Cryptohopper Review: Best Crypto Trading Bot for Automation?

Cryptohopper Review: Best crypto trading bot for automation. Discover usage, pricing, features, bot configuration, best strategies and more.

Cryptohopper Review: Automated bots have become essential tools in the fast-paced world of cryptocurrency trading, allowing traders to maximize opportunities around the clock. This article delves into this crypto bot, one of the leading cryptocurrency trading tools designed to simplify and enhance trading for both beginners and experienced users. With advanced features, an intuitive interface, and support for major exchanges like Binance, Coinbase Pro, and KuCoin, Cryptohopper has positioned itself as a top contender for the title of best crypto trading bot for automation.

Since its launch in 2017, this crypto bot has been trusted by over 400,000 users worldwide, offering powerful tools such as copy trading, trailing stop-loss, backtesting, and a drag-and-drop strategy builder. But does it truly deliver the value and functionality that traders need? In this Cryptohopper review, we’ll explore its features, pricing, supported exchanges, and trading strategies, while leveraging insights from top sources like CoinBureau, Techopedia, Altrady, GoodCrypto, and Atomic Wallet.

Whether you’re looking to automate complex strategies or simply minimize the risks of emotional trading, this crypto tool could be the solution you need. Keep reading to find out if it’s truly the best crypto trading tool for your trading needs.

Cryptohopper Review: What is Cryptohopper?

Cryptohopper is an automated trading platform designed to help traders buy and sell cryptocurrencies using predefined strategies without the need for constant manual input. Launched in 2017 by two brothers from the Netherlands, this crypto tool quickly gained traction among both beginners and professional traders. Today, the platform boasts over 400,000 active users, thanks to its robust features like copy trading, trailing stop-loss, backtesting, and an intuitive drag-and-drop strategy builder.

The primary goal of this crypto tool is to simplify cryptocurrency trading by automating complex strategies that can run 24/7. By eliminating human emotions such as fear and greed from trading decisions, Cryptohopper allows traders to execute strategies consistently, regardless of market conditions. This makes it particularly useful for those who want to maximize profit potential without being glued to their screens.

this trading tool is compatible with 14 major cryptocurrency exchanges, including Binance, Coinbase Pro, KuCoin, and OKX. This wide integration ensures that users have access to high liquidity and diverse trading pairs, making it easy to apply strategies across various markets. While the platform is beginner-friendly, it also offers advanced features like market-making and arbitrage, making it suitable for experienced traders looking to implement complex strategies.

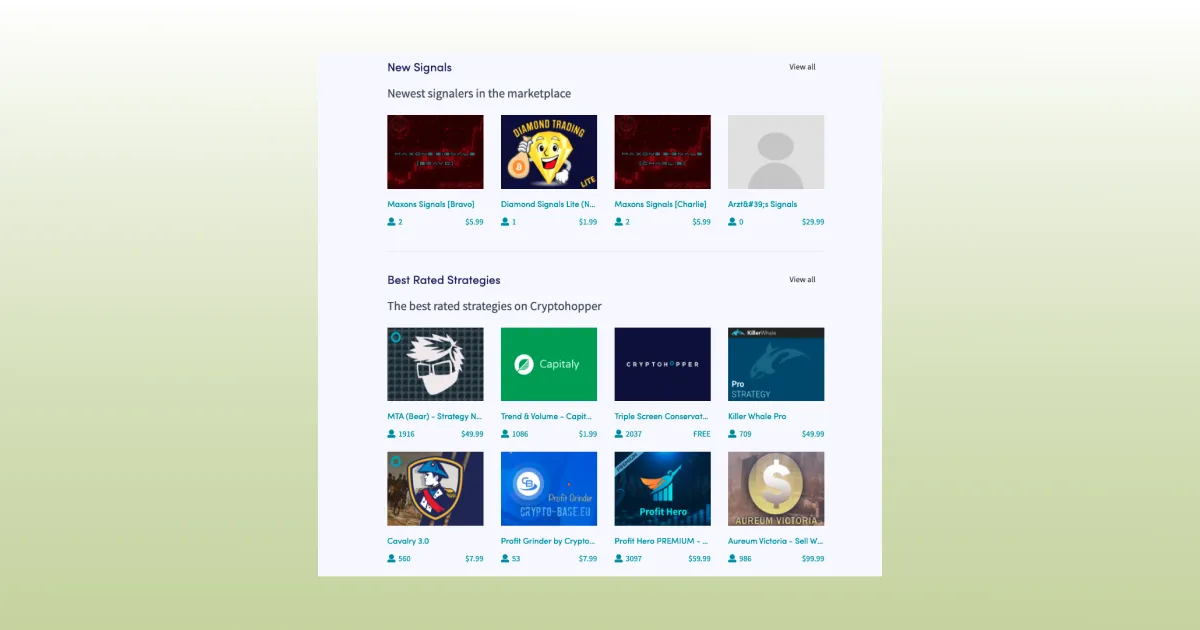

One of the standout features of Cryptohopper is its marketplace, where users can buy and sell trading strategies created by other traders. This allows new users to start with proven strategies and customize them based on their preferences. As noted in reviews from CoinBureau and Altrady, the flexibility and customization options make the trading tool a powerful tool for anyone looking to optimize their cryptocurrency trading experience.

Cryptohopper serves as a versatile platform that caters to different trading styles and objectives, making it a top choice for automated trading in the cryptocurrency market.

How Does Cryptohopper Work for Automated Crypto Trading?

Cryptohopper operates as a cloud-based trading platform that enables users to automate their cryptocurrency trades across multiple exchanges. The core idea behind this trading tool is to allow traders to create and deploy automated trading strategies that can execute trades 24/7 without manual intervention. This not only saves time but also helps reduce the emotional biases that often impact trading decisions, such as fear and greed.

The platform works by connecting to major exchanges like Binance, Coinbase Pro, KuCoin, and OKX using API keys. Once connected, users can set up trading bots to automatically buy or sell based on pre-defined strategies. These strategies can range from basic rules like setting stop-loss orders to more complex algorithmic strategies that involve multiple indicators and patterns.

Automation and Strategy Configuration

One of this crypto bot’s biggest strengths is its flexibility in strategy configuration. Traders can either build their own strategies using the drag-and-drop strategy designer or choose from pre-configured templates in the Cryptohopper marketplace. This marketplace also offers strategies developed by other experienced traders, which can be a great starting point for beginners. According to sources like Techopedia and CoinBureau, this crypto bot’s strategy designer doesn’t require coding skills, making it accessible for those without a technical background.

How the Bots Operate

The automated bots operate using a series of conditional “IF/THEN” logic. For example, a bot can be programmed to buy Bitcoin when the price drops to a certain level and sell when it reaches a predefined profit margin. The platform also includes advanced features like trailing stop-loss, which locks in profits as the price rises, and dynamic rebalancing for portfolio management.

User Experience Case Study

A notable example of its effectiveness is shared by experienced users on platforms like Altrady and GoodCrypto, who highlight how the automated bots helped them stay active in the market even during non-trading hours. One user reported that using this crypto tool’s trailing stop-loss and backtesting tools significantly improved their strategy’s profitability by preventing premature exits during price fluctuations.

Algorithmic and AI-Powered Trading

Cryptohopper also incorporates AI and algorithmic trading capabilities. It uses these technologies to analyze market trends and adjust trading strategies in real-time. This adaptability is crucial in volatile markets, where conditions can change rapidly. Furthermore, the platform’s backtesting feature allows traders to test their strategies using historical data, minimizing the risks before deploying them in live markets.

this crypto tool provides an easy-to-use yet powerful solution for automated cryptocurrency trading, catering to both beginners and experienced traders looking to automate their strategies and make data-driven trading decisions.

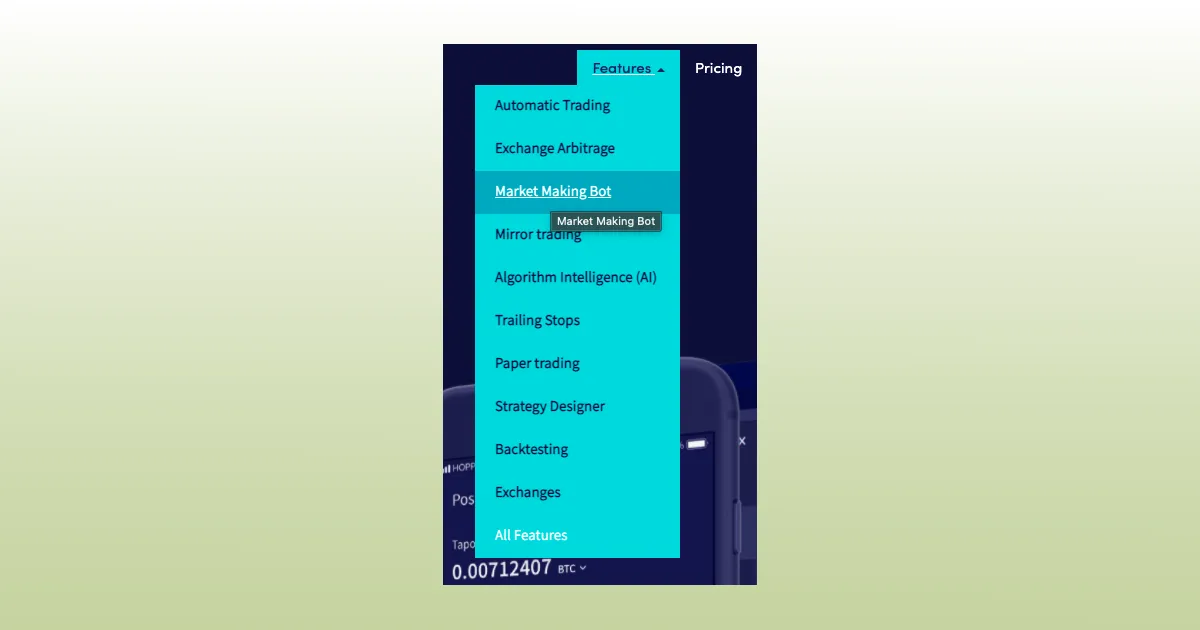

Key Features of the Cryptohopper Trade Bot

Cryptohopper is packed with a variety of features that make it one of the most versatile automated trading platforms for cryptocurrency enthusiasts. From robust strategy customization to advanced trading tools, this trading tool caters to traders of all experience levels. Below are some of its standout features:

1. Automated Trading 24/7

The core function of this trading tool is its ability to automate trading strategies around the clock. Traders can set up bots to execute trades based on pre-configured conditions, ensuring that no opportunity is missed due to time zone differences or human limitations. This feature allows traders to stay active in the market, even while they’re asleep, which is crucial in the highly volatile crypto space.

2. Strategy Designer & Backtesting

Cryptohopper’s drag-and-drop strategy designer is a user-friendly tool that allows traders to create complex trading strategies without needing any programming skills. Users can also backtest their strategies using historical data to understand how they would have performed in the past. This helps refine strategies before deploying them live, minimizing risk and optimizing results.

For instance, a user shared on CoinBureau that they improved their trading efficiency by using the backtesting feature, which enabled them to identify and remove underperforming parameters before activating their bot in a live market.

3. Copy Trading and Marketplace

this trading tool’s built-in marketplace offers a unique social trading experience where users can buy and sell strategies and signals from professional traders. This is especially beneficial for beginners who want to leverage expert knowledge without creating strategies from scratch. According to Altrady, many new traders have successfully used this feature to jumpstart their trading journey by mirroring the actions of seasoned traders.

4. Trailing Stop-Loss & Risk Management Tools

this crypto bot’s trailing stop-loss is a dynamic tool designed to help traders lock in profits while minimizing losses. Unlike a standard stop-loss, which is set at a fixed price, the trailing stop-loss moves with the asset’s price, ensuring that profits are captured as the price rises but stopping losses if the price drops. This feature, along with other tools like stop-loss orders and take-profit settings, provides a comprehensive risk management suite for traders.

5. Multi-Exchange Integration

Cryptohopper supports integration with 14 major cryptocurrency exchanges, including Binance, Coinbase Pro, KuCoin, and OKX. This wide compatibility allows users to manage multiple exchange accounts from a single platform, streamlining their trading activities. Whether it’s rebalancing a portfolio or executing cross-exchange arbitrage strategies, users can trade efficiently without logging into each exchange separately.

6. Paper Trading

To help new users get familiar with the platform without risking real funds, this crypto bot offers a paper trading feature. This allows traders to simulate trades in a risk-free environment, testing different strategies and gaining confidence before entering the live market.

7. Cryptohopper Academy & Community Support

The platform offers educational resources through the Cryptohopper Academy, providing tutorials, guides, and videos to help users master the bot. Additionally, the community forum enables users to share insights, discuss strategies, and learn from each other, making it a supportive environment for traders at all levels.

These features, combined with this crypto bot’s user-friendly interface and flexible subscription plans, make it a powerful tool for automating crypto trades and managing risk effectively. Whether you’re a novice looking for guidance or an advanced trader seeking sophisticated tools, Cryptohopper has the right features to elevate your trading experience.

Supported Exchanges and Trading Pairs in Cryptohopper

One of the standout features of Cryptohopper is its extensive support for major cryptocurrency exchanges, allowing users to seamlessly trade across multiple platforms. As of now, this crypto tool is integrated with 18 of the world’s leading exchanges, making it highly versatile for traders who want to diversify their portfolios and access a wide range of trading pairs.

List of Supported Exchanges

Cryptohopper is compatible with popular exchanges like:

- Binance and Binance US

- Coinbase Pro

- KuCoin

- Kraken

- OKX

- Bitfinex

- Huobi

- Poloniex

- Crypto.com

- Bittrex

- HitBTC

- Bitpanda Pro

- Bitvavo

- Exmo

- Bybit

This broad integration means that traders can connect multiple exchange accounts through this crypto tool’s platform and manage their trading strategies from a single dashboard. Each exchange provides unique trading pairs, ensuring users have access to both mainstream cryptocurrencies like Bitcoin and Ethereum, as well as lesser-known altcoins.

Trading Pair Flexibility

The number of trading pairs available depends on the connected exchange, allowing users to trade hundreds of pairs across various markets. This flexibility is crucial for implementing diverse strategies, such as arbitrage, which takes advantage of price differences between pairs on different exchanges. Additionally, users can automate trades for multiple assets simultaneously, optimizing their portfolios without the hassle of switching between platforms.

Real-World Use Case

A user shared on GoodCrypto that the multi-exchange support has significantly enhanced their trading efficiency. By connecting accounts from Binance and Coinbase Pro, they were able to perform cross-exchange arbitrage without moving funds manually, saving both time and reducing trading fees.

Advanced Trading Features for Each Exchange

Each supported exchange allows users to access advanced features like stop-loss, take-profit, and trailing stop-loss tools directly from this crypto tool. This unified setup ensures a consistent trading experience, regardless of the exchange, enabling traders to apply sophisticated strategies with ease.

Cryptohopper’s integration with a vast array of exchanges makes it an attractive choice for those seeking a comprehensive automated trading solution that can adapt to various trading pairs and platforms. This versatility, combined with its powerful trading tools, provides traders with the flexibility needed to maximize their market opportunities.

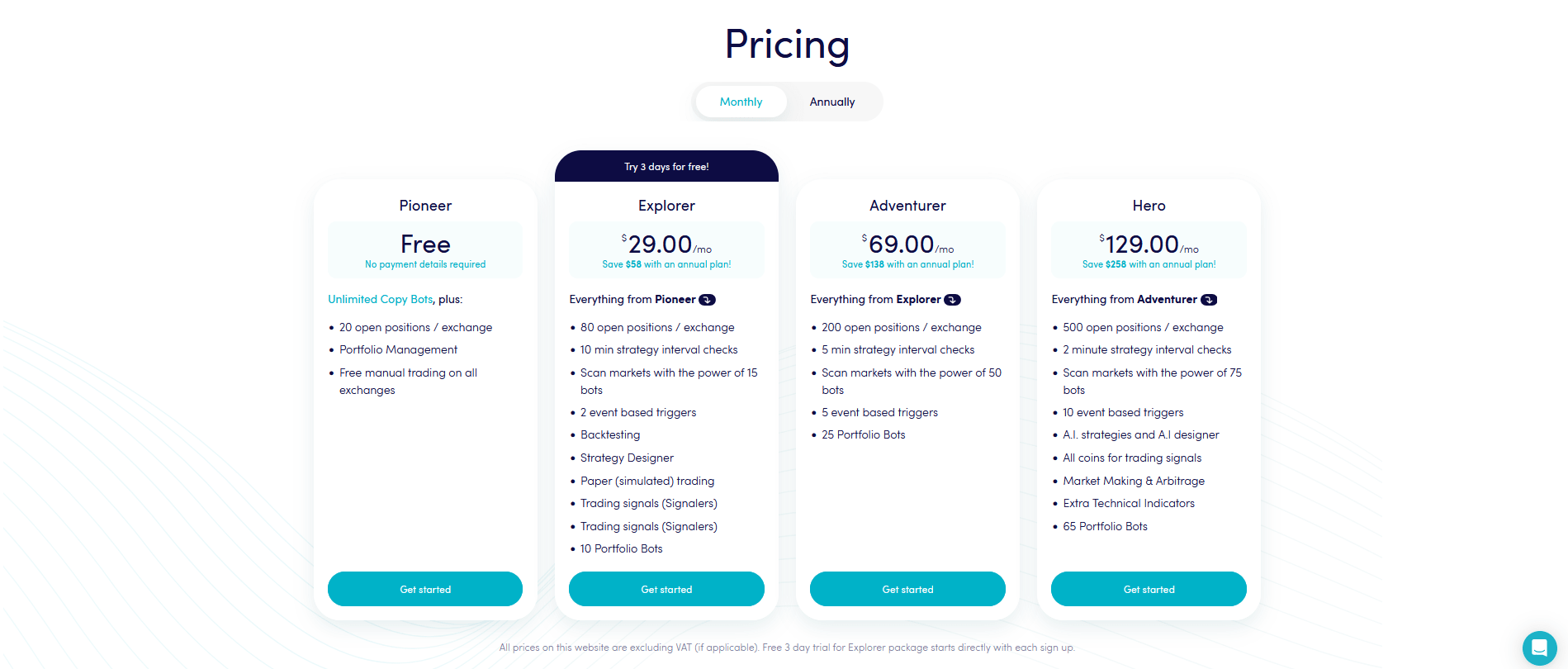

Exploring Cryptohopper Pricing and Plans

Cryptohopper offers four distinct pricing plans, each designed to meet the needs of traders at various skill levels. These plans can be paid either monthly or annually, with significant savings available for annual subscriptions. Here’s an updated breakdown of the plans:

| Plan | Monthly Price | Annual Price | Key Features | Best For |

|---|---|---|---|---|

| Pioneer Plan (Free) | $0/month | Free |

- 20 open positions per exchange - Unlimited Copy Bots - Manual trading on all exchanges - Basic portfolio management |

Beginners exploring the platform |

| Explorer Plan | $29/month | $24.16/month (billed annually at $289.92) |

- 80 open positions per exchange - 10-minute strategy interval checks - Paper trading and backtesting - Up to 15 bots for market scanning - 2 event-based triggers |

New traders looking to start automation |

| Adventurer Plan | $69/month | $57.50/month (billed annually at $690) |

- 200 open positions per exchange - 5-minute strategy interval checks - Up to 50 market scanning bots - 5 event-based triggers - 25 Portfolio Bots |

Intermediate traders seeking flexibility |

| Hero Plan | $129/month | $107.50/month (billed annually at $1,290) |

- 500 open positions per exchange - 2-minute strategy interval checks - Up to 75 bots for market scanning - AI-powered strategies & designer - Market-making & arbitrage features - 65 Portfolio Bots |

Professional traders needing full control |

1. Pioneer Plan (Free)

The Pioneer Plan is a completely free plan aimed at newcomers wanting to explore the basic features of Cryptohopper without any financial commitment. It includes:

- 20 open positions per exchange

- Unlimited Copy Bots

- Manual trading on all supported exchanges

- Basic portfolio management

This plan is ideal for users who want to get familiar with the platform before upgrading to a paid plan.

2. Explorer Plan

- Monthly Price: $29/month

- Annual Price: $24.16/month (billed annually at $289.92)

The Explorer Plan is perfect for beginners looking to start with automated trading. It includes:

- 80 open positions per exchange

- 10-minute strategy interval checks

- Paper trading and backtesting tools

- Strategy Designer

- Up to 15 bots for market scanning

- 2 event-based triggers

This plan offers a solid foundation for traders to experiment with strategy building and market analysis.

3. Adventurer Plan

- Monthly Price: $69/month

- Annual Price: $57.50/month (billed annually at $690)

The Adventurer Plan is designed for intermediate traders who need more flexibility and trading capacity. It provides:

- 200 open positions per exchange

- 5-minute strategy interval checks

- Up to 50 market scanning bots

- 5 event-based triggers

- 25 Portfolio Bots

This plan is ideal for traders looking to optimize and scale up their strategies for more active trading.

4. Hero Plan

- Monthly Price: $129/month

- Annual Price: $107.50/month (billed annually at $1,290)

The Hero Plan is the top-tier plan, packed with advanced tools and features for professional traders. It includes:

- 500 open positions per exchange

- 2-minute strategy interval checks

- Up to 75 bots for market scanning

- 10 event-based triggers

- AI-powered strategies and AI strategy designer

- Market-making and arbitrage functionalities

- 65 Portfolio Bots

This plan is best suited for experienced traders looking for comprehensive features and complete control over their strategies.

Choosing the Right Plan

For beginners, the Pioneer Plan offers a no-risk introduction. As traders grow more comfortable, the Explorer Plan provides basic automation features. The Adventurer Plan is ideal for those looking to enhance their trading speed and capabilities, while the Hero Plan offers the full suite of advanced tools for professional traders.

With the flexibility of both monthly and annual billing, this trading tool ensures that traders can find a plan that fits their trading goals and budget.

Setting Up Your Cryptohopper Trading Software

To begin, head over to the Cryptohopper website and sign up for an account if you haven’t done so already. After creating an account, you can start exploring the platform using the free Pioneer Plan or take advantage of the 3-day trial for the Explorer Plan to access more features.

Here’s a simple step-by-step guide to help you set up your first trading bot:

1. Connect Your Exchange Account

The first step is to link your trading software to one of the supported exchanges, such as Binance, Coinbase Pro, or KuCoin. Navigate to the “Exchanges” section in the dashboard and select your preferred exchange. Cryptohopper uses API keys to connect securely to your account, which enables the bot to execute trades but never withdraw funds.

- Tip: Make sure to create an API key from your exchange account with trading permissions only and disable withdrawal rights to ensure maximum security.

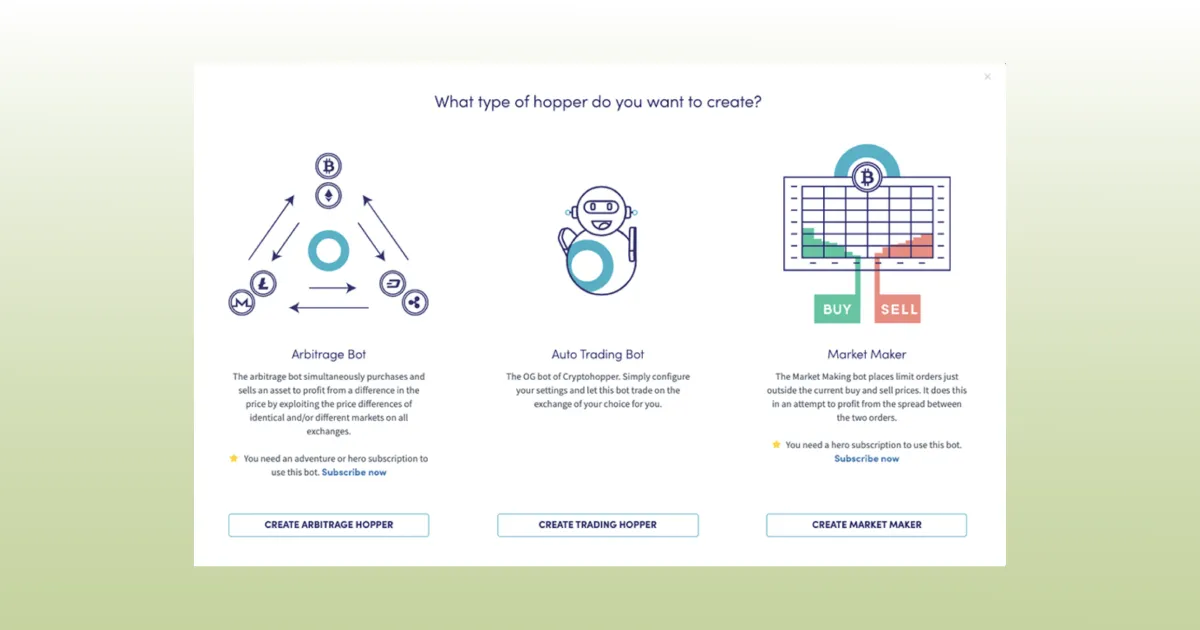

2. Configure Your Bot Settings

Once connected, it’s time to set up your bot. Go to the “Your Hoppers” section and create a new bot. You’ll need to specify:

- Name of the bot: Choose a unique and memorable name.

- Exchange: Select the connected exchange.

- Base currency: Choose which asset (e.g., BTC, ETH, USDT) you want to use for trading.

3. Choose or Create a Strategy

You can either select a pre-configured strategy from the trading tool Marketplace or create your own using the Strategy Designer. The drag-and-drop interface allows you to design complex trading strategies without any coding experience. For beginners, choosing a ready-made strategy from the marketplace is a good starting point.

- User Experience Insight: Many new users shared on platforms like CoinBureau that starting with a pre-configured strategy helped them understand how automated trading works before building their own.

4. Set Trading Parameters and Triggers

Fine-tune your bot by defining specific conditions for buying and selling, such as stop-loss, take-profit, and trailing stop-loss levels. You can also set event-based triggers (e.g., buy if the price drops by 5%) to react to sudden market changes.

- Example Setup: Suppose you want your bot to buy Bitcoin whenever its price drops by 3%. Set an “IF” condition to monitor for the drop and a “THEN” action to initiate the purchase.

5. Test Your Strategy with Paper Trading

Before going live, it’s highly recommended to use this trading tool’s Paper Trading feature. This lets you test your strategy in a simulated environment using virtual funds, allowing you to see how your bot performs under real market conditions without risking any capital.

6. Activate Your Bot and Monitor Performance

Once you’re confident in your setup, activate your bot. You can monitor its performance directly from the dashboard, where you’ll see real-time data on your bot’s activity, profit/loss, and open positions.

Setting up your Cryptohopper trading tool is just the beginning. As markets evolve, don’t hesitate to tweak your strategies or try new configurations to optimize performance and achieve your trading goals.

Best Trading Strategies for Cryptohopper Users

Cryptohopper offers a range of strategies that can be customized or chosen from its marketplace, making it suitable for traders of all experience levels. Whether you’re looking to capitalize on market trends or minimize risks during volatile periods, having the right strategy in place is crucial for maximizing your trading success. Below are some of the best strategies recommended for this trading tool users:

1. Trend-Following Strategy

A trend-following strategy is designed to capture profits by identifying and trading along with the direction of the market’s movement, whether bullish or bearish. Traders can set their bots to buy when the price is trending upward and sell when the trend reverses. This type of strategy works well in a strong, trending market and can be enhanced using technical indicators like Moving Averages (MA) or the Relative Strength Index (RSI).

- Example: One user on Techopedia reported success using a trend-following strategy during a prolonged Bitcoin bull market by configuring their bot to buy when the RSI was below 30 and sell when it crossed above 70.

2. Dollar-Cost Averaging (DCA) Strategy

DCA is a popular strategy that involves dividing your total investment into smaller amounts and investing these amounts at regular intervals, regardless of the asset’s price. The goal is to reduce the impact of short-term volatility and lower the average cost of the asset over time. this automated trading platform supports this strategy by allowing users to automate DCA buy orders, making it ideal for long-term investors.

- How to Set It Up: Use Cryptohopper’s “DCA Buy” feature to automatically purchase a set amount of your chosen cryptocurrency whenever the price falls by a specified percentage.

3. Market-Making Strategy

Market-making is an advanced strategy where the bot places both buy and sell orders at different price levels to profit from small spreads. This approach works well in stable or low-volatility markets and helps improve liquidity on exchanges. Experienced traders can fine-tune their bots to capture small gains consistently.

- Tip: To minimize risk, set tighter spreads and choose pairs with high liquidity.

4. Arbitrage Strategy

Arbitrage strategies are used to exploit price differences between the same trading pairs on different exchanges. With this crypto bot’s exchange arbitrage tool, users can automate this process and execute trades instantly whenever such opportunities arise. However, this strategy requires quick action and high trading volume to be effective.

- Use Case: A trader using this automated trading platform’s arbitrage bot shared on GoodCrypto that they were able to achieve consistent small profits by simultaneously monitoring price variations between Binance and Coinbase Pro.

5. Copy Trading and Social Trading

For those who prefer a more hands-off approach, this automated trading platform’s Copy Trading and Social Trading features are ideal. With copy trading, users can automatically mirror the strategies of professional traders available in the Cryptohopper Marketplace. This is particularly useful for beginners who want to learn and profit from experienced traders.

- Pro Tip: Always review the performance and user feedback of a strategy in the marketplace before subscribing to ensure it aligns with your trading style and goals.

6. Mean Reversion Strategy

The mean reversion strategy is based on the idea that the price of an asset will tend to return to its average over time. Traders using this strategy set their bots to buy when the price is below the average and sell when it rises above the average. This approach works best in a range-bound market.

- Indicator to Use: Bollinger Bands can be effective for identifying overbought and oversold conditions, helping to pinpoint potential buy and sell signals.

Final Thoughts on Choosing the Right Strategy

Selecting the best strategy for this crypto tool depends on your risk tolerance, market conditions, and trading experience. Beginners might benefit from using simpler strategies like DCA or copy trading, while advanced traders can experiment with complex setups like arbitrage and market-making. No matter which strategy you choose, always backtest it thoroughly using Cryptohopper’s Paper Trading feature to ensure it’s viable before going live.

Cryptohopper Marketplace: Copy Trading and Social Trading Explained

The Cryptohopper Marketplace is a unique feature that sets the platform apart by allowing traders to access a wide variety of strategies and templates created by other users. This marketplace is beneficial for both beginners and experienced traders who want to leverage the knowledge of the community or share their own strategies for profit. It essentially acts as a hub where traders can buy, sell, and modify trading strategies, signals, and bot configurations.

How Copy Trading Works in Cryptohopper

Copy trading is a method where traders can replicate the strategies and actions of successful traders directly in their accounts. this crypto tool’s Marketplace provides access to Copy Bots, which are pre-configured trade bots based on the strategies of top-performing traders. Users can browse through the marketplace, evaluate performance statistics, and choose a bot that aligns with their risk tolerance and trading goals.

- For Beginners: Copy trading is an excellent way for beginners to start their trading journey without needing to build their own strategies. By following experienced traders, newcomers can learn effective trading patterns and potentially profit from expert knowledge.

- For Experienced Traders: The marketplace allows seasoned traders to monetize their skills by sharing their strategies with the community. Traders can list their bots for others to buy, generating additional income.

Social Trading and Strategy Sharing

Social trading is another key component of the this crypto tool Marketplace. It allows traders to share insights, discuss strategies, and collaborate on trading ideas. This community-driven approach helps users learn from each other, adapt their strategies, and stay updated with current market trends. Users can leave reviews and ratings on different strategies, making it easier to identify which bots are performing well.

One user experience shared on Altrady highlighted how the social trading feature enabled them to refine their strategy by comparing it with others, leading to a 15% improvement in their monthly returns.

Evaluating and Customizing Bots

Each strategy in the marketplace is transparent, showing detailed information such as historical performance, the number of subscribers, and user feedback. Traders can review these metrics before making a purchase. Once a bot is selected, users can also tweak and customize it according to their specific requirements, making the strategy truly their own.

- Tip: Always backtest any strategy before deploying it with real funds to ensure it performs well under current market conditions.

Marketplace for All Levels

Whether you’re just starting out or are an advanced trader, this crypto tool Marketplace has something for everyone. Beginners can find simple, profitable strategies, while advanced users can experiment with complex setups. By combining copy trading, social trading, and a transparent marketplace, this crypto tool provides a versatile environment where traders can grow, collaborate, and succeed.

Security and Safety in Cryptohopper: Protecting Your Crypto Trades

Security is a top priority for any automated trading platform, and Cryptohopper has implemented several measures to ensure that user accounts and funds remain safe. As a cloud-based trading software, this trading software does not directly hold any user funds. Instead, it operates through API keys, which provide limited access to your exchange accounts, enabling the bot to trade without the ability to withdraw funds. This separation of functionality ensures that even in the unlikely event of a security breach, your funds cannot be moved.

API Security and Permissions

Cryptohopper uses API keys to connect to major exchanges like Binance, Coinbase Pro, and KuCoin. Users must generate API keys with read and trade permissions, but it is recommended to disable withdrawal rights. This approach provides a strong layer of security, ensuring that even if someone gains access to your API key, they will not be able to steal your funds.

- Tip: Always create a new API key specifically for trade bots, and never share it publicly.

Two-Factor Authentication (2FA)

this trading software encourages all users to enable Two-Factor Authentication (2FA). By adding this extra layer of protection, traders are required to enter a unique, time-sensitive code from an authentication app (such as Google Authenticator) when logging in. This prevents unauthorized access to your account, even if someone has your login credentials.

GDPR Compliance and Data Privacy

As a European-based company, this trading software adheres to strict GDPR compliance regulations, ensuring that all user data is handled securely and transparently. The platform does not share or misuse your personal information and takes steps to verify the compliance of all its affiliates.

User Experience Insight

According to GoodCrypto, one user shared how setting up separate API keys for different exchanges and activating 2FA significantly enhanced their peace of mind, allowing them to focus on fine-tuning their trading strategies without worrying about security.

No Withdrawal Rights and Fund Safety

The fact that this trading tool cannot withdraw funds is one of the key aspects that makes it safer than some alternatives. This non-custodial setup means that, while the bot can execute trades and manage positions on your behalf, it cannot transfer your crypto to external addresses. All funds remain in your exchange account, fully controlled by you.

Cryptohopper’s Secure Marketplace

Even the Cryptohopper Marketplace, where traders can buy and sell strategies, operates under stringent security protocols. Every listed strategy undergoes scrutiny to ensure it’s free of malicious code or suspicious behavior, making it safer for traders to experiment with different trading tools without risk.

By incorporating these layers of security—API permissions, 2FA, data privacy, and non-custodial trading—this trading software provides a solid foundation for users to trade confidently and securely, protecting both their funds and personal data.

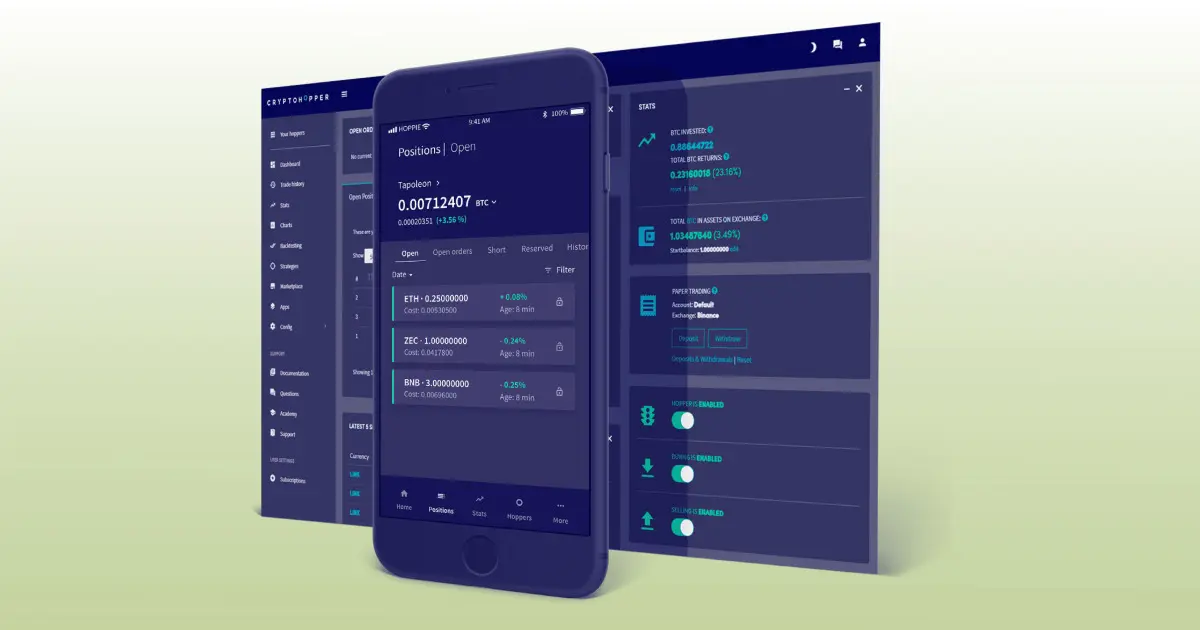

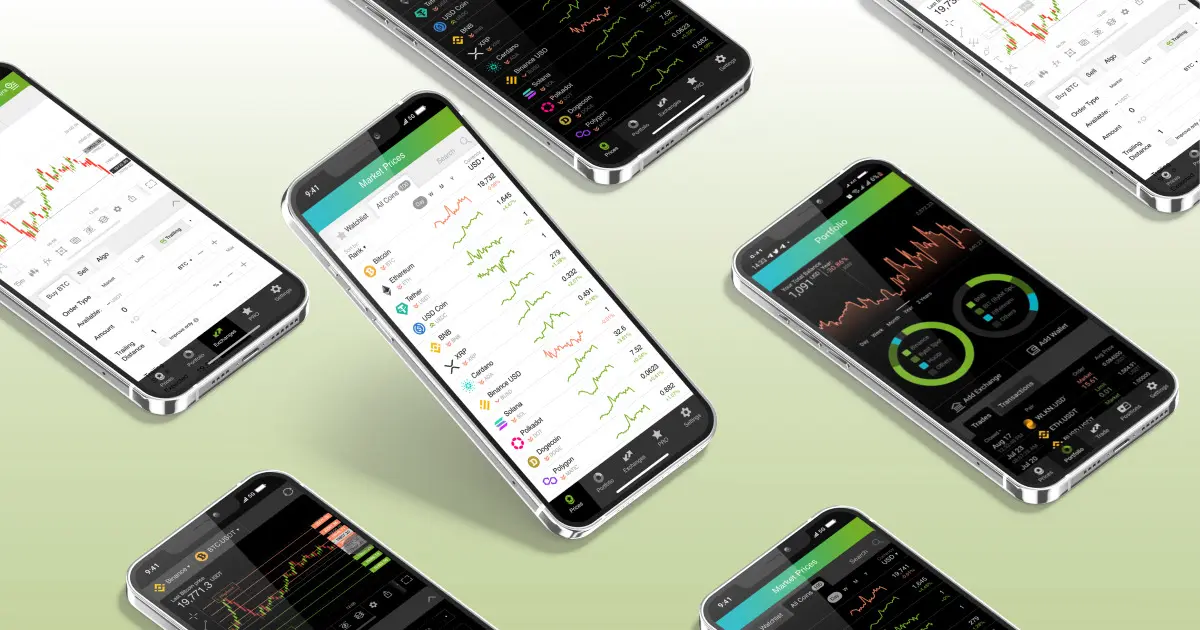

Using the Cryptohopper Mobile App for Crypto Trading on the Go

The Cryptohopper mobile app is a powerful tool that allows traders to manage their strategies, monitor the market, and execute trades from anywhere. Available for both iOS and Android, the app offers nearly the same functionality as the desktop version, making it perfect for traders who want to stay connected to the market without being tied to their computer.

Key Features of the Cryptohopper Mobile App

The app provides real-time access to your trade bots and strategies, allowing users to adjust settings, view active positions, and track performance on the go. With a few taps, you can switch between different trading strategies, change parameters, or even manually override your bot if the market takes a sudden turn.

- Strategy Monitoring: You can review and modify your strategy configurations directly from the app, ensuring you’re always in control of your trades, whether you’re at home or on the move.

- Push Notifications: The app’s push notifications keep you informed of important events, such as trade executions, market movements, and strategy triggers, enabling you to react quickly to changes.

Real-World Use Case

One user mentioned on Atomic Wallet that the mobile app saved them from missing a crucial market reversal. While away from their desk, they received a notification that their trailing stop-loss was triggered, signaling a potential downward trend. With just a few taps, they adjusted their strategy to switch to a short position, ultimately avoiding a significant loss.

Who Is It Best For?

The Cryptohopper mobile app is ideal for traders who need the flexibility to monitor and adjust their trades on the go. Whether you’re commuting, traveling, or simply not near your desktop, the app ensures that you stay connected to your portfolio at all times.

Getting Started with the Cryptohopper Mobile App

To get started, download the app from the Apple App Store or Google Play Store, and log in with your existing account credentials. From there, you’ll be able to access your dashboard, manage your bots, and track your trading performance with ease.

the automated trading platform mobile app complements the platform’s desktop features, providing a seamless trading experience across devices. It’s an excellent addition for traders who want to stay active in the market and never miss an opportunity, no matter where they are.

Customer Support and User Experience in Cryptohopper

Customer support and user experience are crucial factors when choosing a trading platform, and this trading software does a commendable job in both areas. The platform aims to make trading accessible to users of all skill levels through its intuitive interface and robust support options. Here’s a closer look at what traders can expect:

User-Friendly Interface

Cryptohopper is known for its simple and clean design, making it easy for users to navigate the various tools and features without getting overwhelmed. According to feedback from Techopedia, both beginners and advanced traders find the dashboard intuitive, with essential elements like strategy management, trading positions, and performance metrics clearly displayed.

The platform’s drag-and-drop strategy builder is particularly noteworthy, allowing traders to create complex trading strategies without any coding skills. This makes it easier for beginners to design and implement strategies quickly, while more experienced traders can take advantage of advanced options like technical indicators and AI-powered trading strategies.

Educational Resources and Community Support

This crypto bot goes beyond traditional customer support by providing extensive educational resources, including the Cryptohopper Academy, which offers tutorials, video guides, and webinars to help users master the platform. Additionally, the community forum serves as a hub where traders can exchange ideas, share strategies, and ask questions, fostering a collaborative environment.

One user on GoodCrypto noted that participating in the community forum helped them refine their trading approach by learning from other traders’ experiences and adjusting their strategies based on shared insights.

Customer Support Channels

This crypto bot offers multiple support options to address user queries, including:

- Email Support: For more detailed assistance, users can reach out to the support team via email.

- Live Chat: The live chat feature is available for quick and immediate help, making it convenient for urgent issues.

- Help Center: The platform’s extensive help center includes a wide range of articles, FAQs, and step-by-step guides covering everything from setting up a trading tool to advanced strategy customization.

24/7 Availability and Quick Response Times

According to several reviews, Cryptohopper’s customer support team is responsive and helpful, often resolving issues in a timely manner. This is crucial, especially when dealing with automated trading, where a delayed response could potentially lead to missed opportunities or misconfigurations.

User Experience Insight

A user mentioned on Techopedia that they appreciated the platform’s ease of use and quick support response time when they encountered an API connection issue. The support team guided them through the process step-by-step, ensuring that their trading tool was back online swiftly, which prevented any disruption to their strategies.

Verdict on User Experience

This crypto bot provides a solid user experience by combining a user-friendly interface, comprehensive educational resources, and responsive support. Whether you’re a beginner looking for guidance or an experienced trader seeking advanced tools, this crypto tool’s focus on accessibility and support makes it a reliable choice for automated cryptocurrency trading.

Is Cryptohopper Profitable vs Competitors? Real-World Review and Testimonials

When it comes to automated cryptocurrency trading, profitability is the most critical factor for users. While this crypto bot is a versatile tool with a wide range of features, whether or not it is profitable depends largely on the trading strategy employed and the market conditions. In comparison to its competitors like 3Commas, HaasOnline, and Shrimpy, this crypto bot stands out for its user-friendly interface, extensive marketplace, and flexibility, but results may vary.

| Platform | Key Features | User Experience | Profitability Potential | Best For |

|---|---|---|---|---|

| Cryptohopper |

- AI strategy designer - Copy trading and social trading marketplace - Extensive backtesting tools - Trailing stop-loss and dynamic rebalancing - 7-day free trial |

- User-friendly interface - Ideal for beginners and advanced traders - Strong community support and educational resources |

- Depends on strategy configuration - 10% monthly gains reported by some users - Requires regular monitoring and strategy updates |

Beginners looking for ease of use, and advanced traders wanting flexible strategy options. |

| 3Commas |

- Smart trading terminal - Dollar-Cost Averaging (DCA) bots - Options for multiple trading tools - Advanced order types and stop-loss settings |

- Comprehensive toolset but steeper learning curve - Best for traders with some experience - Focused more on active manual trading |

- High potential for profitability with DCA bots - Requires detailed strategy setup - Not as beginner-friendly |

Intermediate and advanced traders looking for complex automation tools. |

| HaasOnline |

- Scriptable bots using HaasScript - Market-making and arbitrage tools - Wide range of technical indicators - Algorithmic trading features |

- Requires coding knowledge - High degree of customization - Suitable for highly technical traders |

- High profitability potential for experienced users - Steep learning curve - Not suitable for beginners |

Professional traders with coding skills looking for full customization. |

| Shrimpy |

- Social trading and portfolio management - Rebalancing tools - Built-in strategy automation - Easy-to-use interface |

- User-friendly platform - Focused on long-term portfolio management - Limited advanced trading features |

- Lower profitability potential compared to other bots - Best for passive and long-term investors |

Beginners and long-term holders looking for automated rebalancing. |

Real-World Profitability and Testimonials

Many users report mixed results depending on their trading experience and strategy configurations. For instance, one user shared on CoinBureau that they initially struggled with this crypto tool due to their lack of experience in setting up trading strategies. However, after taking advantage of the Cryptohopper Academy and experimenting with different strategies using the backtesting tool, they were able to optimize their approach and saw consistent returns of around 10% monthly during favorable market conditions.

On the other hand, some advanced traders found this crypto bot’s AI strategy designer and market-making features to be game-changers, providing them with tools that are not as accessible on competing platforms. One trader mentioned on GoodCrypto that they were able to profit during both bullish and bearish trends by using this trading tool’s trailing stop-loss and dynamic rebalancing features, which helped lock in gains and minimize losses.

How Does It Compare to Competitors?

Compared to other trading softwares like 3Commas and HaasOnline, this trading tool is more accessible for beginners due to its user-friendly interface and extensive educational resources. 3Commas, for example, offers a similarly comprehensive suite of tools, but it’s often noted that it has a steeper learning curve and lacks the same level of social trading and marketplace options. the trading tool’s marketplace allows users to leverage strategies from top traders, providing an edge for those who are just starting.

However, profitability is not guaranteed. As noted by CoinBureau, the performance of any automated trade bot, including Cryptohopper, is only as good as the strategy it executes. For instance, some traders using aggressive strategies without proper risk management faced substantial losses during high-volatility periods, underscoring the importance of strategy optimization and continuous monitoring.

User Experience Insight

For those considering this trading tool, a common recommendation is to start with the Explorer Plan and utilize the 7-day free trial. This approach allows users to test different strategies without financial risk. One user shared that by using Cryptohopper’s Paper Trading feature for two weeks, they were able to refine their strategy before committing real funds, which significantly improved their overall experience and profitability.

While this crypto bot offers a solid set of tools and features that can lead to profitability, its success depends heavily on the user’s strategy, market knowledge, and the ability to adapt to changing conditions. Compared to its competitors, this crypto bot’s emphasis on flexibility, educational support, and a vibrant marketplace makes it a strong contender, but like any trading platform, it requires a strategic approach and ongoing learning to achieve consistent results.

Cryptohopper Review Conclusion: Is It the Best Crypto Trading Bot?

After thoroughly analyzing Cryptohopper’s features, usability, and real-world user feedback, it’s clear that this platform offers a solid set of tools for both beginner and advanced traders looking to automate their trading strategies. Its intuitive interface, extensive strategy marketplace, and advanced features like trailing stop-loss, AI strategy designer, and exchange arbitrage set it apart from many competitors in the automated trading space.

Strengths of Cryptohopper

One of Cryptohopper’s main advantages is its ability to cater to different experience levels. With easy-to-use strategy templates and the option to create complex setups using the drag-and-drop designer, it empowers traders to customize their strategies without needing coding skills. This flexibility, combined with robust risk management tools, gives users the control they need to navigate volatile markets effectively.

Additionally, the support for major exchanges like Binance, Coinbase Pro, and KuCoin ensures high liquidity and access to a wide range of trading pairs. This makes it suitable for executing various trading strategies, from simple long/short setups to sophisticated market-making and arbitrage.

Potential Drawbacks

However, like any trading software, profitability is not guaranteed and depends heavily on the strategy, market conditions, and the trader’s expertise. Users need to be proactive in testing, optimizing, and updating their strategies regularly to achieve consistent results. Beginners may need to invest time in learning how to best use the platform, even with the educational resources available.

Real-World Testimonials

User experiences shared on platforms like CoinBureau and GoodCrypto suggest that many traders have found success by leveraging this automated trading platform’s tools, but only after refining their strategies through backtesting and practice. One experienced trader reported achieving consistent monthly returns by using a mix of this crypto bot’s trailing stop-loss and dynamic rebalancing features.

Is Cryptohopper the Best Crypto Trading Bot for Automation?

Ultimately, this crypto tool stands out as a powerful, versatile trading software that can be adapted to various trading styles. For beginners, the marketplace and social trading options provide a strong starting point, while advanced traders can unlock more sophisticated strategies with higher-tier plans. However, as with any trading tool, success depends on the user’s ability to implement sound strategies and remain disciplined.

For those willing to put in the time to learn and adapt, Cryptohopper is definitely one of the best options available for automating crypto trading.

Frequently Asked Questions About Cryptohopper: Crypto Trading Bot (FAQs)

Cryptohopper is one of the most popular automated trading tools in the cryptocurrency world, but like any advanced trading tool, it raises several questions, especially for new users. Here, we’ve compiled a list of frequently asked questions to help you better understand how this crypto tool works and what you can expect when using it.

Is Cryptohopper Safe to Use?

Yes, this trading tool is designed with safety in mind. The platform connects to your exchange accounts using API keys, which provide trading access but do not allow the bot to withdraw funds. This ensures that your funds are secure within your exchange account. Additionally, this crypto tool recommends disabling withdrawal rights on API keys to add an extra layer of security. The platform also supports Two-Factor Authentication (2FA) to protect your account from unauthorized access.

Can Beginners Use Cryptohopper?

Absolutely! this crypto tool is designed to cater to traders of all experience levels. Beginners can take advantage of the user-friendly interface, the marketplace for pre-configured strategies, and educational resources like the this crypto bot Academy. New users can start with the free Pioneer Plan or try the Explorer Plan with a 7-day free trial to explore the platform without financial risk.

What Makes Cryptohopper Different from Other Trading tools?

Cryptohopper stands out due to its flexibility, extensive strategy marketplace, and support for both simple and advanced trading strategies. It offers features like a drag-and-drop strategy builder, AI-powered strategy designer, trailing stop-loss, and arbitrage tools. This combination of accessibility and advanced options makes this crypto bot unique compared to competitors like 3Commas or HaasOnline, which may have steeper learning curves.

How Much Does Cryptohopper Cost?

Cryptohopper offers four pricing plans: Pioneer (Free), Explorer ($29/month), Adventurer ($69/month), and Hero ($129/month). Annual billing options are available at a discounted rate. Each plan offers different features and trading limits, making it easy to choose a plan that fits your trading goals and budget. The Pioneer Plan is completely free and provides a basic introduction to the platform.

Which Exchanges Does Cryptohopper Support?

Cryptohopper supports a wide range of popular cryptocurrency exchanges, including Binance, Coinbase Pro, KuCoin, Kraken, and OKX, among others. Currently, it integrates with 14 major exchanges, allowing users to automate their trades across multiple platforms and access a diverse range of trading pairs.

Can I Use Cryptohopper to Trade Multiple Cryptocurrencies at Once?

Yes, this crypto bot allows users to trade multiple cryptocurrencies simultaneously. You can create multiple trading tools, each configured with different strategies and trading pairs. This flexibility makes it easy to diversify your trading activities and manage your portfolio from a single platform.

What Kind of Strategies Can I Implement on Cryptohopper?

Cryptohopper supports a variety of strategies, ranging from simple stop-loss and take-profit rules to complex algorithmic and AI-powered strategies. You can build your own strategy using the drag-and-drop designer or choose from hundreds of pre-configured strategies in this Trading Software Marketplace. The platform also offers features like Dollar-Cost Averaging (DCA), trailing stop-loss, and market-making strategies.

Does Cryptohopper Guarantee Profit?

No, Cryptohopper does not guarantee profit. While the platform provides powerful tools for strategy building and automation, the success of your trades depends entirely on the strategies you use and how well they are implemented. It’s crucial to thoroughly backtest and optimize your strategies before deploying them in live markets.

What Happens If There’s a Problem with My Bot?

If you encounter issues, this trading tool offers multiple support options, including email support, a live chat feature, and an extensive knowledge base. Additionally, there’s an active community forum where users share insights and solutions, making it easier to troubleshoot any problems that arise.

Can I Use Cryptohopper on My Mobile Device?

Yes, Cryptohopper has a dedicated mobile app available for both iOS and Android. The app provides almost all the functionality of the desktop version, allowing users to manage their bots, adjust strategies, and receive notifications on the go. This flexibility ensures that you stay connected to the market, no matter where you are.

Discussion