disciplined approach.

For example, an experienced user might set up a bot to follow a dollar-cost averaging strategy, where it automatically buys assets at regular intervals, lowering the average cost of entry over time. This level of automation and precision allows both beginners and seasoned traders to streamline their trading processes, reducing the need for constant monitoring and enabling more effective risk management.

How Artificial Intelligence Enhances Crypto Trading

Artificial intelligence (AI) revolutionizes crypto trading by adding speed, precision, and predictive power. Here’s how AI takes crypto trading to the next level:

- Real-Time Data Analysis: AI continuously scans vast market data, identifying patterns and trends instantly, which helps traders spot profitable opportunities.

- Predictive Insights: Using historical and real-time data, AI can forecast potential price movements, giving traders a critical edge in the fast-paced crypto market.

- Emotion-Free Decisions: AI bots follow pre-set rules, avoiding emotional reactions like panic selling, which often leads to better long-term results.

- 24/7 Market Monitoring: With around-the-clock functionality, AI bots capture trading opportunities anytime, making crypto trading more accessible and efficient.

Key Features of the Best AI Cryptocurrency Trading Bots

The best AI crypto automated trading tools come equipped with essential features that help traders streamline their strategies and maximize profits. Here’s a look at the standout functionalities that set these bots apart:

- Automated Trading Strategies: Top bots support a variety of trading strategies like grid trading, dollar-cost averaging (DCA), and arbitrage, allowing traders to automate complex strategies tailored to market conditions.

- Backtesting Capabilities: Backtesting enables users to test strategies using historical data before committing real funds. This feature helps traders refine their approach, minimizing risks and improving overall strategy performance.

- Customizable Parameters: Advanced bots offer flexibility, letting traders adjust parameters such as risk tolerance, trading frequency, and profit targets. Customization is crucial for tailoring the bot to specific goals and market behaviors.

- Real-Time Market Analysis: With AI-driven analytics, these bots scan markets in real-time, identifying potential trades within seconds. This instant analysis can provide an advantage, especially in a volatile market.

- Security Features: Security is critical in crypto trading. Leading bots integrate multi-layer protection like API key encryption and two-factor authentication (2FA) to safeguard user funds and data.

For example, a user seeking hands-free portfolio management might set their bot to buy assets at regular intervals via dollar-cost averaging, allowing them to gradually build holdings without constantly monitoring the market. This combination of automation, customization, and security makes AI cryptocurrency trading bots a valuable tool for both novice and experienced traders.

Security, Challenges, and Risks of AI Crypto Trading Bots

While AI cryptocurrency trading bots offer powerful tools for automated trading, they also come with certain risks and challenges that traders should be aware of. Here are the main points to consider:

- Security Concerns: Since these bots connect to crypto exchanges through APIs, security is critical. The best bots use multi-layer security features like API key encryption, two-factor authentication (2FA), and secure data protocols to protect user assets. However, using any bot requires caution, as poor security practices or compromised APIs can expose accounts to potential hacking risks.

- Market Volatility: The crypto market is notoriously volatile, and while AI bots can analyze trends and react quickly, they aren’t immune to sudden, extreme price swings. In highly volatile markets, even the best AI algorithms can sometimes make miscalculations, leading to unexpected losses.

- Over-Reliance on Automation: Relying too heavily on bots without oversight can be risky. AI bots follow set rules and algorithms, but they can’t adapt to unique, real-world events like regulatory changes or major economic news. Traders who “set and forget” their bots may miss crucial signals that require manual intervention.

- Technical Issues and Downtime: Even reliable bots can face technical issues, such as server downtime or connectivity errors. Such interruptions can halt trading and potentially miss out on critical opportunities or, worse, leave trades open in a volatile market.

For instance, a user who relied entirely on an AI bot without monitoring it encountered losses when a technical glitch prevented the bot from executing trades as planned. This case underscores the importance of regular monitoring and setting up alerts, ensuring that the bot performs as expected even in fast-moving markets.

10 Best Free AI Crypto Trading Bots in 2024

Here are some of the best free AI crypto automated trading tools to consider in 2024, offering robust features, automation, and ease of use for traders of all experience levels.

| Trading Bot | Key Features | Pros | Cons | Best For | Free/Pricing Options |

|---|---|---|---|---|---|

| CryptoHero | Automated long and short trading, backtesting, compatibility with Binance and Kraken | Easy to use, accessible on mobile and desktop | Limited customization, fewer exchanges | Beginners looking for simple automation | Free plan; premium from $19/month |

| Shrimpy | Portfolio rebalancing, social trading, analytics | Great for passive management, supports multiple exchanges | Limited to rebalancing, lacks trade customization | Long-term investors | Free plan; premium from $15/month |

| AlgosOne | Real-time machine learning, customizable risk management | Highly customizable, AI-driven analysis | Limited exchange integrations, complex for beginners | Advanced users needing AI insights | Free basic tools; charges for premium |

| Intellectia | Aggregates news, social media, and market data | Comprehensive market insights, easy to navigate | No direct trading; focused on analysis | Traders needing data for decision-making | Free basic features; premium for advanced insights |

| Gunbot | Supports multiple strategies like Bollinger Bands, integrates with Binance, Bitfinex, and Bittrex | Extensive customization options, wide strategy selection | Complex setup for beginners, higher initial cost | Experienced traders seeking custom strategies | One-time purchase; starting at $99 |

| Cornix | Telegram-based interface, DCA and trailing stop strategies | Mobile-friendly, easy Telegram integration | Limited advanced features, fewer customization options | Mobile-focused traders, casual users | Subscription-based; starting at $19/month |

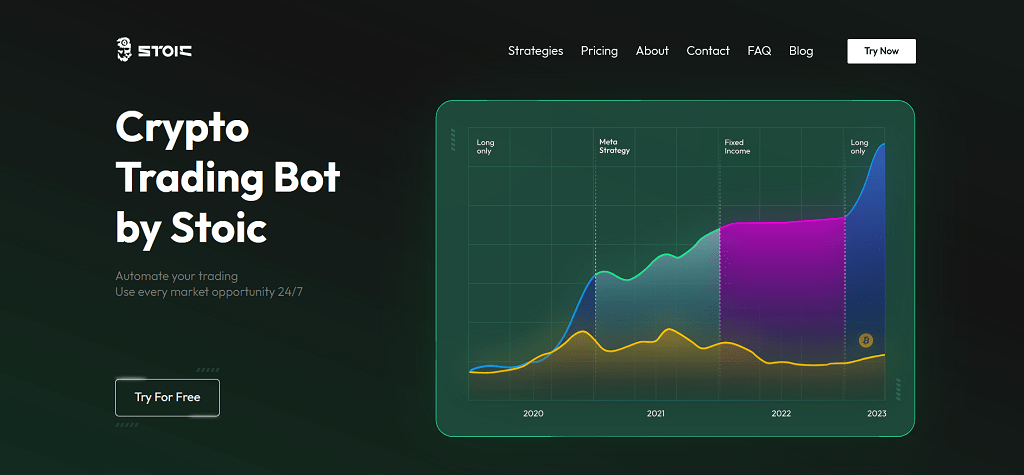

| Stoic by Cindicator | Automated hedge fund strategies, direct Binance integration | Proven strategies, minimal management required | Limited to Binance, minimal customization | Long-term Binance users | Free basic; premium options available |

| Mudrex | Drag-and-drop strategy builder, backtesting, strategy marketplace | Customizable without coding, strong community | Limited exchanges, charges for advanced tools | Users wanting to build or buy strategies | Free plan; premium from $16/month |

| Kryll | AI-driven portfolio and market analysis, layer-2 blockchain integration | Web3-friendly, strong for tracking blockchain assets | Complex for beginners, limited exchange options | Advanced Web3 and DeFi traders | Free basic features; premium available |

| Zignaly | Copy trading with expert traders, profit-sharing model | Easy for beginners, access to expert strategies | Relies on trader success, limited customization | Beginners seeking expert guidance | Profit-sharing with no fees until profits |

CryptoHero

CryptoHero is a beginner-friendly AI trading bot known for its simplicity and accessibility, making it an excellent choice for those new to automated crypto trading. It’s designed to help users automate trades across major exchanges without needing programming skills.

Key Features

- Offers automated long and short trading strategies.

- Backtesting capabilities allow users to test strategies with historical data.

- Compatible with top exchanges, including Binance and Kraken.

Pros and Cons

- Pros: Simple setup, great for beginners, accessible on mobile and desktop.

- Cons: Limited customization for advanced trading; fewer integrated exchanges.

User Experience and Suitability CryptoHero is ideal for those looking to manage trades passively. Its intuitive interface and pre-configured strategies make it particularly suited for entry-level traders.

Pricing Information CryptoHero offers a free plan with essential features, while premium options start at $19/month, adding more advanced tools.

Final Verdict CryptoHero’s ease of use and free access to basic features make it an appealing choice for beginners seeking automated trading without a steep learning curve.

Shrimpy

Shrimpy focuses on portfolio management, allowing users to automate portfolio rebalancing and copy top traders’ strategies. It’s ideal for long-term investors who want to balance their crypto assets efficiently.

Key Features

- Automated portfolio rebalancing with customizable time intervals.

- Social trading and copy-trading features to follow experienced traders.

- Detailed performance tracking and analytics.

Pros and Cons

- Pros: Effective for passive management, supports multiple exchanges, strong community features.

- Cons: Limited to portfolio rebalancing; lacks in-depth trade customization.

User Experience and Suitability Shrimpy’s intuitive interface is ideal for users who prefer set-it-and-forget-it strategies, particularly for long-term holding and asset balancing.

Pricing Information The free plan includes basic rebalancing features, with premium plans starting at $15/month for advanced analytics and increased rebalancing frequency.

Final Verdict Shrimpy is best suited for passive investors who want a hands-off approach to portfolio rebalancing and benefit from a social trading community.

AlgosOne

AlgosOne stands out with machine-learning algorithms designed to optimize trade execution based on real-time market data. It’s tailored for users interested in dynamic AI-driven strategies.

Key Features

- Real-time data analysis using machine learning for optimized trading.

- Customizable risk management settings.

- Supports multiple strategies, including trend-following and arbitrage.

Pros and Cons

- Pros: High level of customization; AI-driven analytics; versatile strategies.

- Cons: Limited exchange integrations; potentially complex for beginners.

User Experience and Suitability AlgosOne’s dynamic features suit experienced traders looking for sophisticated AI-powered insights. It’s highly customizable, making it attractive for advanced users with specific strategy needs.

Pricing Information AlgosOne is free to use with core features, but charges apply for access to premium tools and dedicated support.

Final Verdict For traders who want to leverage machine learning to refine their strategies, AlgosOne is a strong contender, though it may be too advanced for beginners.

Intellectia

Intellectia provides AI-driven market insights, analyzing trends and major events in real time. It is perfect for traders who want to make informed decisions based on data from multiple sources, including social media and news.

Key Features

- Aggregates data from news, social media, and financial sources.

- Real-time alerts on significant market changes.

- Supports analysis across 100+ cryptocurrencies.

Pros and Cons

- Pros: Comprehensive insights; easy-to-use dashboard; ideal for research-focused traders.

- Cons: Does not execute trades directly; designed more for analysis than full automation.

User Experience and Suitability Intellectia is best for traders who value detailed market analysis to guide their manual trading decisions. It’s particularly suited for those who want to stay updated on major crypto events.

Pricing Information Intellectia offers free basic features, with premium subscriptions for advanced analytics and deeper insights.

Final Verdict While not a traditional trading bot, Intellectia is a valuable tool for traders seeking in-depth, AI-powered crypto analysis and market insights.

Gunbot

Gunbot is a highly customizable crypto automated trading tool known for offering a wide range of strategies and advanced settings, making it suitable for both novice and experienced traders. It allows users to configure multiple strategies and tailor them to different market conditions, providing flexibility for those who prefer a hands-on approach to trading automation.

Key Features

- Supports a variety of strategies, including Bollinger Bands, step gain, and trailing stop, allowing traders to adapt to changing market conditions.

- Integrates with numerous popular exchanges, such as Binance, Bitfinex, Bittrex, and Coinbase Pro.

- Offers advanced risk management options, including stop-loss and take-profit settings.

- Allows for detailed strategy customization, enabling traders to modify parameters to suit specific goals.

Pros and Cons

- Pros: Extensive customization options; wide selection of trading strategies; integrates with multiple exchanges.

- Cons: Complex setup for beginners; requires technical knowledge for advanced configurations; higher initial cost.

User Experience and Suitability Gunbot is ideal for traders who want full control over their trading strategies. While it offers pre-configured strategies, users with technical experience will benefit most from its customizability and flexibility. It may take some time to learn, but Gunbot provides comprehensive resources and a supportive community for assistance.

Pricing Information Gunbot operates on a one-time purchase model, with the Starter license starting at $99. More advanced licenses with additional features and exchange support are available at higher price points.

Final Verdict Gunbot is an excellent choice for experienced traders who want a highly customizable trading bot with a one-time payment option. It offers a wealth of strategies and customization but may be too complex for absolute beginners.

Cornix

Cornix is a unique crypto automated trading tool focused on mobile accessibility, allowing users to automate trades directly from Telegram. With its Telegram-based interface, Cornix makes it easy for traders to manage their accounts on the go, providing real-time notifications and trade management options right within the app.

Key Features

- Integrated with Telegram for seamless, mobile-friendly trading.

- Supports multiple strategies, including dollar-cost averaging (DCA) and trailing stop-loss, which are ideal for both beginners and intermediate traders.

- Offers real-time trade notifications and the ability to adjust trades directly in Telegram, allowing users to stay connected to their strategies without needing a dedicated trading platform.

- Compatible with various major exchanges, including Binance, Kraken, and Huobi.

Pros and Cons

- Pros: Mobile-focused with easy Telegram integration; convenient for traders who prefer managing trades on mobile; simple setup and notifications.

- Cons: Limited advanced features compared to desktop bots; fewer customization options; may be less suitable for highly technical strategies.

User Experience and Suitability Cornix is designed for traders who prefer to manage their trades on the go. Its Telegram-based interface makes it incredibly accessible, especially for users who want a convenient, mobile-first trading experience. Cornix is suitable for those who prioritize simplicity and mobility, making it a great choice for casual traders or those new to automation.

Pricing Information Cornix uses a subscription-based pricing model, with plans starting at around $19 per month. More advanced plans with increased customization and strategy options are available at higher monthly fees.

Final Verdict Cornix offers a unique, mobile-friendly solution for crypto trading automation, especially suitable for traders who rely on Telegram for managing their trades. Its simplicity and accessibility make it ideal for mobile-focused traders, though it may lack the depth of features found in more robust, desktop-based bots.

Stoic by Cindicator

Stoic combines hedge fund strategies with AI, offering a fully automated solution for Binance users. It’s aimed at long-term investors looking for automated portfolio management.

Key Features

- Connects directly with Binance for automated trading.

- AI-driven hedge fund strategies with continuous optimization.

- Simple setup and minimal management required.

Pros and Cons

- Pros: Proven hedge fund strategies; no active management needed.

- Cons: Limited to Binance; minimal customization.

User Experience and Suitability Stoic is ideal for Binance users who want an AI-backed, set-it-and-forget-it experience that follows reliable hedge fund strategies.

Pricing Information Stoic offers free basic services, with premium tiers for additional features.

Final Verdict Stoic is a great choice for long-term Binance investors looking to use hedge fund-level strategies without active management.

Mudrex

Mudrex provides a user-friendly platform for creating, testing, and automating trading strategies, ideal for users who want to design their own strategies without coding.

Key Features

- Strategy builder with drag-and-drop interface.

- Access to a marketplace with pre-made strategies.

- Backtesting on historical data for performance validation.

Pros and Cons

- Pros: No coding needed; customizable strategies; strong community.

- Cons: Limited to supported exchanges; charges for advanced features.

User Experience and Suitability Mudrex is perfect for users who want to build and test strategies in a beginner-friendly environment. The strategy marketplace also provides ready-made options.

Pricing Information Free plan available; premium tiers start at $16/month.

Final Verdict Mudrex’s simplicity and customization make it a valuable option for traders who enjoy strategy-building without technical coding.

Kryll

Kryll is a Web3-based trading bot that provides powerful AI-driven portfolio and market analysis, making it suitable for users interested in blockchain technology and decentralized finance.

Key Features

- AI-powered portfolio tracking and wallet analytics.

- Connects with layer-2 blockchains for seamless trading.

- Comprehensive data insights for blockchain assets.

Pros and Cons

- Pros: Decentralized and Web3-friendly; great for tracking multiple blockchain assets.

- Cons: Complex for beginners; limited to specific exchanges.

User Experience and Suitability Kryll is well-suited for traders who prefer decentralized finance and blockchain-based trading. It appeals to advanced users focused on Web3 assets.

Pricing Information Free basic features, with premium options available.

Final Verdict Kryll’s focus on blockchain assets makes it ideal for Web3 and DeFi traders who want AI-driven analytics in a decentralized environment.

Zignaly

Zignaly allows users to follow expert traders through a copy trading model, offering a unique way to automate trades based on professional strategies.

Key Features

- Social trading and copy-trading with professional traders.

- Profit-sharing model without upfront fees.

- Easy-to-use dashboard for managing copied strategies.

Pros and Cons

- Pros: Great for beginners; access to expert strategies; flexible pricing.

- Cons: Relies heavily on the chosen trader’s success; limited direct customization.

User Experience and Suitability Zignaly is ideal for users looking for hands-free trading options guided by professional insights, making it a strong choice for beginners.

Pricing Information Profit-sharing model with no fees until profitable trades are made.

Final Verdict Zignaly offers an approachable copy-trading platform, perfect for beginners who want access to expert strategies without requiring advanced knowledge.

Tips for Maximizing Profit with AI Cryptocurrency Trading Bots

AI trading bots can streamline and enhance crypto trading, but maximizing profit requires strategic use. Here are key tips:

- Backtest and Paper Trade First

Before going live, test your bot with historical data and in paper trading mode. This helps refine strategies and adjust settings without risking real funds. - Set Clear Goals

Define your trading goals and select strategies that align with them, whether it’s steady growth through dollar-cost averaging or aggressive gains via grid trading. - Monitor Performance

Regularly check your bot’s performance, especially during market shifts. AI bots aren’t foolproof—adjust parameters if the market changes drastically. - Utilize Risk Management

Use stop-loss and take-profit features to protect against losses in volatile markets, helping to manage risk and secure profits. - Stay Informed on Market News

AI bots can’t account for breaking news or regulatory changes. Stay updated on major events and adjust your bot’s strategy if needed. - Diversify Assets

Spread your bot’s trades across different cryptocurrencies to reduce risk and capture varied market opportunities. - Evaluate Performance Regularly

Periodically review metrics like ROI and success rate to see where your bot excels and where adjustments may be needed.

Conclusion on Best AI Crypto Trading Bots in 2024

AI crypto automated trading tools have become essential tools for traders seeking to streamline their strategies and automate trades efficiently. In 2024, the best free AI crypto bots offer diverse features, from real-time market analysis to customizable risk management and advanced backtesting. Whether you’re a beginner looking for user-friendly solutions or an experienced trader needing robust customization, these bots provide options suited to every level and trading style.

With tools like portfolio rebalancing, automated strategies, and social trading, these bots enable traders to maximize profitability while maintaining control over risk. However, effective bot trading requires regular monitoring, clear trading goals, and ongoing adaptation to market shifts. For many, the integration of artificial intelligence has transformed the way they approach crypto trading, making it more accessible, data-driven, and efficient.

By selecting a bot that aligns with your trading goals and comfort level, you can leverage AI to enhance your crypto portfolio, trade with confidence, and stay agile in an ever-evolving market.

Frequently Asked Questions (FAQs) on AI Crypto Trading Bots

What are AI cryptocurrency trading bots, and how do they work?

AI cryptocurrency trading bots are automated software programs that analyze market data and execute trades based on preset strategies. They connect to exchanges via APIs and continuously monitor market trends, allowing traders to take advantage of profitable opportunities 24/7 without needing to manually track the market.

Are AI cryptocurrency trading bots suitable for beginners?

Yes, many AI trading bots are designed for beginners, with user-friendly interfaces and pre-configured strategies. Bots like CryptoHero and Cornix are particularly easy to set up and use, allowing new traders to automate trades with minimal experience. However, it’s essential for beginners to understand basic trading principles and monitor bot performance regularly.

How do AI trading bots manage risk in a volatile market?

Most AI bots offer risk management tools such as stop-loss, take-profit settings, and position size adjustments. These features help traders control potential losses and lock in profits when certain market conditions are met. Using these tools effectively can help mitigate the risks associated with crypto’s price volatility.

Do I need to monitor my trading bot once it’s set up?

Yes, regular monitoring is advised. While AI bots can automate trades, market conditions can change rapidly, which may require adjustments to your bot’s parameters. Checking in periodically ensures your bot is performing as expected, especially during high market volatility.

Can I use multiple bots for different strategies?

Absolutely. Many traders diversify by using different bots with varied strategies across multiple cryptocurrencies. For example, one bot may follow a grid trading strategy, while another uses dollar-cost averaging. Diversifying across strategies can spread risk and increase the chances of capturing profitable trades.

Is it safe to connect an AI bot to my exchange account?

Most reputable AI bots use encrypted API connections and secure authentication processes to protect user funds. However, to ensure safety, it’s wise to enable two-factor authentication (2FA) on your exchange account and to review the bot’s security features before connecting.

How much does an AI cryptocurrency trading bot cost?

Many AI crypto bots offer free basic plans with limited features. Premium plans generally start around $15-$20 per month, while advanced bots with extensive customization and backtesting tools may charge higher monthly fees or one-time payments.

How reliable are AI cryptocurrency trading bots in making profitable trades?

While AI bots can enhance trading efficiency, they’re not guaranteed to be profitable. Bots rely on algorithms and historical data, which may not always predict future market movements accurately. Success often depends on using a well-suited strategy, monitoring performance, and adjusting as needed.

Can I customize my AI cryptocurrency trading bot's strategy?

Yes, most AI trading bots allow varying levels of customization. Advanced bots like Gunbot and AlgosOne offer extensive customization options, enabling users to adjust parameters such as risk tolerance, trade frequency, and profit targets. Other bots may offer preset strategies with limited customization, which is ideal for beginners.

Do AI trading bots work with all exchanges?

Not all bots support every exchange. Many popular bots integrate with major exchanges like Binance, Kraken, and Coinbase Pro, but it’s essential to check the bot’s compatibility with your preferred platform before signing up.

Is it possible to lose money using an AI crypto automated trading tools?

Yes, there is always a risk of loss in crypto trading, even with AI bots. Market volatility, strategy misalignment, or technical issues can lead to losses. Effective risk management features like stop-loss settings and careful monitoring can help mitigate these risks.

How much time do I need to invest in managing my AI trading bot?

Although AI trading bots are automated, regular monitoring is recommended. While some users only need to check their bots weekly, others may adjust settings more frequently, especially during volatile periods or after significant market news.

Can I run an AI trading bot on my mobile device?

Yes, many bots like Cornix are mobile-friendly, and some, such as Shrimpy, offer both desktop and mobile versions. Mobile compatibility allows users to manage and monitor their bots on the go, making it convenient for traders with busy schedules.

Do AI trading bots require coding knowledge?

Most bots do not require coding skills, especially those geared toward beginners, which offer pre-configured strategies. However, bots like Gunbot or HaasOnline may allow coding for users seeking to create highly customized strategies, making them ideal for more technical users.

Can I try AI trading bots for free before committing to a paid plan?

Yes, many AI cryptocurrency trading bots offer free plans or trial versions with basic features. These free options allow users to test the bot’s functionality and explore its features before deciding to upgrade to a premium plan.

Discussion