10 Best Free AI Trading Bots for Crypto & Stock Trading

Find the 10 best free AI trading bots for crypto & stock trading, offering automated strategies, top features & insights for profitable trades.

Discover the 10 best free AI trading bots for crypto and stock trading that deliver automated strategies, powerful features, and deep insights for profitable trades. In today’s fast-paced markets, artificial intelligence trading bots have revolutionized how both beginner and seasoned investors manage their portfolios by offering advanced data-driven strategies, high-speed trade execution, and round-the-clock market monitoring. This article explores the top free artificial intelligence trading bots to streamline cryptocurrency and stock trading, focusing on popular, well-tested bots that maximize efficiency and minimize emotional bias.

We’ve analyzed information from expert sources including AutoGPT, Golden Owl, 99Bitcoins, and Unite.AI to bring you a comprehensive and trustworthy guide on selecting the right AI trading tool. From market analysis tools to trend prediction capabilities, these AI bots provide a range of innovative features to enhance trading performance and optimize profits.

What is AI Trading and How Do AI Trading Bots Work?

AI trading uses artificial intelligence to automate and optimize trading in crypto and stock markets. artificial intelligence trading bots analyze vast amounts of real-time market data, identifying patterns and executing trades swiftly to maximize potential profits while reducing human error.

These bots operate based on pre-set strategies, monitoring prices, spotting favorable trends, and placing buy or sell orders automatically. Running 24/7, AI bots are especially valuable in the fast-moving crypto market, where they can seize opportunities even during off-hours.

For instance, a trader using a bot like Trade Ideas (Holly AI) reported improved accuracy and efficiency by relying on its predictive algorithms. artificial intelligence trading bots offer a smart solution for traders, from novices to experts, looking to refine strategies, backtest results, and automate their trading approach effectively.

Benefits of Using Artificial Intelligence Trading Bots in cryptocurrency & Stock Trading

AI bots for trading offer key advantages that enhance trading efficiency and outcomes:

- Speed and Precision: Instantly analyze data and execute trades, capturing fleeting market opportunities.

- Emotion-Free Decisions: Bots follow set strategies, avoiding impulsive actions that can hurt profits.

- 24/7 Market Monitoring: Particularly useful in crypto markets, bots trade continuously, maximizing gains even during off-hours.

- Backtesting Capabilities: Simulate strategies with historical data, refining approaches before using real funds.

Types of Artificial Intelligence Trading Bots for Crypto & Stock Markets

AI bots for trading come in various types, each designed to fit different trading strategies and market conditions. Here are the primary types:

- Technical Analysis Bots: These bots focus on chart patterns and indicators like moving averages or RSI to identify trends and trigger trades based on historical price data. They’re ideal for traders focused on market timing.

- Fundamental Analysis Bots: These bots scan news, earnings reports, and social media sentiment to make trades based on broader market signals. Useful for long-term investors, they help capture value based on real-world events.

- Sentiment Analysis Bots: Using natural language processing (NLP), these bots analyze market sentiment from news and social media to gauge investor mood, helping traders respond quickly to market shifts.

- Hybrid Bots: Combining technical and fundamental approaches, these bots aim for a balanced strategy, useful for diverse markets. They offer the flexibility to adjust to short-term trends and long-term events.

Experienced users find that hybrid bots, such as those combining technical indicators with sentiment analysis, can provide an adaptable edge in both volatile and steady markets.

How to Choose the Right AI Trading Bot for Your Needs

Selecting the best AI trading bot depends on several key factors. Here’s a quick guide to help you decide:

- Define Your Trading Goals: Choose a bot that aligns with your goals—whether you’re focused on day trading, long-term investments, or passive income. For example, a bot focused on dollar-cost averaging may suit long-term investors, while grid trading bots work well in stable markets.

- Consider Strategy Customization: Look for bots that allow strategy adjustments, including stop-loss settings, risk levels, and asset selection. Flexible bots, like those that combine technical and sentiment analysis, offer adaptability in changing markets.

- Evaluate Ease of Use: Beginners may prefer bots with a simple interface and pre-set strategies, while advanced traders might want more complex features like backtesting and API integrations.

- Check Supported Exchanges and Assets: Ensure the bot is compatible with your preferred exchanges and assets, especially if you trade both crypto and stocks. Some bots only support a limited number of exchanges or specialize in certain asset types.

- Research User Feedback and Reliability: Look into reviews and case studies to assess each bot’s reliability, as performance can vary significantly. Some users have noted strong, consistent returns with bots that provide real-time sentiment tracking, which may be valuable in highly volatile markets.

Key Features to Look for in AI Trading Bots

When selecting an AI trading tool, focusing on the right features can greatly impact trading success. Here are essential features to consider:

- Strategy Customization: Look for bots that allow adjustments in trading strategies, such as stop-loss settings, risk levels, and asset-specific preferences. Customizable bots give users more control over adapting to different market conditions.

- Backtesting and Simulation: Bots with backtesting capabilities let traders test strategies using historical data before committing real funds. This feature helps users refine their approach and make data-driven adjustments.

- Real-Time Market Monitoring: Bots that analyze and react to market data instantly can maximize potential profits by catching rapid shifts. For instance, bots with real-time sentiment analysis can react quickly to breaking news or price movements.

- Risk Management Tools: Built-in tools like stop-loss limits, trailing stops, and profit-taking thresholds help protect against major losses and secure profits automatically.

- User-Friendly Interface: A straightforward, intuitive interface is valuable, especially for new traders. An easy-to-navigate bot can save time and reduce errors, making it more efficient in day-to-day use.

Experienced users note that bots with strong backtesting and real-time tracking features have helped them refine strategies over time, boosting overall profitability.

Top 10 Free AI Trading Bots for Crypto & Stock Trading

Here’s a look at the top free AI trading bots available today, each with unique features designed to enhance trading in crypto and stock markets.

| AI Bot Name | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Kavout | Predictive stock & crypto rankings, real-time data tracking | Advanced analysis, user-friendly | Limited exchanges, premium features require subscription | Data-focused traders |

| Trade Ideas (Holly AI) | Real-time stock screening, pre-built models | Comprehensive analysis, customizable strategy | Limited crypto support, U.S. stocks focused | Day traders, U.S. stock market |

| TrendSpider | Automated trendline detection, dynamic alerts | Accurate charting, backtesting | Learning curve, best for technical traders | Technical analysis traders |

| Imperative Execution (IntelligenceCross) | Liquidity optimization, AI-based matching | Reduces trading costs, ideal for high-frequency | Stock markets only, geared towards institutions | Institutional traders |

| Signal Stack | Alert-to-trade automation, multi-broker integration | Fast execution, works with custom strategies | Requires alerts tool, suited to experienced users | Technical traders using alerts |

| Tickeron | Predictive analysis, AI Robots for pattern tracking | Supports stocks & crypto, customizable | Advanced features require subscription | Pattern & sentiment-focused traders |

| Numerai | Crowdsourced trading models, hedge fund-level insights | Innovative, data-driven, rewards contributors | Requires coding knowledge, suited for professionals | Algorithmic & data science traders |

| EquBot | Watson-powered insights, equity trading | Advanced AI technology, data-rich analysis | Stock-focused, high subscription costs | Equity traders, advanced insights |

| BlackBoxStocks | Real-time financial data, options momentum alerts | Great for options, intuitive interface | Primarily for stocks & options, subscription required | Options traders |

| Composer | Strategy builder, no coding needed, backtesting | Easy for non-coders, diverse strategies | Limited to specific exchanges, paid plans | Non-coders, custom strategy builders |

Kavout

Kavout is an AI-powered trading platform that leverages its AI engine, “Kai,” to analyze vast data from news, social media, and market trends. By ranking stocks and crypto assets, it offers traders predictions on price movements based on data-driven insights.

- Key Features: Predictive stock and crypto rankings, customizable alerts, real-time data tracking

- Pros and Cons:

- Pros: Advanced data analysis, user-friendly dashboard, great for both beginner and advanced users

- Cons: Limited to certain exchanges; premium features require a subscription

- Pricing Information: Offers a free trial, with premium features available in tiered subscription plans

- Supported Platforms and Integrations: Compatible with multiple exchanges and integrates with trading view for technical analysis

- Best Use Cases: Ideal for traders seeking data-rich analysis for stock and crypto markets

- Overall Rating: A solid choice for data-focused traders who benefit from AI-driven predictions

Trade Ideas (Holly AI)

Holly AI, part of the Trade Ideas platform, uses a combination of technical indicators and backtesting to pinpoint trading opportunities in stock markets. Designed for trading stocks, it’s well-suited for those looking to refine strategies through AI-powered analysis.

- Key Features: Real-time stock screening, pre-built trading models, simulated trading environment

- Pros and Cons:

- Pros: Comprehensive market analysis, customizable strategy, excellent for day traders

- Cons: Limited crypto support; more suitable for U.S. stock markets

- Pricing Information: Subscription-based, with a free trial available

- Supported Platforms and Integrations: Primarily for stock markets; compatible with major brokerage accounts

- Best Use Cases: Works best for day traders focused on U.S. stocks and those looking to build refined equity trading strategies

- Overall Rating: Recommended for active traders, particularly those focused on U.S. stock markets

TrendSpider

TrendSpider stands out for its automated charting and technical analysis, offering a machine learning-powered approach to detect trends and patterns in stock and crypto markets. With a focus on technical analysis, it caters to traders looking for precision.

- Key Features: Automated trendline detection, backtesting, dynamic alerts, real-time data

- Pros and Cons:

- Pros: Great for technical analysis, customizable alerts, comprehensive charts

- Cons: Requires a learning curve for beginners; best suited for technical traders

- Pricing Information: Offers a free trial with paid plans available

- Supported Platforms and Integrations: Compatible with multiple crypto and stock exchanges

- Best Use Cases: Suitable for traders focused on technical indicators and those who prioritize charting accuracy

- Overall Rating: A strong choice for technical traders who rely heavily on charting and pattern analysis

Imperative Execution (IntelligenceCross)

IntelligenceCross by Imperative Execution optimizes trading efficiency for stocks through AI-driven liquidity management. It’s particularly useful for minimizing market impact and helping traders get the best prices in volatile markets.

- Key Features: Liquidity optimization, reduced market impact, AI-based matching

- Pros and Cons:

- Pros: Ideal for reducing trading costs, good for institutional traders

- Cons: Limited to stock markets; best suited for high-frequency trading

- Pricing Information: Free to access with certain brokerage accounts

- Supported Platforms and Integrations: Integrates with U.S. equity markets and select brokers

- Best Use Cases: Best for high-frequency and institutional traders in the stock market

- Overall Rating: Highly recommended for institutional investors and advanced stock traders

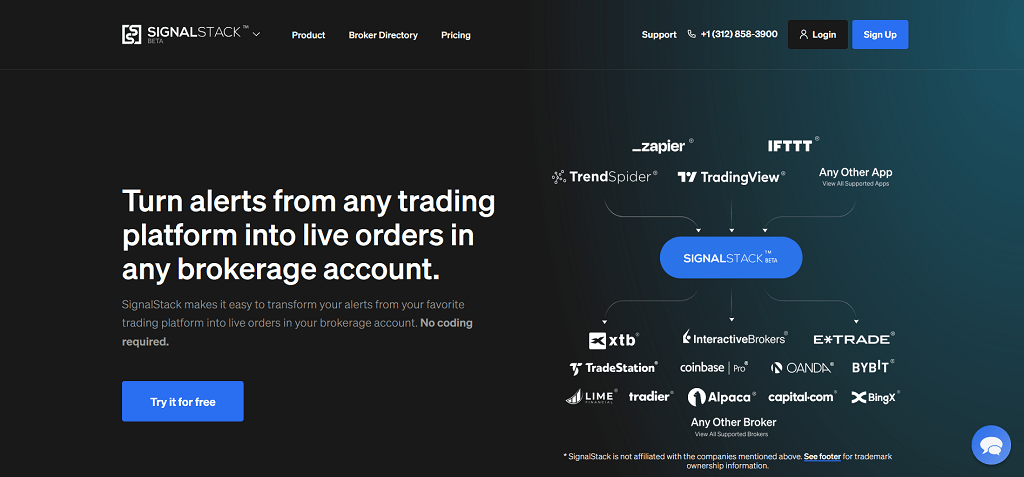

Signal Stack

Signal Stack allows traders to convert alerts into automated trades, bridging the gap between charting tools and live trading. It’s favored by traders who use platforms like TradingView and need seamless, real-time trade executions.

- Key Features: Alert-to-trade automation, multiple broker integrations, real-time trading

- Pros and Cons:

- Pros: Fast execution, compatible with custom trading strategies, works with major platforms

- Cons: Requires TradingView or another alert-based tool; geared towards experienced users

- Pricing Information: Free trial with monthly subscription options

- Supported Platforms and Integrations: Integrates with TradingView, Interactive Brokers, and more

- Best Use Cases: Ideal for active traders who use alerts and need instant trade execution

- Overall Rating: Recommended for technical traders who value fast, automated execution from alerts

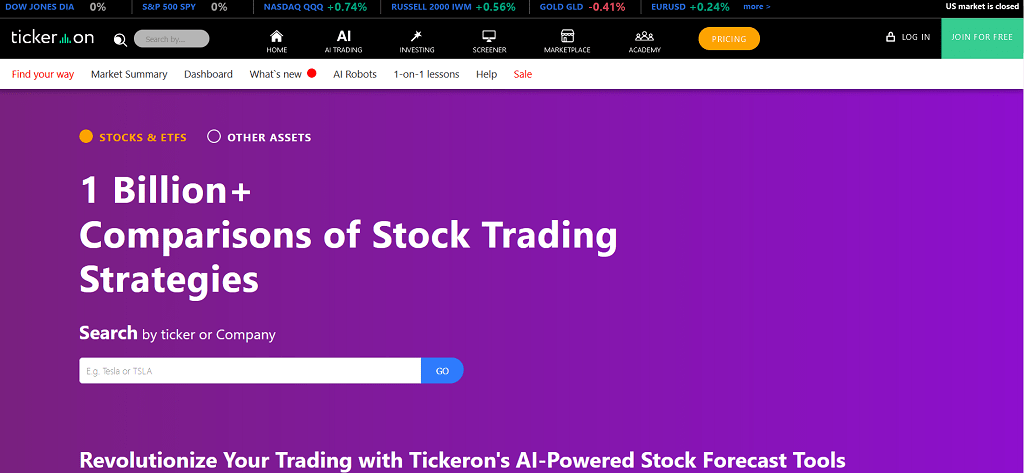

Tickeron

Tickeron combines real-time stock and crypto analysis with predictive AI to offer a wide range of tools for different trading styles. Its AI Robots provide insights into price patterns and market sentiment.

- Key Features: Predictive market analysis, sentiment tracking, customizable AI Robots

- Pros and Cons:

- Pros: Great for identifying patterns, customizable, supports both stocks and crypto

- Cons: Certain advanced features require a subscription; not suited for beginners

- Pricing Information: Free to start with subscription options for more features

- Supported Platforms and Integrations: Compatible with various exchanges for both stock and crypto markets

- Best Use Cases: Ideal for traders looking for pattern recognition and predictive market insights

- Overall Rating: A good fit for traders interested in sentiment analysis and market pattern prediction

Numerai

Numerai is a hedge fund that uses crowdsourced AI models to inform its trades. This bot is unique in that it allows data scientists to submit models to guide trading decisions, making it a powerful option for advanced traders and data enthusiasts.

- Key Features: Crowdsourced trading models, hedge fund-level analysis, crypto predictions

- Pros and Cons:

- Pros: Innovative model, rewards contributors, supports data-driven decisions

- Cons: Limited to those with coding knowledge; mainly suited for professionals

- Pricing Information: Free to contribute, with rewards based on performance

- Supported Platforms and Integrations: Integrates with various exchanges through API

- Best Use Cases: Great for data scientists and traders interested in crowdsourced AI models

- Overall Rating: Best for experienced users interested in algorithmic trading

EquBot

EquBot uses IBM’s Watson to power its AI-driven trading strategies, providing a unique advantage through machine learning. Known for its equity-focused algorithms, EquBot is ideal for stock traders looking for AI insights.

- Key Features: Watson-powered insights, equity trading focus, real-time analysis

- Pros and Cons:

- Pros: Unique AI technology, good for trading stocks, supports data-rich analysis

- Cons: Limited to equity markets, high subscription costs for advanced features

- Pricing Information: Subscription-based with various plans

- Supported Platforms and Integrations: Compatible with select stock trading platforms

- Best Use Cases: Best suited for traders focused on equity markets and advanced AI insights

- Overall Rating: Highly recommended for equity traders who want a sophisticated AI approach

BlackBoxStocks

BlackBoxStocks provides traders with real-time financial information and automated alerts for stocks and options. Its AI technology helps users identify potential trades based on market momentum and volatility.

- Key Features: Real-time financial data, momentum alerts, options-focused insights

- Pros and Cons:

- Pros: Great for options trading, intuitive interface, educational resources

- Cons: Primarily focused on options and stocks; requires a subscription

- Pricing Information: Free trial available, then subscription-based

- Supported Platforms and Integrations: Works with multiple brokerage accounts

- Best Use Cases: Ideal for options traders looking for real-time momentum alerts

- Overall Rating: Well-suited for options and stock traders seeking real-time analysis

Composer

Composer offers a platform where traders can build and test custom investment strategies without coding. This bot empowers users with a drag-and-drop interface to create diversified strategies that automate trades based on set conditions.

- Key Features: Strategy building, backtesting, customizable workflows, no coding needed

- Pros and Cons:

- Pros: User-friendly for non-coders, powerful backtesting, diversified strategy options

- Cons: Limited to specific exchanges, subscription required for full features

- Pricing Information: Free to start, with premium features available in paid plans

- Supported Platforms and Integrations: Integrates with major exchanges for crypto and stock

- Best Use Cases: Great for users who want to build strategies without coding

- Overall Rating: Excellent for traders looking to automate and diversify trading strategies without technical expertise

Popular Automated Strategies for cryptocurrency & Stock Trading

There are several effective automated trading strategies that AI bots use in crypto and stock markets. Here’s a look at the main strategies:

- Grid Trading: Profits from market fluctuations by setting buy and sell orders within a specific price range, ideal for sideways markets.

- Dollar-Cost Averaging (DCA): Invests a fixed amount at regular intervals, reducing risk by averaging costs over time, favored by long-term investors.

- Arbitrage: Exploits price differences across exchanges, buying low and selling high instantly. This strategy is effective but requires low fees and quick execution.

- Trend Following: Bots track and follow upward or downward trends, buying in bull trends and selling in bear trends, which works well in directional markets.

- Mean Reversion: Assumes prices return to average, buying below and selling above the average price, suitable for range-bound markets.

- Scalping: Focuses on frequent, small profits by placing multiple quick trades. Best in highly liquid markets with minimal price slippage.

- Momentum Trading: Targets assets with strong recent performance, aiming to capitalize on continued momentum, useful in volatile markets.

Experienced traders often blend strategies, like combining trend following with DCA, to optimize returns across varying market conditions.

Risks and Limitations of AI Bots for Trading

While automated trading bots offer advantages, they come with certain risks and limitations:

- Market Volatility: Bots can struggle in sudden, extreme price swings, leading to unexpected losses if not configured properly with risk controls.

- Technical Failures: Bots rely on technology, and issues like server downtime, bugs, or poor internet connectivity can disrupt trades, affecting performance.

- Over-Reliance on Historical Data: Many bots base strategies on past data, which may not accurately predict future market conditions, especially in unpredictable markets.

- High Fees and Costs: While some bots are free, high-frequency trading strategies may incur transaction fees that can cut into profits, especially for smaller accounts.

- Limited Flexibility: Most bots follow set strategies, making it challenging to adapt quickly to changing market conditions without manual adjustments.

- Security Risks: Bots require exchange access, which can expose users to potential hacks or breaches if not properly secured.

Traders should use AI bots with caution, setting realistic expectations, and always monitoring their performance to mitigate risks.

Best Practices for Effective Use of Artificial Intelligence Trading Bots

Using AI trading tools effectively requires a careful, informed approach. Here are some best practices to optimize performance:

- Start with Backtesting: Before trading live, use historical data to test your bot’s strategy. Backtesting helps reveal how the bot might perform under different market conditions, allowing you to refine settings.

- Set Risk Management Controls: Enable features like stop-loss, take-profit, and position size limits to protect your capital from unexpected market swings.

- Monitor Bot Performance: Even the best bots need oversight. Regularly check your bot’s performance to ensure it’s achieving your trading goals and adjust settings if necessary.

- Choose Low-Fee Exchanges: Since frequent trading can lead to high fees, using exchanges with low fees minimizes costs and preserves profit margins, especially in high-volume strategies.

- Stay Updated on Market Conditions: Markets can shift quickly. Staying informed about economic events, policy changes, or news can help you make timely adjustments to your bot’s strategy.

- Combine Strategies for Balance: Many traders find that blending strategies, like trend following with dollar-cost averaging, can provide steadier results across varying market conditions.

Using AI trading tools effectively involves a balanced approach—one that combines automated precision with ongoing human oversight to maximize gains and minimize risks.

Trends in AI-Powered Trading for Crypto & Stocks in 2024

AI-driven trading in 2024 is advancing rapidly, fueled by emerging technologies and evolving market needs. Here are some key trends shaping the field this year:

- Increased Use of Machine Learning Models: More trading bots are incorporating machine learning, allowing them to adapt to shifting market conditions and improve over time. This trend is especially popular in volatile markets like crypto, where adaptable bots have an advantage.

- Focus on Predictive Analytics and Sentiment Analysis: Many AI bots are now using predictive algorithms and sentiment analysis to gauge market sentiment based on news and social media, helping traders make quicker decisions in response to market shifts.

- Integration with Decentralized Finance (DeFi): As DeFi grows, bots that connect with DeFi platforms are gaining traction. These bots can now engage in decentralized trades, lending, and staking, opening new ways to generate returns in crypto.

- Enhanced User Accessibility and Customization: Bots are becoming more user-friendly, with intuitive interfaces and customizable strategies that appeal to beginners. This trend democratizes trading, allowing more people to benefit from AI-driven automation.

- Emphasis on Security and Risk Management: With increased concerns around cyber threats, AI trading platforms are focusing on stronger security features and robust risk controls to protect user funds, adding reliability to the growing AI trading landscape.

The combination of adaptability, data analysis, and security is transforming AI-powered trading, making it more dynamic and accessible for traders of all levels in 2024.

Conclusion: Maximizing Profits with AI Trading Bots

AI bots have transformed the landscape of cryptocurrency and stock trading, offering powerful tools to streamline strategy, manage risk, and boost profitability. By automating trade execution and analyzing vast data in real-time, these bots minimize the emotional biases that often affect human traders. They also provide continuous market monitoring, making them especially useful in fast-paced environments like crypto markets, where 24/7 activity can yield profitable opportunities at any time.

For traders at any level, from beginners to advanced users, artificial intelligence trading bots open up possibilities to refine and test strategies without the constant need for manual input. By choosing a bot that aligns with specific trading goals, setting up effective risk management, and staying engaged in the bot’s performance, traders can harness the full potential of AI-driven trading. The combination of precision, adaptability, and efficiency these bots bring can be instrumental in navigating today’s dynamic markets successfully.

Frequently Asked Questions (FAQs) on AI Trading Bots

Are artificial intelligence trading bots profitable?

AI bots can be profitable when used effectively, but results vary based on market conditions, bot configuration, and strategy. While many traders find success with bots, understanding their limitations and monitoring performance is essential to maintain profitability.

Do AI trading tools work for both crypto and stock markets?

Yes, many AI bots are designed for both crypto and stock markets. However, some bots may specialize in one market due to specific features like exchange compatibility or market analysis tools, so it’s wise to choose one that aligns with your trading goals.

How much does it cost to use an Artificial Intelligence trading bot?

Artificial intelligence trading bot costs vary widely. Some bots are free or offer free trials, while others have subscription plans or charge fees based on trading volume. Be sure to factor in any additional exchange fees when considering the total cost.

Can beginners use automated trading bots?

Absolutely. Many bots are beginner-friendly, with simple interfaces and pre-built strategies. For those new to trading, starting with a bot that has a guided setup and educational resources can be helpful.

Are artificial intelligence trading bots safe to use?

Most reputable bots are secure, but safety depends on the bot’s developer, platform security, and the trader’s personal settings. Always choose bots from reliable providers, enable security features, and avoid sharing sensitive account information.

How do artificial intelligence trading bots handle risk?

Many bots come with risk management tools like stop-loss and take-profit orders, allowing users to limit potential losses. Setting these controls properly is key to managing risk effectively.

Can I use multiple trading bots at once?

Yes, some traders use multiple bots for different strategies or markets. Running several bots can provide a balanced approach but requires monitoring to avoid overlapping trades or increased risks.

How often should I monitor my AI trading tools?

While AI bots can run independently, regular monitoring is essential. Market conditions change frequently, and periodic adjustments can help optimize performance.

Do artificial intelligence trading bots guarantee profits?

No, AI bots don’t guarantee profits. They automate trading based on preset strategies, but their success depends on market conditions, strategy effectiveness, and risk management.

What’s the difference between rule-based and AI-driven bots?

Rule-based bots follow predefined instructions, while AI-driven bots can adapt based on data and machine learning. AI bots are generally more dynamic but may require more oversight.

How do I choose the best artificial intelligence trading bot for my needs?

Consider factors like supported markets, strategy customization, ease of use, and risk management features. Testing a bot’s demo or trial can also help you gauge if it aligns with your goals.

Can AI bots be used for long-term investing?

Yes, certain AI bots are suited for long-term strategies like dollar-cost averaging. However, many bots are designed for short-term trading, so be sure to choose one compatible with your investment horizon.

Do I need technical skills to use an AI bot?

Not necessarily. While some bots require coding knowledge for advanced customization, many offer user-friendly setups that require little to no technical skills.

Discussion