NFT Art: Mint & Sell Digital Art in Top 5 Best NFT Markets

NFT Art: Learn how to mint & sell Digital Art in Top 5 Best NFT Markets. Find top NFT Marketplaces, minting tips and profit from NFT crypto art.

NFT Art is revolutionizing the digital art landscape by providing artists with innovative ways to create, mint, and sell their virtual art in thriving NFT markets. With the rapid rise of NFT crypto art, artists are tapping into the world of non-fungible tokens to monetize their work, connect with collectors, and reach a global audience. But the key to success lies in choosing the right platform to mint and sell your NFT artwork.

This comprehensive guide will walk you through the entire process, from understanding NFT minting to listing and profiting from your virtual art on the top 5 best NFT marketplaces. Whether you’re an established artist or a newcomer to the NFT markets, you’ll discover the leading platforms such as OpenSea, Rarible, SuperRare, Nifty Gateway, and Foundation—each with unique features and communities that can help you stand out.

Learn how to navigate these NFT artwork markets, implement effective strategies, and maximize your earnings by leveraging these platforms to showcase your digital artwork in the booming NFT crypto art industry. Let’s dive into the top marketplaces, essential minting steps, and tips to build a profitable presence in the world of Digital Creation.

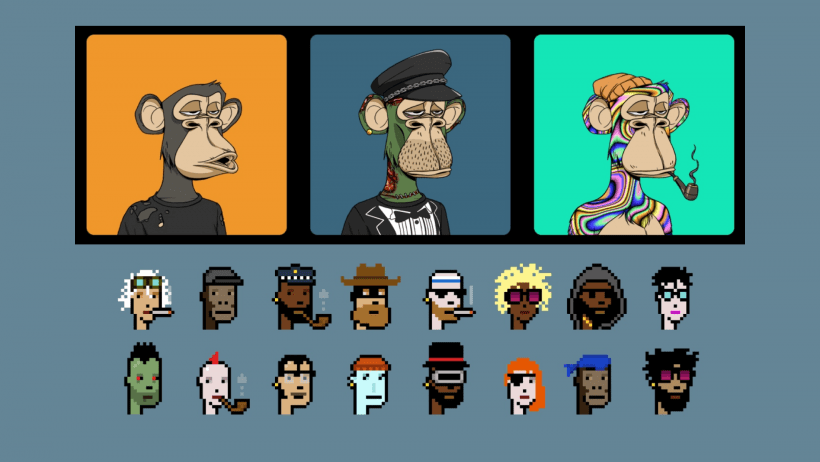

What is NFT Art? Exploring the Basics of Digital Art in the Crypto World

NFT Artwork has transformed how artists create and monetize digital creations. An NFT, or non-fungible token, is a unique digital asset verified on the blockchain, ensuring ownership and rarity for digital files like images, music, or 3D models. Unlike traditional digital artwork, NFTs can't be replicated, making each piece one-of-a-kind.

Owning an NFT means holding a certificate of authenticity, which opens new revenue opportunities for artists through royalties on resales. Platforms like Rarible and SuperRare allow creators to earn up to 10% royalties, providing long-term passive income. This shift has attracted artists of all levels, with notable successes like Beeple’s $69 million NFT sale, showing the potential value of digital creations.

The appeal lies in NFTs' ability to secure ownership, prevent forgery, and reach a global market. Artists from various fields are now using platforms like OpenSea and Foundation to showcase and profit from their work, making NFTs a powerful tool for creative expression and income.

How to Mint NFT Artwork: A Complete Guide for Beginners

Minting an NFT involves turning your digital creation into a unique token on the blockchain, making it available for trade on top marketplaces like OpenSea and Rarible. For beginners, it may seem technical, but it can be done with just a few straightforward steps.

1. Set Up a Crypto Wallet

Start by creating a cryptocurrency wallet such as MetaMask, which supports Ethereum, the primary blockchain used for NFTs. Make sure to securely back up your 12-word recovery phrase and add some ETH to cover gas fees, which are necessary for processing transactions.

2. Choose the Right Marketplace

Selecting the right platform is crucial for visibility and sales. OpenSea is the largest and most versatile, while SuperRare and Foundation cater to high-end art but may require an invitation. Consider your art style and audience when choosing.

3. Upload and Mint Your NFT

Once your wallet is connected, click the “Create” button on your chosen platform. Upload your file, add a title and description, and set royalties (usually 5% to 10%) to earn a percentage on future sales. This step defines your art’s uniqueness and secures your rights on the blockchain.

4. Pay the Gas Fee & List Your Art

Minting your NFT involves a gas fee that varies based on network activity. After paying the fee, list your NFT for sale by setting a price or opting for an auction. Promote your work on social media and engage with NFT communities to attract potential buyers.

Following these steps will help you successfully mint your first NFT and start building your presence in the digital design world.

Choosing the Right Blockchain: Ethereum vs. Other Blockchains for NFTs

Choosing the right blockchain is a crucial decision when minting and selling NFTs. The blockchain determines transaction costs, speed, and long-term value of your digital assets. While Ethereum has been the dominant choice due to its large user base and well-established ecosystem, other blockchains like Polygon, Binance Smart Chain, and Tezos are gaining popularity for their lower fees and unique features.

Ethereum: The Pioneer for NFTs

Ethereum is widely considered the go-to blockchain for NFTs, supporting major marketplaces like OpenSea, Rarible, and SuperRare. Its extensive network of developers, high liquidity, and smart contract functionality make it ideal for both new and experienced creators. However, Ethereum’s biggest drawback is its high “gas fees,” which are transaction costs paid to network validators. For example, minting an NFT on Ethereum during peak times can cost upwards of $100, which can be prohibitive for artists with limited budgets.

Despite these costs, many high-profile NFT sales, like Beeple’s $69 million collection, took place on Ethereum, establishing it as the premium choice for high-value digital artwork.

Alternative Blockchains: Affordable and Scalable Options

To combat Ethereum’s high fees, artists are turning to alternative blockchains like Polygon and Tezos. Polygon, for instance, is integrated into platforms like OpenSea, offering faster transactions and significantly lower fees. This makes it a strong option for creators looking to minimize expenses. Additionally, Polygon's compatibility with Ethereum allows seamless transfers between the two, providing flexibility for artists.

Tezos is another appealing alternative, known for its eco-friendly “proof-of-stake” model that uses less energy compared to Ethereum’s traditional proof-of-work. Its lower environmental impact has made it popular among eco-conscious artists and collectors. In fact, French artist Joanie Lemercier moved his NFT project to Tezos after learning about Ethereum’s carbon footprint, which aligned better with his sustainability values.

Meanwhile, Binance Smart Chain (BSC) has gained traction due to its fast transaction speeds and lower costs, making it ideal for collectibles and gaming-related NFTs. However, BSC’s smaller community and lack of high-profile art sales mean it may not yet offer the same visibility for digital artwork creators as Ethereum.

Which Blockchain Should You Choose?

The choice of blockchain ultimately depends on your goals and budget. If you’re focused on high-value art and have the budget to cover gas fees, Ethereum remains a solid choice. However, if cost-efficiency and sustainability are priorities, alternatives like Polygon and Tezos offer compelling benefits. By weighing the pros and cons of each blockchain, artists can ensure their work is not only accessible but also aligned with their personal values and audience preferences.

Top 5 NFT Markets for Digital Artists to Mint & Sell Art

Choosing the right NFT marketplace is essential for artists aiming to maximize visibility, control costs, and build a loyal collector base. Below are detailed reviews of the top 5 NFT markets, analyzed based on their features, user experience, fees, and best use cases to help digital artists make informed decisions.

| NFT Market | Unique Features | Best For | Fees | Royalties | Pros | Cons |

|---|---|---|---|---|---|---|

| OpenSea | Lazy minting, supports multiple blockchains | Broad audience and diverse art styles | 2.5% sales fee | Up to 10% | No upfront fees, large audience, high liquidity | High Ethereum gas fees |

| Rarible | Community governance via $RARI tokens, custom NFTs | Artists wanting royalties and community control | 2.5% for buyers/sellers | Up to 10% | Supports customizable smart contracts | Lower visibility compared to larger platforms |

| SuperRare | Exclusive, single-edition art | High-end digital artists | 15% commission | 10% on future sales | High-quality, serious collectors | High entry barriers, limited audience |

| Nifty Gateway | Curated limited-edition drops, fiat and crypto support | Premium collaborations and exclusive releases | 5% seller fee + $0.30 | Split between artist/platform | High visibility, broad payment options | Highly competitive, drops sell out quickly |

| Foundation | Invite-only artist curation, strong community | Experimental and niche digital artwork | 15% commission | 10% on secondary sales | Strong artist support, community engagement | Invite-only model limits accessibility |

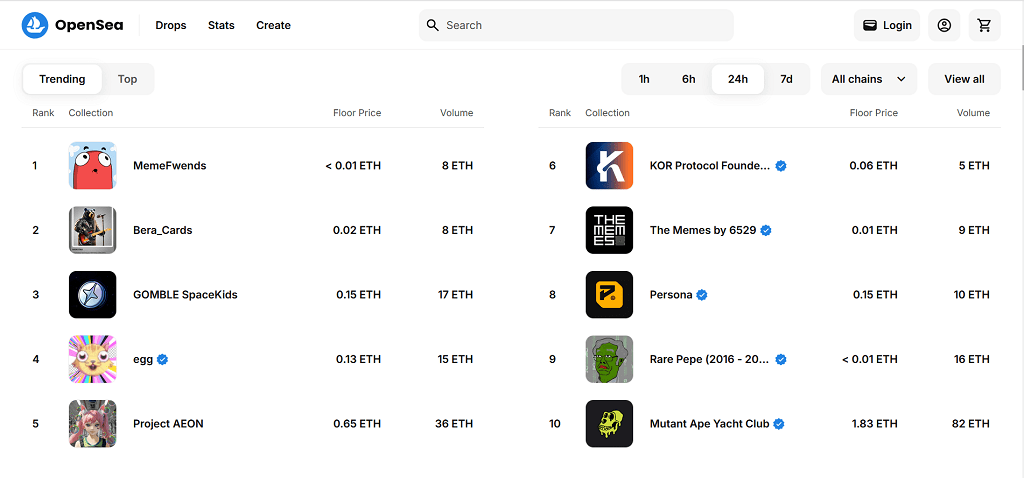

OpenSea: The Largest and Most Versatile NFT Marketplace

- Platform Overview:

OpenSea is the world’s largest NFT marketplace, supporting a wide array of digital assets like art, music, domain names, and virtual worlds. It caters to both beginner and experienced artists with its user-friendly interface and broad audience reach. It also supports multiple blockchains, including Ethereum and Polygon, making it highly versatile for creators. - Unique Features:

OpenSea offers “lazy minting,” allowing artists to list NFTs without paying upfront fees. It also supports the integration of external collections, giving creators flexibility in managing their assets across multiple platforms. - User Experience:

The platform is easy to navigate, with simple tools for uploading and managing NFT collections. Artists can track their sales, interact with collectors, and customize their storefronts, enhancing the user experience. - Fee Structure:

OpenSea charges a 2.5% fee on each sale. Artists can set royalties up to 10% on secondary sales, providing ongoing revenue streams. - Pros and Cons:

Pros:

- No upfront minting fees due to lazy minting.

- Broad audience reach and high liquidity.

- Supports multiple blockchains.

Cons:

- High gas fees for Ethereum-based transactions.

- Intense competition due to its large user base.

- Best For:

OpenSea is best for creators who want to reach a wide audience and need flexibility in managing their NFTs across various blockchains. - Case Study/Example:

Artist “Fewocious” gained massive success on OpenSea, earning over $1 million by leveraging the platform’s reach and building a strong community around his unique art style.

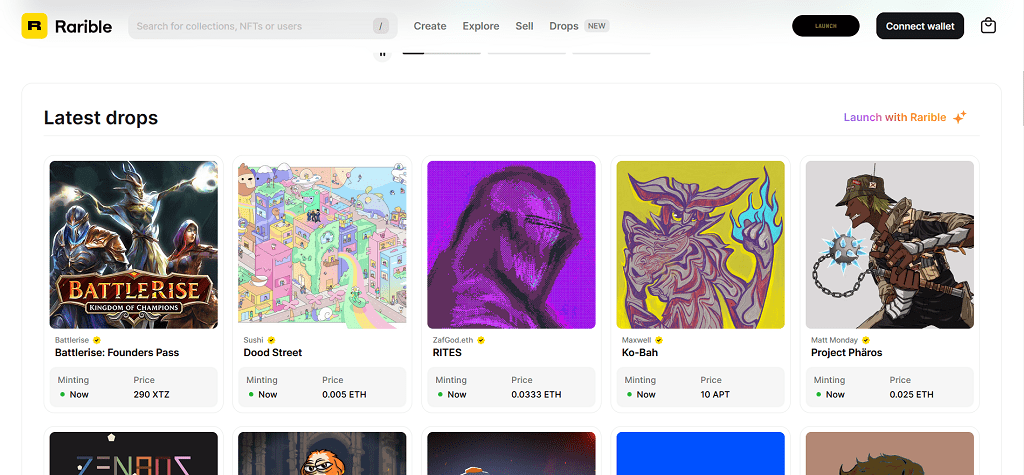

Rarible: Community-Driven and Royalty-Focused

Platform Overview:

Rarible is a community-oriented NFT marketplace that empowers artists by offering governance through its native token, $RARI. It is known for its focus on digital art and has a strong community of creators and collectors.

- Unique Features:

Rarible allows artists to create “community-based” NFTs and vote on platform decisions using $RARI tokens. It supports customizable smart contracts, enabling artists to define unique properties for their digital assets. - User Experience:

Rarible’s interface is easy to use, with tools for setting up royalties, tracking sales, and customizing NFT properties. The platform also emphasizes community engagement, which can be appealing to creators looking to build a loyal following. - Fee Structure:

Rarible charges a 2.5% fee for both buyers and sellers. Artists can set royalties up to 10%, making it a strong choice for long-term revenue generation. - Pros and Cons:

Pros:

- Supports creator royalties up to 10%.

- Community governance via $RARI tokens.

- Direct artist-to-collector interaction.

Cons:

- Verification can be challenging for new artists.

- Smaller audience compared to OpenSea.

- Best For:

Rarible is ideal for artists seeking a community-focused platform with strong control over royalties and creative freedom. - Case Study/Example:

Digital artist Pak utilized Rarible’s tools to launch community-based NFTs, fostering an engaged collector base and generating significant sales.

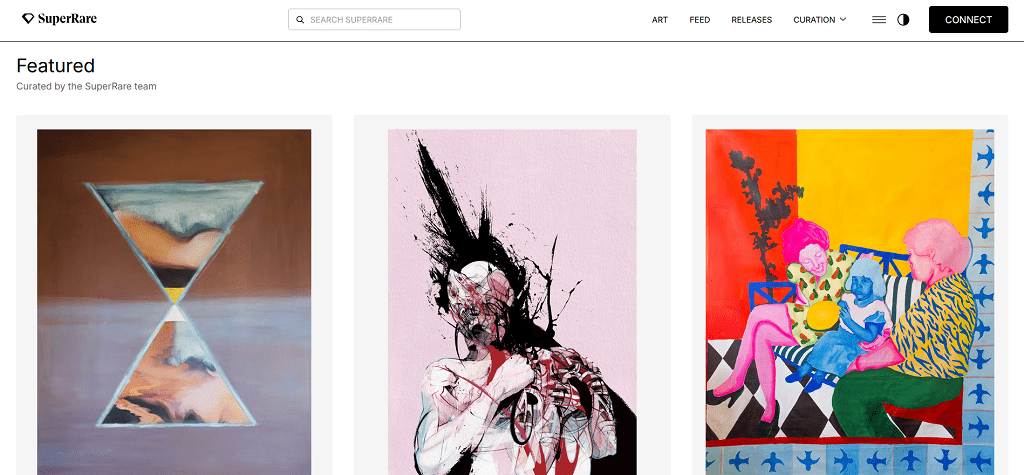

SuperRare: High-End Marketplace for Unique Digital Art

- Platform Overview:

SuperRare is an exclusive NFT marketplace focusing on one-of-a-kind digital artworks. With a curated approach, SuperRare targets serious collectors and high-end artists, making it a premier platform for rare digital art. - Unique Features:

Each piece listed on SuperRare is a single-edition work, ensuring rarity and exclusivity. The platform also provides a clean, minimalistic interface that emphasizes the artwork, creating a premium experience for both creators and collectors. - User Experience:

SuperRare’s interface is polished and professional, with detailed artist profiles and an emphasis on storytelling. However, the strict submission process means that not all artists can easily join the platform. - Fee Structure:

SuperRare takes a 15% commission on primary sales and a 3% fee from buyers. Artists earn 85% of the sale and 10% royalties on future sales, making it lucrative for long-term earning potential. - Pros and Cons:

Pros:

- Exclusivity attracts serious collectors.

- High-quality, curated artworks.

- Long-term royalties for artists.

Cons:

- High barriers to entry for new artists.

- Limited to a smaller, high-end audience.

- Best For:

SuperRare is best for established artists looking to sell high-value, one-of-a-kind pieces to serious collectors. - Case Study/Example:

Digital artist Hackatao has made significant sales on SuperRare, benefiting from the platform’s focus on high-end collectors and its premium positioning.

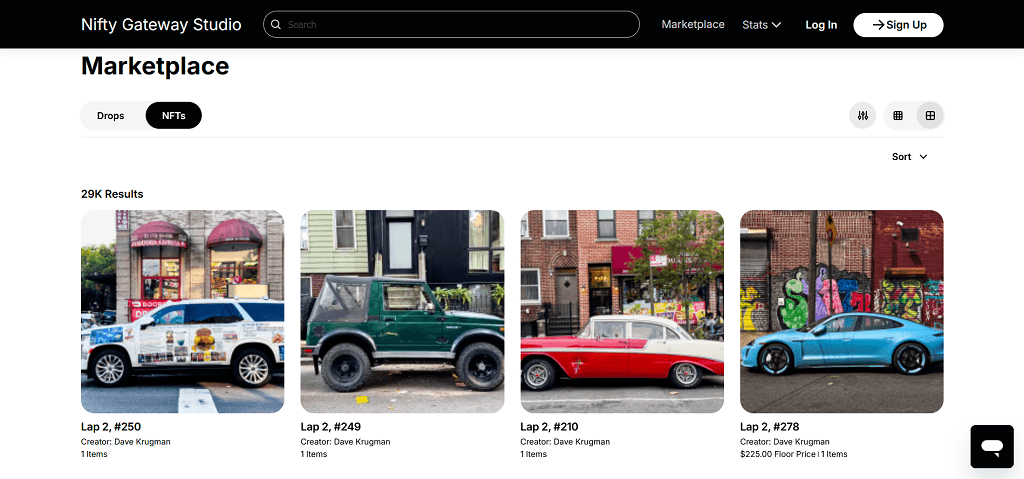

Nifty Gateway: Ideal for Premium Limited-Edition Crypto Art

- Platform Overview:

Nifty Gateway is a premium marketplace known for its collaborations with top artists, brands, and celebrities. It specializes in curated “drops” of limited-edition NFTs, often selling out within minutes due to high demand. - Unique Features:

The platform offers scheduled drops and supports purchases in both fiat and cryptocurrency, making it accessible to a broader audience. Nifty Gateway also manages custody of the NFTs, simplifying the process for buyers and sellers. - User Experience:

Nifty Gateway’s emphasis on limited drops creates a sense of urgency, driving high engagement. Its interface is sleek and focused, making it easy for collectors to explore and purchase high-profile NFTs. - Fee Structure:

Nifty Gateway charges a 5% seller fee and a 30 cent transaction fee on secondary sales. It also offers royalty splits between the artist and platform, supporting long-term creator earnings. - Pros and Cons:

Pros:

- High visibility due to curated drops.

- Option to purchase with credit cards.

- Strong marketing support for artists.

Cons:

- Competitive; drops sell out quickly.

- Focused on high-end, exclusive releases.

- Best For:

Nifty Gateway is ideal for artists with high-profile collaborations or those looking to reach an exclusive, premium audience. - Case Study/Example:

Artist Beeple used Nifty Gateway for his early NFT drops, achieving instant sell-outs and building momentum that culminated in his record-breaking $69 million sale on another platform.

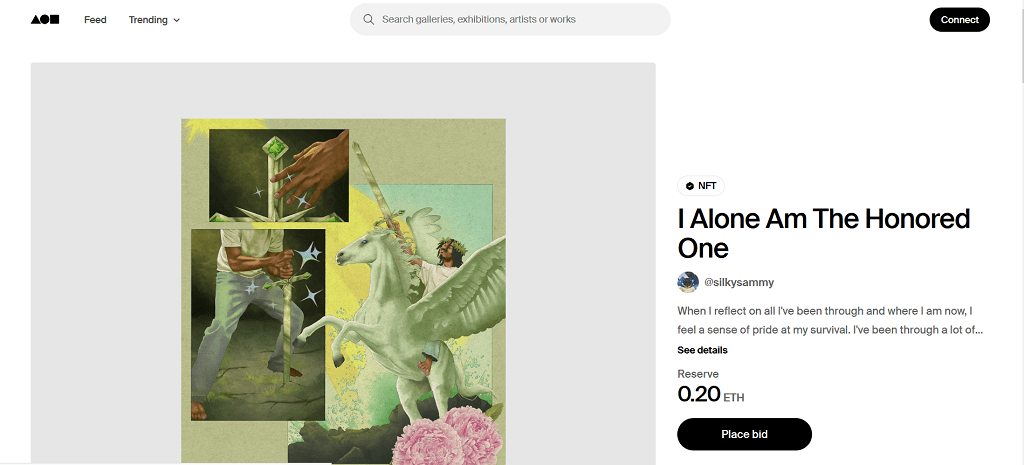

Foundation: A Curated Marketplace Supporting Digital Art Culture

- Platform Overview:

Foundation is a curated, invitation-only platform that prioritizes artistic quality and community. It is known for supporting experimental and avant-garde digital art, making it a go-to for creative professionals and collectors who appreciate unique artistic perspectives. - Unique Features:

Foundation emphasizes artist curation through an invite-only system, maintaining high standards for its offerings. It also integrates social elements, allowing artists to support and promote each other’s work. - User Experience:

Foundation’s interface is clean and intuitive, with a strong focus on the story behind the art. The exclusivity of the platform can help artists build a niche following and gain recognition in a dedicated art community. - Fee Structure:

Foundation takes a 15% commission on primary sales, with a 10% royalty on secondary sales. The fee structure aligns with other high-end marketplaces, rewarding artists for future resales. - Pros and Cons:

Pros:

- High-quality, curated platform.

- Strong community and artist support.

- Artist-to-artist invitation system.

Cons:

- Limited accessibility due to invite-only model.

- Smaller user base compared to larger platforms.

- Best For:

Foundation is perfect for artists focused on building a niche presence in the digital art community and seeking a platform that values artistic integrity. - Case Study/Example:

Emerging digital artist Krista Kim launched her “Mars House” on Foundation, selling it for over $500,000 and establishing herself as a pioneer in digital real estate NFTs.

How to Promote Your Digital Art in NFT Marketplaces

Successfully promoting your digital art in NFT marketplaces is crucial for gaining visibility, building a collector base, and ultimately maximizing sales. With the right strategies, you can distinguish your work in a crowded market and attract potential buyers. Here are some effective tactics to help you promote your art and stand out in the competitive NFT space.

1. Leverage Social Media for Exposure

Social media platforms like Twitter, Instagram, and TikTok are essential tools for NFT artists. Regularly share updates, showcase your creative process, and engage with your audience. Use relevant hashtags like #NFTArt, #DigitalArt, and #CryptoArt to reach a broader audience. A great example is Beeple, who used Twitter to create buzz around his collections, which played a significant role in his multi-million dollar NFT sales. Additionally, join dedicated NFT communities on Discord and Reddit to connect with potential buyers and fellow creators.

2. Collaborate with Other Artists and Influencers

Collaborations can exponentially increase your visibility by tapping into other creators’ audiences. Partner with fellow artists for joint projects or collaborate with influencers who have established communities in the NFT space. These partnerships can introduce your work to new collectors and add credibility to your profile. For instance, the well-known NFT artist Pak has collaborated with other digital creators to launch community-focused projects, which boosted his visibility and sales.

3. List Your Work on Multiple Marketplaces

While focusing on a primary marketplace like OpenSea or Rarible is a good strategy, listing your art on multiple platforms can expand your reach. For example, if you start on OpenSea, consider also minting exclusive pieces on platforms like Foundation or SuperRare. Each marketplace has a unique community, and showcasing your work across different platforms helps attract diverse collectors.

4. Utilize NFT Calendar Sites and Drops

NFT calendar websites, like NFTCalendar.io, allow you to announce upcoming drops and events, generating excitement around your releases. Scheduling a drop and promoting it ahead of time builds anticipation and encourages collectors to be ready for the launch. Platforms like Foundation and Nifty Gateway often host curated drops, which help generate buzz and drive interest in the artwork.

5. Optimize Your NFT Listings with Detailed Descriptions and Tags

Metadata is critical when listing NFTs. Use descriptive titles, compelling stories, and accurate tags for your artwork to enhance discoverability. Buyers often search by specific themes or styles, so using precise keywords related to your art style will help it appear in relevant searches.

6. Engage Actively with Your Community

Building a strong relationship with your audience is key. Respond to comments, share behind-the-scenes content, and provide value by discussing your creative journey. Collectors appreciate authenticity, and by cultivating a loyal community, you increase the chances of your NFTs being shared and recommended by fans.

By implementing these strategies, you can effectively promote your digital creation, build your reputation, and increase your chances of success in the ever-evolving NFT market.

Future of Digital Creation: Trends to Watch in the NFT Markets

The Crypto Art market is constantly evolving, with new technologies and trends shaping how digital artwork is created, sold, and collected. As the industry matures, several key trends are emerging that will significantly impact artists, collectors, and the broader NFT community. Understanding these trends can help digital artists and investors stay ahead of the curve and leverage new opportunities for growth and innovation.

1. Cross-Blockchain Compatibility and Expansion

Currently, most NFTs are minted on the Ethereum blockchain, but high gas fees and network congestion have led to the rise of alternative blockchains like Polygon, Tezos, and Binance Smart Chain. The future of NFT art will likely include cross-blockchain compatibility, allowing artists to seamlessly move their NFTs between different chains. This flexibility will lower costs and make it easier for creators to reach new audiences. For example, platforms like OpenSea already support both Ethereum and Polygon, giving artists the ability to choose a more cost-effective blockchain for minting and transactions.

2. Integration of AI and Generative Art

AI and generative art are gaining traction in the NFT space, enabling creators to produce complex, algorithm-driven artwork that evolves over time. Artists like Pak and platforms like Art Blocks have pioneered the use of generative algorithms to create unique art pieces that push the boundaries of digital creativity. This trend will continue to grow, as AI-based art offers collectors the chance to own pieces that change dynamically, providing a new layer of interaction and personalization.

3. Enhanced Utility and Real-World Benefits

As the NFT market becomes more sophisticated, computer-generated art is beginning to offer more than just aesthetic value. NFTs are being paired with real-world benefits such as access to exclusive events, physical collectibles, or even property rights. This trend is transforming NFTs into multi-dimensional assets. For instance, projects like Bored Ape Yacht Club offer membership perks and event access, demonstrating how NFTs can be used to create value beyond digital ownership.

4. Growth of Decentralized Autonomous Organizations (DAOs)

DAOs are community-led entities with no central authority, and they are starting to reshape how virtual art projects are managed and funded. Through DAOs, artists and collectors can pool funds, vote on project directions, and co-own pieces of virtual art. Platforms like Rarible are already exploring DAO-based governance models, giving creators more control over platform decisions and incentivizing community participation.

5. Sustainability and Eco-Friendly Solutions

With the rise of eco-consciousness, the environmental impact of blockchain technology has become a critical issue. Ethereum’s current proof-of-work (PoW) model consumes large amounts of energy, leading many artists to switch to more sustainable platforms like Tezos, which use less energy-intensive proof-of-stake (PoS) models. As blockchain technology evolves, we can expect more eco-friendly solutions, such as Ethereum’s anticipated shift to Ethereum 2.0, which promises to drastically reduce its energy consumption.

6. Metaverse Integration

The concept of the metaverse—shared virtual spaces where users interact using digital avatars—is driving a new wave of interest in NFTs. Platforms like Decentraland and The Sandbox are integrating NFTs as virtual real estate, wearables, and art, allowing artists to create immersive experiences and monetize their work in new ways. As the metaverse becomes more mainstream, owning and displaying NFT artwork in these digital worlds will become increasingly popular.

As these trends unfold, the future of Crypto Art will be defined by greater technological innovation, cross-chain collaboration, and expanded utility. For digital artists, staying updated on these developments is key to harnessing the full potential of the evolving NFT marketplaces.

Maximizing Profits: Strategies for Selling and Promoting NFT Artwork

Creating unique and captivating digital artwork is only half the battle when it comes to achieving success in the NFT market. To maximize profits, artists must adopt strategic approaches for selling and promoting their art. By understanding pricing, leveraging marketing channels, and building strong relationships with collectors, digital creators can significantly enhance their earnings and reputation in the NFT space.

1. Set the Right Price and Offer Royalties

Pricing is one of the most crucial factors for selling NFTs. New artists should start by researching similar artworks on platforms like OpenSea and Rarible to determine competitive prices. A common strategy is to list initial works at a lower price to build momentum and a collector base, and then gradually increase prices as demand grows. Additionally, setting a royalty percentage (usually between 5% to 10%) on secondary sales ensures artists receive a share of profits when their work is resold, generating passive income over time.

For example, digital artist Beeple leveraged this model by setting royalties on his early sales, earning substantial sums when collectors later resold his art at much higher prices.

2. Build Your Personal Brand and Engage the Community

Artists who actively promote their work and engage with their audience have a higher chance of success. Use social media platforms like Twitter, Instagram, and Discord to share behind-the-scenes content, explain your creative process, and announce upcoming drops. Regular updates not only keep your audience engaged but also establish your personal brand, making your art more recognizable.

One effective case is that of digital artist Pak, who cultivated a strong community presence through engaging Twitter updates and collaborations, leading to multi-million-dollar sales on platforms like SuperRare and Nifty Gateway.

3. Leverage Multiple Marketplaces

While focusing on one platform helps build a reputation, diversifying across multiple NFT marketplaces can increase your visibility. For instance, artists might use OpenSea for wide exposure and low-cost minting, while opting for Foundation or SuperRare to showcase exclusive, high-value pieces. This strategy allows creators to reach various types of collectors, maximizing sales potential and brand exposure.

4. Time Your Releases Strategically

Timing is a critical aspect of NFT sales. Releasing new collections during peak activity periods or aligning with major events (like cryptocurrency price surges) can amplify interest and lead to higher bids. Announcing your drops in advance through platforms like NFTCalendar.io can create anticipation and drive traffic to your listing. Use this time to build up engagement on social media, generating excitement and encouraging your followers to participate.

5. Collaborate with Other Artists and Influencers

Collaborations can elevate your profile by introducing your work to new audiences. Partnering with well-known NFT artists or influencers who share a similar style or vision can add credibility and attract collectors. These collaborations often result in unique, limited-edition pieces that can command higher prices.

A successful example of this strategy is when artist Fewocious collaborated with music producer RAC. Their joint NFT drop brought together fans from both communities, resulting in sold-out collections and high resale values.

6. Participate in Auctions and Limited-Edition Drops

Exclusive drops and timed auctions create a sense of urgency that can drive up demand. Platforms like Nifty Gateway and Foundation often host such events, making them ideal for artists who want to create buzz around their releases. Setting a minimum reserve price and letting collectors bid can lead to competitive pricing, ensuring you get the best value for your art.

By combining these strategies, digital artists can maximize their sales, build a dedicated following, and generate long-term profits in the growing NFT market. The key is to be proactive, adaptable, and consistently engaged with your community.

Conclusion: Building a Successful NFT Artwork Business

Creating a successful Blockchain Art business goes beyond simply minting and listing digital assets. It requires a thoughtful combination of choosing the right marketplace, strategic promotion, and community engagement. Understanding the nuances of various platforms like OpenSea, Rarible, SuperRare, Nifty Gateway, and Foundation can help you align your digital creations with the right audience, ultimately boosting visibility and profitability.

For newcomers, starting with platforms that offer low-cost or “lazy” minting options, such as OpenSea, is an excellent way to minimize upfront costs while learning the dynamics of the NFT markets. As your experience and collector base grow, transitioning to curated platforms like SuperRare or Foundation can add a premium to your art, attracting serious collectors and driving up value.

Additionally, building a recognizable brand through social media, participating in the community, and leveraging strategic collaborations can create a loyal following that supports your work long-term. Successful NFT artists like Beeple and Pak exemplify how an active presence and smart use of technology can transform digital creation into a lucrative business, generating millions in sales while maintaining artistic integrity.

Ultimately, the key to establishing a sustainable Crypto Art business lies in continuous learning, adapting to market trends, and maintaining authenticity. By strategically navigating the evolving landscape and connecting with your audience, you can position your art to thrive in this dynamic and fast-growing industry.

FAQs: Everything You Need to Know About Minting & Selling NFTs

As the Crypto Art world continues to grow, many digital artists and newcomers have questions about how to navigate this evolving space. Below are answers to some of the most frequently asked questions about minting and selling NFT Artwork, covering key aspects of getting started, choosing the right marketplace, and maximizing profits.

What is minting, and why is it essential for selling NFT?

Minting is the process of turning your digital creation into a unique, verifiable asset on the blockchain, essentially making it an NFT. This step involves uploading your file to a marketplace like OpenSea or Rarible and recording it on the blockchain. Minting establishes your digital artwork’s authenticity and allows it to be bought, sold, or traded in the marketplace. It also enables artists to set up royalties, which is a percentage they earn each time the NFT is resold.

What are the costs associated with minting an NFT?

The primary cost is the gas fee, which varies based on the blockchain used and the network activity at the time of minting. On Ethereum, these fees can range from $30 to over $100, making alternatives like Polygon and Tezos appealing due to their lower costs. Some platforms, such as OpenSea, offer “lazy minting,” where the NFT is only minted when a sale is made, reducing upfront expenses.

How do royalties work, and how can artists benefit from them?

Royalties allow artists to earn a percentage from secondary sales, providing long-term passive income. Typically, artists set royalties between 5% and 10%. For example, if you set a 10% royalty on SuperRare, you’ll earn 10% each time your art is resold. This model incentivizes creators to continue producing quality work and engage with the community, as each sale boosts their earnings.

What are the best platforms to start selling NFTs as a beginner?

For beginners, platforms like OpenSea and Rarible are ideal due to their user-friendly interfaces, easy minting process, and large user bases. OpenSea offers flexibility in choosing blockchains (Ethereum or Polygon), while Rarible’s community-oriented features make it suitable for artists seeking direct engagement with buyers.

How can I promote my NFT artwork to attract collectors?

Promoting your NFT Artwork requires a multi-channel approach. Use social media platforms like Twitter and Instagram to share your work and build a following. Join NFT communities on Discord and Reddit to network and gain visibility. Additionally, consider listing your upcoming drops on calendar sites like NFTCalendar.io to generate buzz around your release.

What makes an NFT valuable, and how can I increase my art’s value?

The value of an NFT is determined by factors like rarity, demand, and the artist’s reputation. To increase your art’s value, focus on creating a unique style, engaging with the community, and offering additional perks, such as access to exclusive content or events. Collaborations with well-known artists can also elevate your profile and attract high-end collectors.

Can I mint and sell the same NFT on multiple platforms?

Technically, you can list the same digital file on multiple platforms, but the NFT token itself should only exist on one blockchain to avoid duplications and confusion. Some platforms like OpenSea support cross-platform visibility, but it’s generally advisable to create unique tokens for each marketplace to maintain the integrity and exclusivity of your work.

Can I change or update my NFT once it’s minted?

Once an NFT is minted on the blockchain, it cannot be altered. This immutability is part of what gives NFTs their authenticity and value. However, you can update the metadata on some platforms if the NFT is created using a mutable option, though this is less common.

How do gas fees impact my pricing strategy?

High gas fees can significantly impact your profit margin, especially for lower-priced NFTs. One strategy is to factor in the gas fees when setting your minimum price or wait for periods of lower network congestion to mint your NFTs. Additionally, using Layer 2 solutions like Polygon can help mitigate high fees.

What happens if my NFT doesn’t sell?

If your NFT doesn’t sell, it will remain listed on the marketplace until you decide to remove it. You won’t incur additional fees unless you relist or mint a new one. Consider adjusting your price, updating the metadata, or promoting the artwork more actively to increase visibility.

What’s the difference between ERC-721 and ERC-1155 tokens?

ERC-721 tokens are used for single, unique NFTs, while ERC-1155 tokens support both unique and semi-fungible assets, allowing for batch minting. ERC-1155 is often used for game assets or collections that include multiple copies of the same item.

Are there legal considerations for selling NFT Artwork?

Yes, there are legal considerations, such as copyright issues. Ensure that you have the right to sell the digital assets and that your NFT does not infringe on third-party copyrights. Some artists include terms and conditions to clarify what rights buyers receive when purchasing their NFT art.

Discussion